Financial Market Madness - Berlusconi Does Hamlet

Stock-Markets / Financial Markets 2011 Nov 08, 2011 - 02:25 AM GMTBy: PhilStockWorld

"So this is how it all ends, not with a bang, but with a status update."

"So this is how it all ends, not with a bang, but with a status update."

That was the great comment tweeted by Joe Weisenthal this morning as Italian Prime Minister Berlusconi wrote on his facebook page: "The rumors of my resignation are groundless."

You know, screw this whole EU crisis thing, I'm just fascinated with what's become of society as we enter what I call the Post-Information Age - the point at which there is now so much information in the World that people don't want to think anymore so we now rely on media personalities who can sum complex political issues up in 140 characters or less.

You know, screw this whole EU crisis thing, I'm just fascinated with what's become of society as we enter what I call the Post-Information Age - the point at which there is now so much information in the World that people don't want to think anymore so we now rely on media personalities who can sum complex political issues up in 140 characters or less.

Of course Twitter itself is just a rip-off of Haiku, which has limited poets to 17 syllables for centuries. Unfortunately, most tweets are not so clever and make little use of seasons, which hard-core Haiku fans consider essential.

Still, we get the occasional gems from Twitter or Facebook and I find it hysterical that Silvio writes on his wall "Le voci di mie dimissioni sono destituite di fondamento" and 510 people like his comment and 465 people make comments and 178 people share it - all in 15 minutes or less and $100Tn worth of Global equities jump up and down 1%, giving Berlusconi the record writing rate of $110Bn per word!

The Post-Information Age has rumors driving the stock market as we prove the old newspaper adage that "a rumor can run around the World before the truth can get its boots on." Faster information gives us faster rumors but not faster Truth - truth takes time but most market participants, egged on by the MSM, would rather be first than right and that's why we've had 3 months of wildly swinging markets in which we actually just finished right back where we began.

That's why I pointed out to Members last week that the best way to play this market is to day-trade the ranges or simply ignore all the BS and just keep selling premium outside the range to the endless supply of suckers who think this time will be different (see Stock World Weekly for a full summary of last week's positions and a view of the week ahead).

We went long in early morning Member Chat on the rumor that Berlusconi was resigning and the Dow futures popped from 11,780 to 11,920 but we were forced to bail at the top when the PM updated his facebook status to "not resigning" although the Futures have held most of their gain (back to about Friday's close) while the EU futures have gone from down 2% to slightly positive.

Unlike Greece, we cannot afford to dismiss the various rumors coming out of Italy, but that certainly doesn't mean we're going to let it control our investing decisions. Cashy and Cautious remains our stance and we held a bit bearish into the weekend in anticipation that the EU was more likely to get worse than better over the weekend.

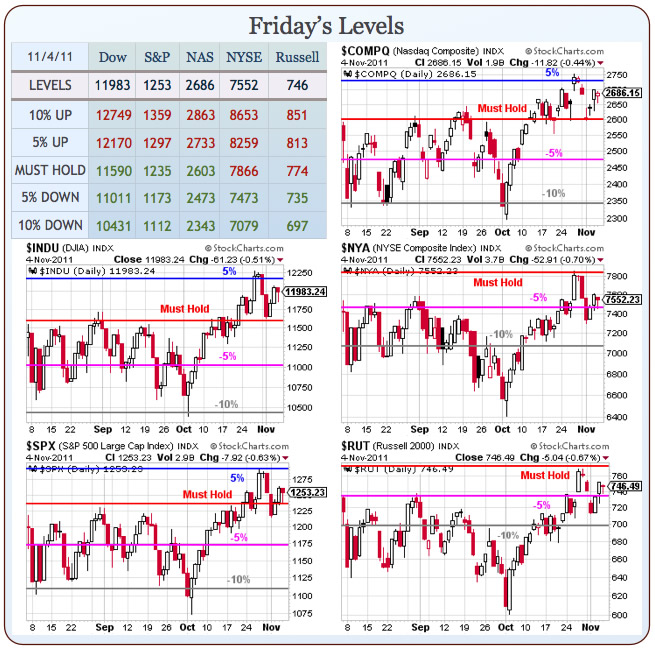

Thanks to Papandreau's resignation as well as rumors of Berlusconi's resignation - it does look like (8:15) we will avoid retesting Friday morning's lows but that's a no-prize until we prove we can make progress back to our 5% lines of Dow 12,170, S&P 1,235 and Nas 2,603 as well as the Must Hold lines of NYSE 7,866 and Russell 774, both of which failed last week, as did S&P 1,235 so we'll be watching those indexes very carefully this week along with the Dollar - which must fail that 77 line in order for our indexes to pop and that's something the BOJ (remember Japan?) does NOT want to see.

Speaking of things that people don't want you to see - kudos to Barry Ritholtz for summarizing "The Big Lie" this weekend, in which he asks:

Why are people trying to rewrite the history of the crisis?

Some are simply trying to save face. Interest groups who advocate for deregulation of the finance sector would prefer that deregulation not receive any blame for the crisis.

Some stand to profit from the status quo: Banks present a systemic risk to the economy, and reducing that risk by lowering their leverage and increasing capital requirements also lowers profitability. Others are hired guns, doing the bidding of bosses on Wall Street.

They all suffer cognitive dissonance — the intellectual crisis that occurs when a failed belief system or philosophy is confronted with proof of its implausibility.

This article was sparked off by Mayor Bloomberg's comments on Friday in which the Mayor parroted the Fox talking points saying:

“It was not the banks that created the mortgage crisis. It was, plain and simple, Congress, who forced everybody to go and give mortgages to people who were on the cusp… But they were the ones who pushed Fannie and Freddie to make a bunch of loans that were imprudent, if you will. They were the ones that pushed the banks to loan to everybody.”

New Deal's Mike Konczal takes this apart point by point so I won't bother but it's neatly summarized in his statement: "It seems there are people who can’t accept that some markets, particularly financial ones, are disastrous when completely unregulated — and thus find any far-fetched excuse to blame the government instead." He goes on to list 6 facts to dispute this claim that will, unfortunately, be completely ignored by Conservative twits.

Welcome to Post-Information Age Investing!

Unfortunately it comes connected to a Post Information Global Government that is just as clueless and swings back and forth in their "opinions" as much as the markets (perhaps in reaction to the markets, which they are obsessed with).

Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.