Gold Producers Are at a Critical Juncture

Commodities / Gold & Silver Stocks Nov 14, 2011 - 09:28 AM GMTBy: Bob_Kirtley

Once again the gold mining stocks are pressing for recognition and acceptance by encroaching on a previous all time high with the view to bursting through it in an attempt to convince the investment community that mining is the place to be. This is a critical juncture for these stocks as they have performed poorly in recent years despite gold making new records highs. The early years of this bull market are now behind us and those early leveraged gains on the back of gold's progress have now dissipated.

Once again the gold mining stocks are pressing for recognition and acceptance by encroaching on a previous all time high with the view to bursting through it in an attempt to convince the investment community that mining is the place to be. This is a critical juncture for these stocks as they have performed poorly in recent years despite gold making new records highs. The early years of this bull market are now behind us and those early leveraged gains on the back of gold's progress have now dissipated.

However, it could be different this time as the Gold Bugs Index (HUI) has rallied once again to within striking distance of an all time high and as we write it stands at 603.66. Should it be successful, then the possibility exists for gold mining stocks to fly a lot higher given their earnings, profitability and potential for future growth. A move from here to the '700' level would go along way to restoring confidence in this sector, it would also reward those who have waited patiently to see a significant improvement in the capital growth of their holdings. It may also be the ignition that attracts new money from those who are currently sitting on the sidelines waiting for confirmation that this is the time to grab a sizable position in some of the much vaunted hot stocks.

However there is competition in the form of investment funds and the ease with which an investor can move in and out of the various funds at the push of a button is an attractive facility for many investors. Exposure to gold does not necessarily mean having to wade through the prospectus and balance sheets of thousands of company's to come up with a few potentially good investments.

The business of mining is fraught with risk and many would rather avoid that sort of exposure. However the allure of a big gain is captivating and when that gold light flashes we can expect rational people to the irrational things.

Now we will take a quick look at the chart of the HUI.

As we can see the HUI formed a double top and then fell back to the 500 level before mounting this recent attack on its previous all time highs. The RSI has the room to push higher, but the other two indicators, the MACD and the STO are looking a tad over extended at the moment. We could see more sideways action from this point despite the mining stocks putting on a good show of late.

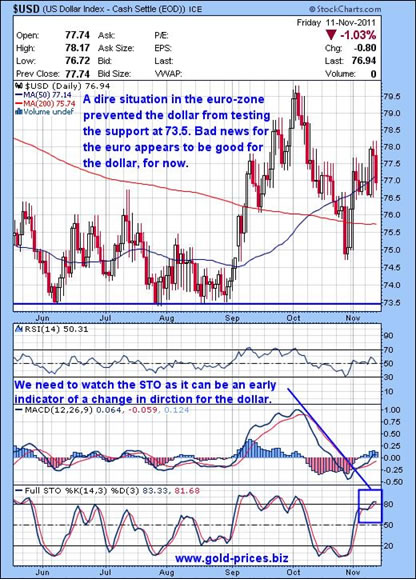

We are still of the opinion that the gold/dollar inverse relationship remains intact and the fortunes of the dollar must be watched closely. A dire situation in the euro-zone saw the euro fall and thus prevented the dollar from testing the support at 73.5. Bad news for the euro appears to be good for the dollar, for now at least. With the appointment of two new leaders for both Greece and Italy we should get a positive reaction from the markets on the basis that something is being done, giving the euro a little boost and adding pressure to the dollar once again.

The USD Chart:

As we can see from the USD chart the indicators are fairly neutral with the exception of the STO, which is high and can be an early indicator of a change in direction for the dollar, so we will watch it intently.

We have been skeptical about the ability of the miners to return to us a better profit than either metals themselves or other related investment vehicles and that continues to be our stance especially if this breakout fails to impress.

Our strategy remains unchanged in that in that it has three elements to it. Firstly, buy and hold both physical gold and silver and keep it in your hands. Secondly build a core holding of quality producing stocks (although we are not prepared to increase our holdings at the moment for the reasons stated above) and finally, in an attempt to gain leverage to the precious metals, the careful selection of a small number of options trades can generate handsome returns when compared to the movement of the underlying commodity. Our concentration remains totally focused on the metals space, it is exciting,rewarding, irritating and sometimes downright infuriating, but this where we want to be.

We maybe trying to hard to pick such turns in the market, however, timing is an essential part of the decision making process in the investment cycle and it should not be underestimated.

Chin up and have a good one.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.