Gold Call Options at $2,000/oz – Goldman and Credit Suisse Bullish Due to US Interest Rates

Commodities / Gold and Silver 2011 Nov 14, 2011 - 10:06 AM GMTBy: GoldCore

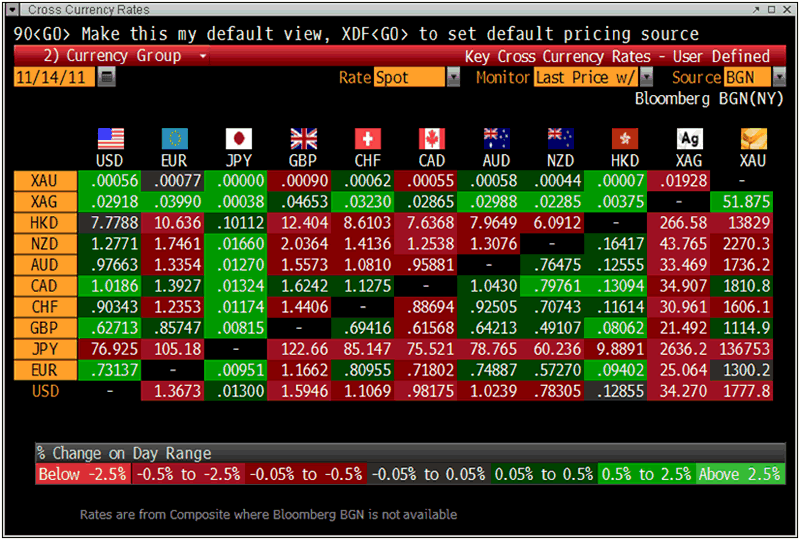

Gold is trading at USD 1,778, EUR 1,300.20, GBP 1,114.90, CHF 1,606.10, JPY 136,750 and CNY per ounce.

Gold is trading at USD 1,778, EUR 1,300.20, GBP 1,114.90, CHF 1,606.10, JPY 136,750 and CNY per ounce.

Gold’s London AM fix this morning was USD 1,780.50, GBP 1,115.29, and EUR 1,299.06 per ounce.

Friday's AM fix was USD 1,764.00, GBP 1,109.02, and EUR 1,294.39 per ounce.

Cross Currency Table

Gold is marginally lower today on hopes that changes in the political leadership in Italy and Greece might lead to a resolution of the eurozone’s debt crisis and prevent contagion and the breakup of the monetary union. This has seen risk appetite return with most Asian equity indices posting gains.

European indices are more subdued and may be taking a more realistic view regarding the political changes in Greece and Italy.

The debt crisis is of a scale that simply changing who is in power and installing unelected technocrats will not solve the crisis.

There is again a real sense of rearranging the deck chairs on the Eurozone Titanic and the root cause of the crisis – too much debt in the banking and financial sector and too much private debt has yet to be confronted.

Gold’s positive momentum continued last week with gold recording a 1.8% gain. Gold has now risen three weeks in a row and looks set to record a second monthly gain after October’s monthly gain.

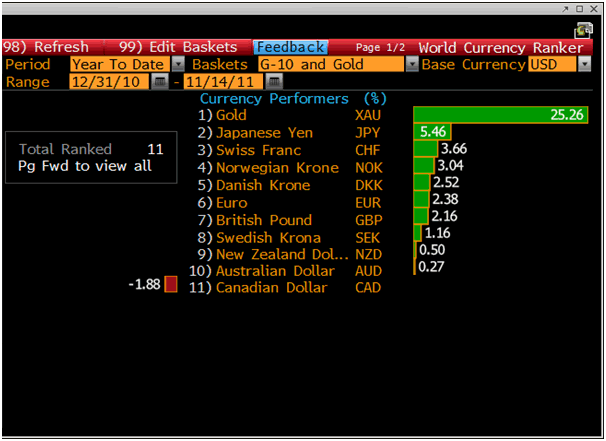

Gold remains up 25% year to date in US dollars and (22% in Euros and British pounds) and thus the recent correction and consolidation was a healthy development that took the short term froth out of the market and has now left the gold market with stronger foundations.

Physical demand from Asia continues but for now is below the very high levels seen in recent weeks.

Central bank demand continues. Overnight, the Russian central bank announced their intention to buy 100 tonnes of gold in 2011. Ria Novosti reports that Russia has acquired over 90 tons of gold since early 2011 and plans to increase the amount by 100 tons, the Central Bank Deputy Head, Sergey Shvecov, stated at a finance conference.

Concerns about the euro and Eurozone and the weak dollar have been cited as reasons for Russia’s continuing FX reserves diversification.

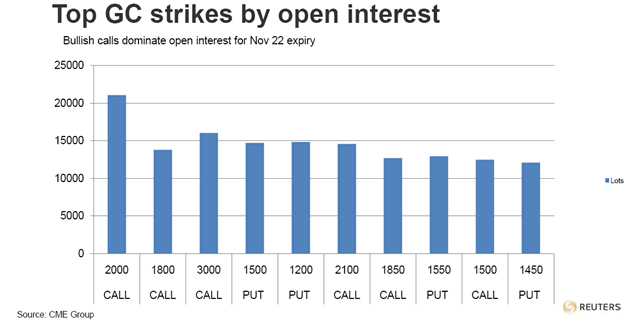

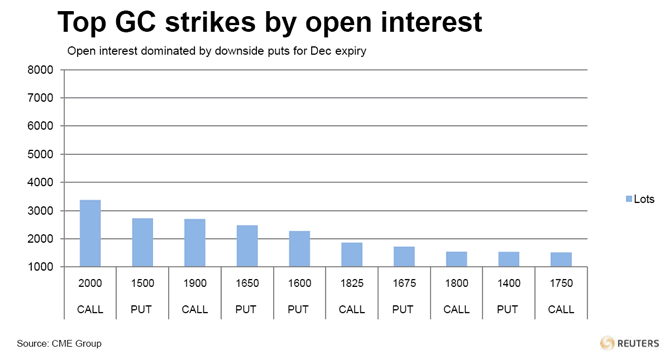

Options traders remain bullish with most open interest for November centering on $2000 calls, $3000 calls.

In options today, the largest change in open interest was seen in $1920 calls for the Nov 22 expiry, where OI rose 643 lots to 1,389 lots. $1900 calls rose 526 lots to 9,242 lots.

Gold ETF data shows continuing safe haven flows and diversification into gold.

Global holdings of gold rose last week, by nearly 897K oz, their largest weekly rise since the week ending Aug 5 2011, when holdings rose by a net 1.089M oz, according to Reuters.

Total gold ETF holdings stand at around 68.854M oz, up a full 1.749M oz in the last month. November is shaping up to show the largest monthly inflow since July. So far this month, holdings have risen by 947K oz.

Goldman Sachs today reaffirmed that it remains overweight in commodities. On gold it says it will roll over its Dec 11 long to Dec 12.

"We expect gold prices to continue to climb in 2011 and 2012 given the current low level of US real interest rates, and as a result recommend a long gold position."

Credit Suisse has said, "that gold may climb over $1,800 in the coming days with negative real interest rates as the ‘key driver’."

SILVER

Silver is trading at $34.30/oz, €25.12/oz and £21.53/oz

PLATINUM GROUP METALS

Platinum is trading at $1,640.70/oz, palladium at $654/oz and rhodium at $1,525/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.