Gold Bull Hammer, as Greek Disaster Movie Continues to Unfold

Commodities / Gold and Silver 2011 Nov 07, 2011 - 06:46 AM GMTBy: Clive_Maund

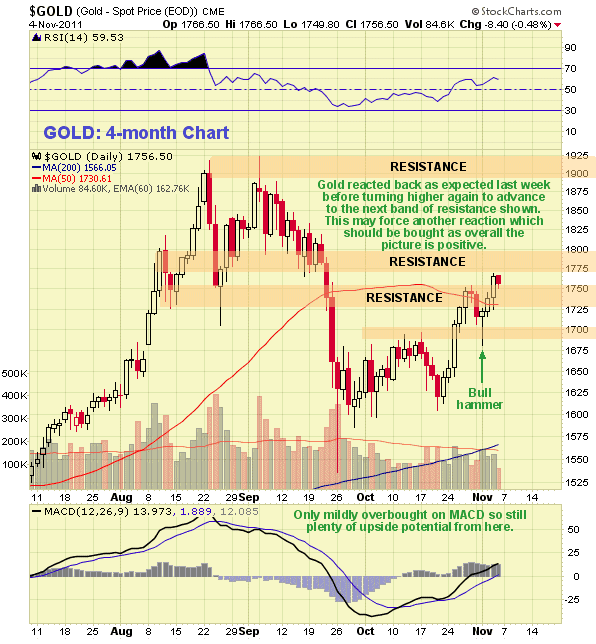

Gold did exactly as predicted in the update last weekend - it dropped back briefly to touch the bottom of our short-term reaction target range at $1680 before rebounding, as we can see on the 4-month chart below, and we were buyers around $1705 and below. The rebound on Tuesday left behind a clear bull hammer on the chart, which is positive. After the rebound gold advanced to the next resistance level shown, which may force another reaction this coming week, especially as Commercial short positions, which are still overall bullish, rose significantly last week - any such reaction should again be bought, although with downside volume now lighter than upside volume and silver now looking set for another upleg, there may be no reaction at all. The Prime Minister of Greece Mr Papandreou got "taken behind the woodshed " by Mr Sarkozy and Mrs Merkel for threatening to tip over the apple cart and wreck their plans with his referendum brainwave, but as this is a family website, we won't repeat here what they said to him, but it served to put him back on side.

Gold did exactly as predicted in the update last weekend - it dropped back briefly to touch the bottom of our short-term reaction target range at $1680 before rebounding, as we can see on the 4-month chart below, and we were buyers around $1705 and below. The rebound on Tuesday left behind a clear bull hammer on the chart, which is positive. After the rebound gold advanced to the next resistance level shown, which may force another reaction this coming week, especially as Commercial short positions, which are still overall bullish, rose significantly last week - any such reaction should again be bought, although with downside volume now lighter than upside volume and silver now looking set for another upleg, there may be no reaction at all. The Prime Minister of Greece Mr Papandreou got "taken behind the woodshed " by Mr Sarkozy and Mrs Merkel for threatening to tip over the apple cart and wreck their plans with his referendum brainwave, but as this is a family website, we won't repeat here what they said to him, but it served to put him back on side.

The chart looks positive here and like gold is shaping up to challenge its highs again - and why shouldn't it? - world leaders are cornered and only have one card left to play in the intractable global debt crisis fiasco, which is to continue to procrastinate with full on Quantitative Easing (QE) - just stop and think about this term for a minute - what kind of idiots do they take most people for that they can't see past patronizing language like this? - if you or I did this with a machine in our backyard we'd be thrown in jail for counterfeiting, but now that they are unencumbered by the inconvenience of a gold standard they can do this in broad daylight and get away with it.

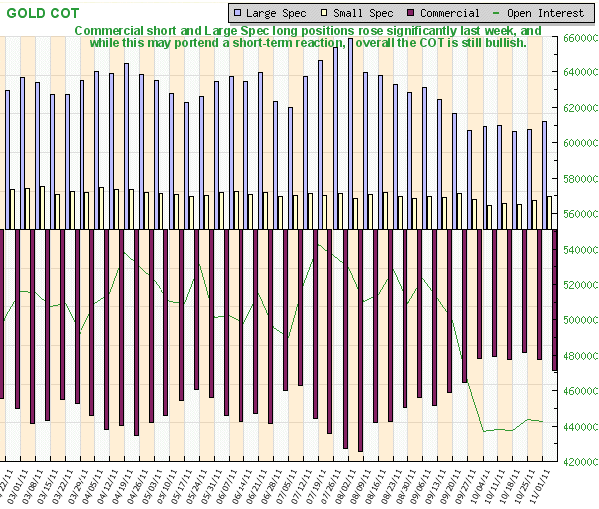

The Commercial short and Large Spec long positions rose significantly last week, and while this may presage a short-term reaction, overall the COT structure remains positive for gold.

