Soveriegn Debt Crisis, It's All Greek To Me

Stock-Markets / Financial Markets 2011 Nov 07, 2011 - 04:12 AM GMTBy: PhilStockWorld

We ended last week’s newsletter “Europhoria” less than europhoric, with Phil’s statement, “We take a series of BALANCED trades – SELLING as much premium as we can so that time (theta decay) is always on our side. We take our profits off the table and, when we have to, we take our losses. However, we try to adjust the losing sides of our positions with the expectation that the markets will remain in a trading range and make the occasional reversals... Our bearish expectations are based on possible Yentervention by the BOJ, negative analysis of the European Financial Stability Facility (EFSF) over the weekend, and LACK of additional stimulus by the US, China and Japan to match the strong but Globally inadequate EU contribution.”

We ended last week’s newsletter “Europhoria” less than europhoric, with Phil’s statement, “We take a series of BALANCED trades – SELLING as much premium as we can so that time (theta decay) is always on our side. We take our profits off the table and, when we have to, we take our losses. However, we try to adjust the losing sides of our positions with the expectation that the markets will remain in a trading range and make the occasional reversals... Our bearish expectations are based on possible Yentervention by the BOJ, negative analysis of the European Financial Stability Facility (EFSF) over the weekend, and LACK of additional stimulus by the US, China and Japan to match the strong but Globally inadequate EU contribution.”

Our worries came to fruition this week. Monday began with a massive Yentervention that pushed the Dollar all the way from 76 to 77.6 in less than 24 hours. This was followed by a surprise announcement from Greek Prime Minister George Papandreou ("G-Pap"). He revealed plans for a national referendum on last week’s proposed expansion of the EFSF and the 50% “haircut” for holders of Greek debt. Completing the trifecta for the bears, in its statement on Wednesday, the Federal Reserve didn’t include additional stimulus for our ailing economy, despite Bernanke’s hinting about the potential for more money printing in late October. President Obama’s $60Bn infrastructure bill being blocked in the Senate did nothing to boost bullish sentiments.

To finish up a very volatile week in Greece, G-Pap won a vote of confidence in the Greek parliament. Business Insider reported, “The highly anticipated vote was crucial to the immediate implementation of bailout measures EU leaders agreed to last week.

“Papandreou's PASOK party will now seek to form a national unity coalition with other parties in parliament. The prime minister has said he is prepared to step down. That would likely turn power over to Evangelos Venizelos, the current finance minister and Papandreou's rival.

“The new government must quickly pass the new reforms that were a contingency for the next bailout so that it can receive the next tranche of aid by mid-December. If it does not, it will almost assuredly default. This decision should calm markets after a turbulent week.” (Greek PM Papandreou Wins Confidence Vote)

In other news, apt to further destroy confidence in the financial markets, the Securities and Exchange Commission (SEC) opened an investigation of MF Global for insider trading allegations. According to Bloomberg, “The U.S. Securities and Exchange Commission is reviewing trades in MF Global Holdings Ltd. (MF) convertible bonds to determine whether some investors sold the debt based on confidential information before the firm’s demise, according to two people with direct knowledge of the matter.” (SEC Said to Conduct Review of Possible Inside Trades of MF Global’s Bonds)

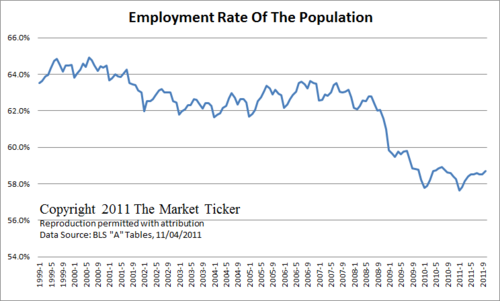

There was some encouraging news on the employment front, as Thursday’s Jobless Claims numbers dropped to 397,000 from the previous week’s revised reading of 406,000. Friday’s Non-Farm Payroll Report showed employment continuing to trend higher as 80,000 jobs were added in October. However, the unemployment rate remained unchanged at 9%. Commenting on the Nonfarm payroll report and the 9% unemployment rate, Karl Denninger wrote, “The problem here is that we're not making actual progress. Yes, it's "better," but this is the reason we continue to see the reliance on "borrow and spend more," and it goes back to 2000 - and it's not fixed.

