US Mint Gold Coin Data and Research Casts Doubt on ‘Gold Bubble’

Commodities / Gold and Silver 2011 Nov 08, 2011 - 08:23 AM GMTBy: GoldCore

Gold is trading at USD 1,790.10, EUR 1,300.60, GBP 1,114.30, CHF 1,606.20, JPY 139,690 and CNY 11,362 per ounce.

Gold is trading at USD 1,790.10, EUR 1,300.60, GBP 1,114.30, CHF 1,606.20, JPY 139,690 and CNY 11,362 per ounce.

Gold’s London AM fix this morning was USD 1,794.00, GBP 1,114.49, and EUR 1,301.51 per ounce.

Yesterday's AM fix was USD 1,764.00, GBP 1,102.78, and EUR 1,286.65 per ounce.

Gold remains firm in all currencies after yesterday’s sharp gains which saw gold rise 2% in dollar and euro terms and nearly 4% in Swiss franc terms.

Gold appears to be breaking out after another period of correction and consolidation. We have now had a higher monthly close in October and two consecutive higher weekly closes. This strongly suggests the short term trend is again aligned with the long term trend of a secular bull market.

Record nominal highs seem likely given the strong fundamentals and improved technical picture – possibly as soon as before the end of 2011.

US Mint Gold Coin Sales Data and Research Casts Doubt on ‘Gold Bubble’ Thesis

US Mint gold coin sales fell in October leading to further speculation that this was another sign that the gold bull market was over.

Rather than idle speculation it is important to look at the facts and analyse them.

