What Are the BEST Technical Indicators for Successful Trading?

/ Learn to Trade Nov 15, 2011 - 03:25 AM GMTBy: EWI

You may have seen a TV ad where "traders" describe their strategies, and one says, "I trade on fundamentals." That sounds very reassuring -- except that, on any given day, "fundamentals" are a mixed bag:

You may have seen a TV ad where "traders" describe their strategies, and one says, "I trade on fundamentals." That sounds very reassuring -- except that, on any given day, "fundamentals" are a mixed bag:

- You might have a good U.S. employment report...but bad news from Europe

- A positive Fed statement...but a negative housing number

- Strong earnings...but slowing consumer spending

And so on. Which "fundamental" factor trumps the other? Which one carries more weight in your forecast? Your guess is as good (or bad) as anybody's.

Your alternative is technical analysis, which forecasts the markets' short- and long-term moves based on objective metrics, not guesses.

Here at EWI, we've always strived to help our readers learn to think for themselves. So we've put together for you a free 8-lesson report, "Best Technical Indicators for Successful Trading" that teaches you how to use these technical tools:

- The Personality of Elliott Waves

- Head and Shoulders Pattern

- Fibonacci Retracements

- Advance-Decline Line

- Sentiment

- Volume

- Trendlines

- Momentum Analysis Using MACD

Here's a small preview of this free 8-lesson report.

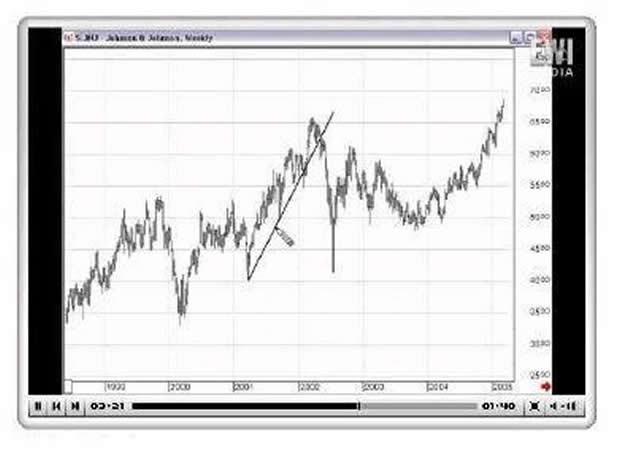

Trendlines A trendline represents the psychology of the market; specifically, the psychology between the bulls and the bears. If the trendline slopes upward, the bulls are in control. If the trendline slopes downward, the bears are in control.

Moreover, the actual angle or slope of a trendline can determine whether or not the market is extremely optimistic, as it was in the upwards sloping line in Figure 1-1 or extremely pessimistic, as it was in the downwards sloping line in the same figure. Now we're on to the fun part -- drawing trendlines. You can do this several different ways...

In this free report, you will learn some of the most effective tools of the trade from analysts at Elliott Wave International, the world's largest technical analysis firm. Find out which technical indicators are best for analyzing chart patterns, which are best for anticipating price action, even which are best for spotting high-confidence trade setups -- plus how they all complement Elliott wave analysis. |

This article was syndicated by Elliott Wave International and was originally published under the headline What Are the BEST Technical Indicators for Successful Trading?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.