“Until and unless this chart (above) gets out of the ditch, and there's no indication that it is, there's no solution that involves continued ‘support’ from government transfers.” Government transfers only make the chart worse.(Employment? Hmmm...)

On Thursday, Lee Adler of the Wall Street Examiner commented on this week’s jobless claims report.“First time claims actually increased by 9,361. The AP, and everybody else, reports a fictitious number, the seasonally smoothed fantasy... Claims did indeed increase in the week ended October 29. The last week in October virtually always has an increase. But there is real, positive news in this. This week’s increase was the smallest for the last week of October since the raging bubble year of 2005, when claims actually fell by nearly 8,800. But in the recovery years of 2003 and 2004, claims rose by 17,000 and 25,700. So this year looks good by that standard. Furthermore, this year’s number is much better than last year’s increase of 30,170, and way better than the recession years of 2008 and 2009, when 50,200 and 21,970 filed claims.”

However, Lee also warned that while there was an increase in real wage withholding data early in October, those gains evaporated in the second half of the month. “Regardless of what the reported number for October is, the reality is that the withholding data deteriorated in the last two weeks. If this trend isn’t reversed, the November jobs number will come as a negative shock to the market.” (First Time Unemployment Claims Increase But Less Than Usual)

Eurozone Contagion

Tyler Durden of Zero Hedge reported on another aspect of the European debt crisis--the exposure of U.S. banks to the European crisis, and the possibility of fiscal contagion spreading to the U.S. After pointing out that Morgan Stanley is carrying $39Bn in gross exposure to the French banking sector, Zero Hedge wrote, “Today it is time to refresh this story, as none other than Bloomberg pulls the scab right off and while confirming our observations, also goes further: yes, banks are not only massively exposed to Europe, but they are in essence misrepresenting this exposure to the public by a factor of well over ten!”(How US Banks Are Lying About Their European Exposure; Or How Bilateral Netting Ends With A Bang, Not A Whimper)

Last week’s agreement in the eurozone included a “voluntary 50% haircut” for Greek bond holders. This is important because at the heart of the problem is a financial instrument called a credit-default swap (CDS). CDSs are contracts between bondholders and independent parties who, for money, agree to insure bonds against DEFAULT. In this case, because a 50% haircut is being accepted voluntarily by bondholders, there is no default, and insurers do not have to pay out on the CDS, although ratings agency Fitch might beg to differ. The Greek bailout plan protects the CDS writers from having to pay billions of Dollars which would become due if Greece defaults. As Phil wrote, “banks, that nicely ‘volunteered’ to take 50% haircuts on their debt are faced once again with the REAL ISSUE, which is that an INVOLUNTARY default by Greece would trigger $500Bn worth of CDSs, the majority of which are insured by Gang of 12 Members in the TBTF Club like GS, MS, CS, DB, BAC, JPM, C…”

The Week Ahead

On the world stage, the Greco-drama continued gripping the financial markets as Prime Minister Papandreou struggled to form a temporary coalition government in the aftermath of his failed push for a referendum on the recent EU bailout deal. He promised the Greek parliament that he would begin forming a power-sharing government and appointing a successor. The UK Independent reported on Saturday, “Greece's future in the euro remained in serious doubt last night, as the government narrowly survived a confidence vote with no sign of the consensus the EU has demanded in return for a proposed rescue package.”(Bailout deal thrown into new chaos after Greek PM wins vote) The situation remains very fluid.

After all the political manipulation, posturing, and austerity measures, the Greek people seem headed towards a breaking point. Public support for the country’s political system has collapsed, as pollster Christoforus Vernadakis declared “everyone is furious with the politicians and the anger has reached violent proportions.”