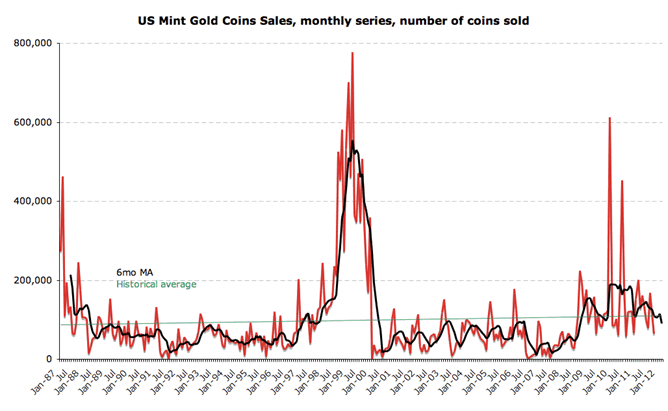

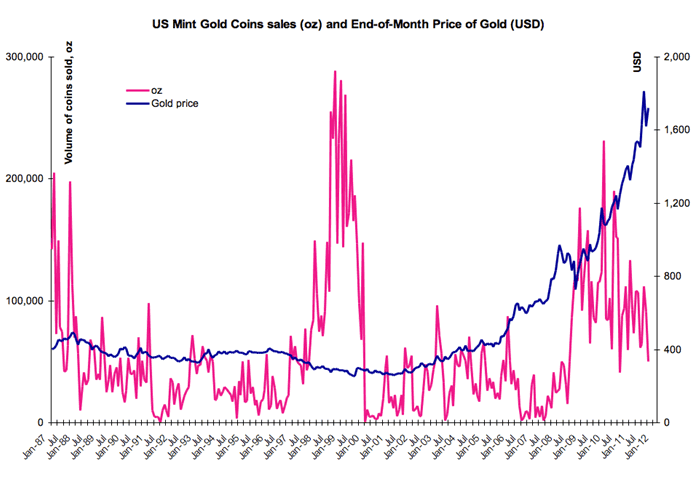

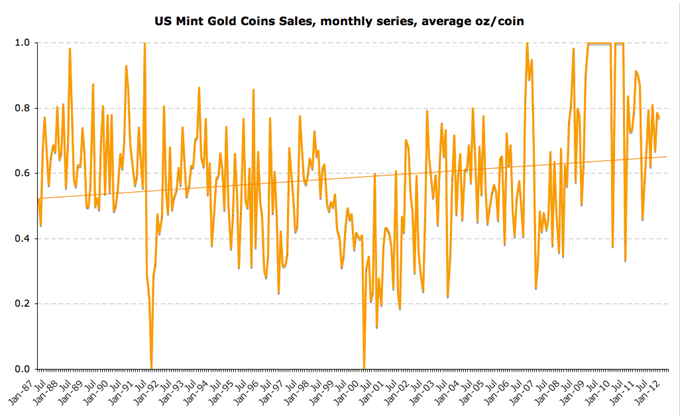

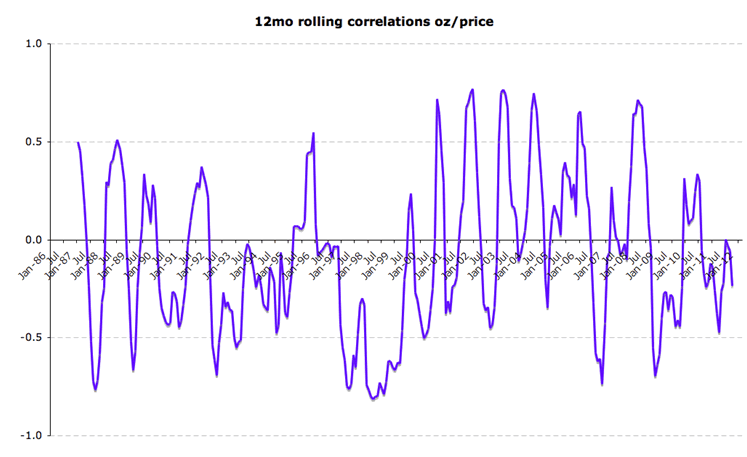

Dr. Constantin Gurdgiev, a non Executive member of the GoldCore Investment Committee, has analysed the data of US Mint coin sales in October and has looked at them in their important historical context going back to 1987.

Dr. Gurdgiev writes “In recent weeks there was some long-expected noises coming out of the gold 'bears' quick to pounce on the allegedly 'collapsing' sales of gold coins by the US mint. I resisted the temptation to make premature conclusions until the full monthly sales data for October is in. At last, we now can make some analytical observations.“

The thesis advanced by the 'bears' is that October sales declines (for US Mint sales of new coins) are:

1. Profoundly deep

2. Consistent with 'gold bubble is bursting at last' environment and

3. Significantly out of line with previous trends, and

4. Changes are reflective of buyers exiting the market on the back of high gold prices

Dr. Gurdgiev concludes that “We are seeing a well-predicted reversion to the mean along upward trend in demand. We are also seeing, in my opinion, gold coins doing exactly what gold in general is expected to do - providing long term hedge instrument against risks associated with other asset classes.”

The data since 1987 until today and the evidence from the US Mint regarding the behaviourally anchored, long term demand for gold coins as wealth preservation tool for retail investors does not support the view of dramatic over buying of gold or piling into gold by ‘Joe Public’, the shoeshine boys or the fabled speculatively crazed retail investor that some commentators suggest is happening today.

The man and woman in the street in the western world continues to be a bigger seller of gold (jewellery into scrap) than buyer as seen in the western world phenomenon that is ‘cash for gold’.

The excellent research on US Mint gold coin sales in October and going back to 1987 by Dr Constantin Gurdgiev can be read here.

China’s Gold Imports Jump Sixfold

Chinese gold imports from Hong Kong rose 30% month on month in September to a record 57 tonnes.

Since May, shipments to the mainland have risen a massive six fold, according to data from the HK Census and Statistics Department.

China’s demand for gold is a game changer which is as of yet largely unacknowledged. It has not been reported on at all in the non specialist financial media. The vital fact that the per capita consumption of 1.3 billion people is increasing from a near zero base is still not appreciated.

Gold ownership in China remains very small vis-à-vis their neighbours in India due to the banning of gold ownership in China from 1950 to 2003. Therefore, the huge increase in demand seen in recent years is sustainable and will continue to be seen in the coming years due to the very important cultural affinity Chinese people throughout the world have for gold.

SILVER

Silver is trading at $34.79/oz, €25.22/oz and £21.65/oz

PLATINUM GROUP METALS

Platinum is trading at $1,657.70/oz, palladium at $672.50/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.