The End Of The Inventory Build Cycle Giving Birth to Recession

Economics / Double Dip Recession Nov 12, 2011 - 12:06 PM GMTBy: Tony_Pallotta

"If you build it, he will come" ~ Field Of Dreams

"If you build it, he will come" ~ Field Of Dreams

Demand begets supply. Supply then fuels demand. Probably the most simplistic way to look at the economic cycle.

In 2009 at the depths of the economic recession in the absence of demand store shelves were bare. Retailers were risk averse and would buy only what they knew they could sell. Then customers began to trickle back in. As confidence grew retailers began to expand their inventory.

Rather than carry three of one item perhaps they carry five as their ability to sell those items grew. With this growth in sales they hired staff. That staff shops and spends money. Those business hire. The cycle catches on and the inventory build process begins. It is self sustaining. As long as their is growth there is demand.

On the other end of the cycle when growth slows so does demand. As demand falls sales fall and the retailer prefers to now hold just three of that item versus the original five. The inventory cycle eventually goes into contraction as retailers buy less this year than what they bought last. Pretty simple, non technical explanation.

So where are we in the US economic cycle? Let's take a look at inventory growth since the depths of the "great" recession.

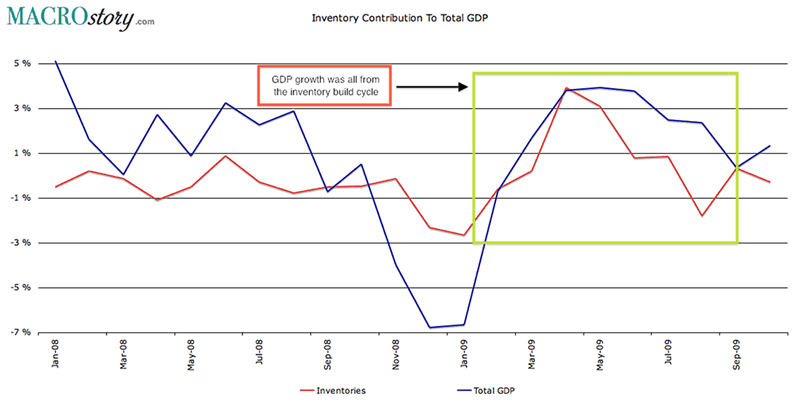

Inventory And GDP

The inventory build cycle was the "recovery." Just look at the following chart showing the GDP contribution from inventory versus total GDP. Without the massive build there was no recovery. Now look at the drop inventory growth and the resulting fall in GDP.

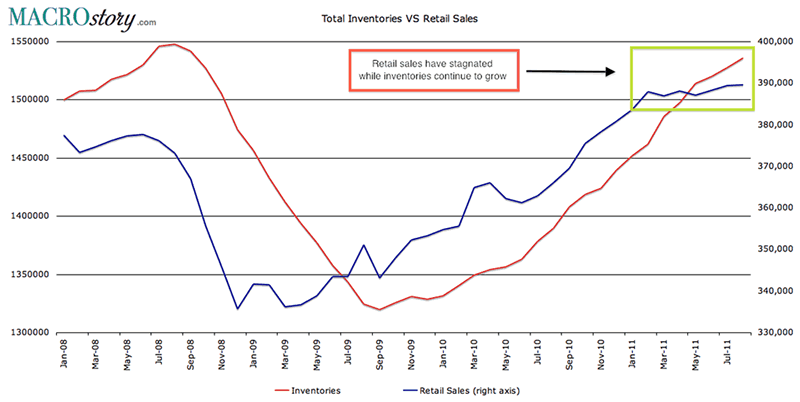

Inventory VS Retail Sales

Notice how retail sales growth has all but disappeared the past few months yet inventory growth has not. This inventory build cannot continue without a pick up in retail sales. At a minimum inventory growth needs to scale back to stay at the pace of sales growth.

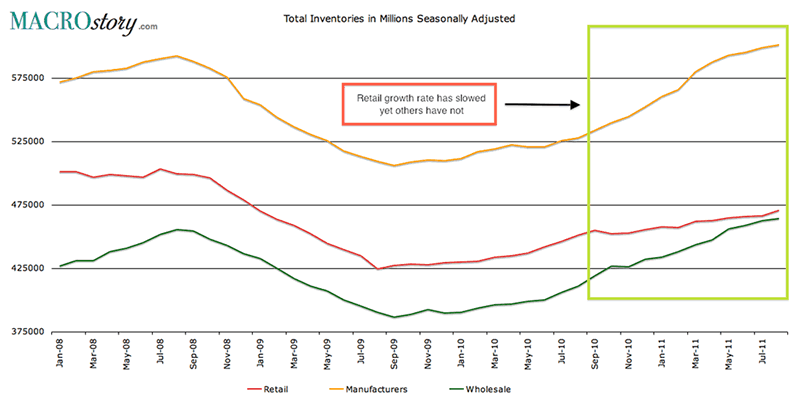

Inventory Composition

Notice the trends within manufacturers, wholesale and retail inventory levels. Retail growth is slowing. That will force a slowdown in the other two categories. In fact September wholesale inventory contracted for the first time since November 2010.

Bottom Line

With retail sales flat and labor still depressed the traditional transition mechanism has failed. The "if you build it he will come" concept has failed to spark growth. Supply failed to fuel further demand. What should have been a normal transition into real growth has failed.

The shelves are full and the risk appetite of retailers in the face of this reality is declining. The inventory build cycle has ended and that gives birth to recession.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.