Turmoil in the eurozone drove the Dollar higher giving Dollar bulls a great week. Should eurozone uncertainty subside, the Dollar is likely to fall, which should be bullish for equities and commodities. However, there are substantial headwinds facing the eurozone. At Friday’s G20 summit, the proposed expansion of the EFSF found “verbal support,” but no new funding. World leaders told Europe to “sort out its own problems” and delayed moves to provide more resources. German Chancellor Angela Merkel remarked at a press conference “there are hardly any countries here which said they were ready to go along with the EFSF.” Potential investors China and Brazil were reported as wanting “to see more detail before they made any firm commitment to put money into the bailout fund.” (Euro zone finds no new money for debt crisis at G20)

On Saturday, European Central Bank (ECB) Governing Council Member Yves Mersch casually mentioned in an interview with an Italian newspaper that the ECB often discusses the possibility of ending the purchases of Italian bonds if it concludes that Italy is not adopting promised reforms. Mersch claimed the “ECB did not want to become a lender of last resort to help the euro zone solve its debt crisis... Our job is not to remedy the errors of politicians.”

Saturday was “Bank Transfer Day,” an offshoot of the “Occupy Wall Street” movement that is encouraging people to move money out of the “too big to fail” banks, and into local credit unions. According to Think Progress, “the Credit Union National Association (CUNA) reports that a whopping 650,000 Americans have joined credit unions since Sept. 29 — the date Bank of America announced it would start charging a $5 monthly debit fee, a move it backed down on this week. To put that in perspective, there were only 600,000 new members for credit unions in all of 2010.” (Moved Your Money)

Pharmboy's Trade Ideas

This week’s trade ideas come from Pharmboy, who submitted the following essay. The remainder of this section is courtesy of Pharmboy.

At PSW, we focus on just about everything from virtual day trades to virtual income portfolios. As Barry Ritholtz noted, the average stock is being held no longer than seven months (in 2007). For longer term, dividend-yielding stocks, a few companies stand out. For investors looking for a mix of solid companies with more speculative biotechs, here are some ideas. Most are buy/write examples - buying 100 shares and selling 1 call and 1 put to reduce the net cost of the shares. (For more details on recent buy/write examples, click here.)

Merck (MRK, $34.02) - we initiated a virtual buy/write on MRK by selling the Jan. 2013 $40 call and $35 put for $8 (sold). We bought the stock for $37.30. Currently MRK is trading lower, but the calls and puts more than offset the lower stock price. I like initiating a virtual new spread by buying 100 shares, and selling 1 Jan. 2013 $35 call and 1 Jan. 2013 $30 put for $5.20 or better (combined).

Bristol-Myers Squibb (BMY, $31.34) - we initiated a buy/write on BMY by selling the Jan. 2013 $25 calls and $27.5 puts for $7.70 (sold). Currently, BMY is trading at $31. For a new virtual position, I would buy the stock and sell the Jan. 2013 $30 call and $27.5 put for $5.80 or better.

(Ed. note: Pharmboy switched from selling a higher strike BMY Jan. 2013 put in the first buy/write example to selling a higher strike call in the second example. The reason is that Pharmboy thought the stock would rise when he provided the first virtual trade idea. Now, he is less confident that BMY will trade higher, although he thinks BMY should stay above $25, even if stocks trade lower.)

Pfizer (PFE, $19.66) - Not one of my favorite big pharmas. Lipitor comes off patent...but IF it maintains its dividend, I’d be VERY conservative with a buy-write. I like buying 100 shares, and selling 1 Jan. 2013 $15 call and 1 Jan. 2013 $17.5 put for $6.65 or better.

British Petroleum (BP, $43.85) - things are looking up for this oil giant, and it pays a nice dividend. I like buying 100 shares and selling 1 Jan. 2013 $40 call and put for $13.30 or better.

Sunoco (SUN, $37.65) - I like selling a Jan. 2013 put for $2.50 or better (trading at $2.44 now). This is to initiate a future buy of SUN.

Intel (INTC, $23.74) - this tech giant continues to shine. I like buying 100 shares and selling 1 Jan. 2013 $22.50 call and put for $6.05 or better.

Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.