Some people have been freaked out over the past day or two by fears of new more stringent CME margin requirements, but according to this press release by the CME Group these fears are unfounded, and the collateral damage caused by MF Global going belly up will be minimized.

As we have said before any attempt to deal head on with the debt and derivatives crisis will lead to an almost instant global economic implosion with catastrophic consequences, because both debt and derivative have risen to levels that are totally out of control - they must be written off, which would involve convulsion - or inflated away to oblivion. Applying austerity measures to the hapless populace to help reduce deficits will not solve the problems - all that will do is lower capital utilisation and productivity and reduce tax revenues and make it even more difficult for governments and municipalities to balance their books. In this respect Greece has been a "trial balloon", a little experiment on the fringes of Europe to see what will happen if you squeeze the masses until the pips squeek. Politicians don't like what they see there at all, and those who saw the video of Gaddafi's demise may have been having sleeping nights, culminating in them suddenly sitting bolt upright in bed at 3 a.m. as the solution hits them - more QE.

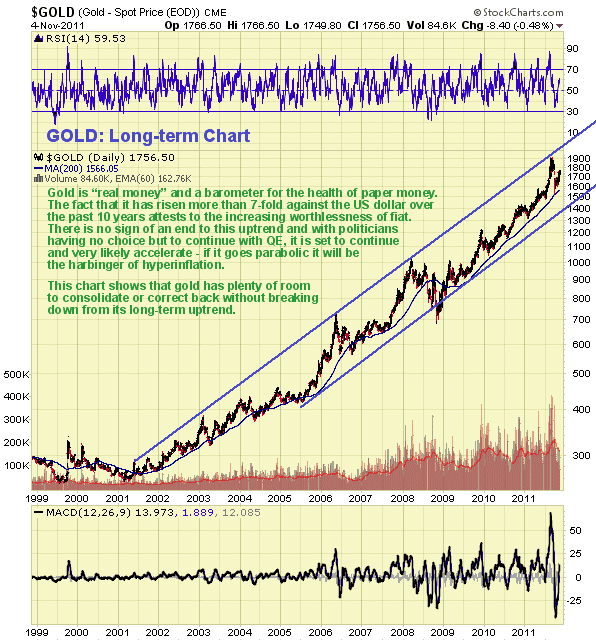

The charts of currency cross rates, for example the dollar versus the British Pound or the Swiss Franc, tend the mask the ongoing demise of fiat, because all fiat currencies are going down the drain together in a race to the bottom. This has massive inflationary implications which will have a huge impact on peoples' standards of living and quality of life in the future, a simple example being that many people who think they have have put away enough for a decent retirement are in for a very nasty shock, because they haven't reckoned on government bandits pillaging their savings via rampant inflation that is set to get much worse, in order that they can stealth default on debts and avoid a liquidity crunch and the resulting political turmoil. Just how bad this situation can be guaged by looking at the charts for gold going back to about the year 2000. As we can see gold has risen more than sevenfold in just over 10 years against the US dollar, and if we stop to consider that gold is real money whose intrinsic value does not change, and which rises or falls in nominal price in response to the rise or fall in the actual value of whatever currency it is being measured against, it is quite clear that fiat currencies like the dollar are on the road to worthlessness. Furthermore, there is no prospect of this process ending - on the contrary, since politicians response to the debt crisis has been to pile on more debt, raise the debt ceiling etc and engage in more financial engineering and rearranging the deck chairs on the Titanic to stave off the inevitable, it is set to accelerate, and this being so it is reasonable to expect gold's steady uptrend to continue, and if anything, accelerate, and as we can see on the chart, even if gold now enters a more lengthy period of consolidation or reacts, there is plenty of room for it to do so without breaking down from its long-term uptrend.

Many readers may have seen the disaster movie 2012, which in the writer's opinion, while certainly entertaining, is probably the most absurd film ever made, which is certainly the view of many scientists. Even if the events depicted in this film were to come true, they would take hundreds or more likely thousands of years to transpire, but of course those kind of timeframes don't suit Hollywood storyboards, so they boil it down to a timeframe of about 3 weeks. So, you don't need to fear huge tsunamis lapping at the slopes of Mt Everest next year (my favorite scene is where the monk on a himalayan mountaintop rings a giant bell before being overcome by the tsunami), but you do need to fear the giant out-of-control tsunami of debt and derivatives which governments and politicians around the world are trying to combat with a blizzard of newly printed up cash - it's the recipe for a perfect hyperinflationary storm and we are not going to have to wait 300 years for it to hit - it could start to kick in next year.

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.