GOLD AND SILVER – Buy Signal Green Flags!

Commodities / Gold & Silver Dec 19, 2007 - 12:46 AM GMTBy: Peter_Degraaf

“When people see gold and silver shining brightly amidst the battered economic ruins, they will finally realize that the gold bugs were right all along.”

“When people see gold and silver shining brightly amidst the battered economic ruins, they will finally realize that the gold bugs were right all along.”

Buy signals are popping up in many places as a result of today's positive action in the metal pits.

Since I posted my last article, gold has made several ‘higher lows', a sign that the bull market is alive and well. Admittedly the HUI, XAU and GDM, went lower than I expected. In retrospect I blame the various ETF's for drawing money away from the gold and silver stocks. The GLD now has over 19,800.000 ounces of gold in back of it. Even during pull-backs in gold, while investors are dumping their gold stocks, fresh money keeps moving into the GLD.

We are now at a stage where mining stocks are severely under-priced , especially when compared to the ETF's. Gold production is in decline. The mining world needs 7 new mines to come on-stream every year, to reduce the deficit between gold demand and gold supply. In 1980, every gold producer with a listing was trading at 10.00 or higher.

The ongoing sub-prime credit problems, initially caused by Federal Reserve policy under (‘easy Al') Mr. Greenspan, are obviously going to be ‘solved' the only way the Fed knows how, and that is via the printing press, and via digital money.

Throughout history, once a nation embarked on the inflationary route, there has only ever been one final outcome: total destruction of the currency. Since 1913 the Fed,

(supposedly created to protect the US dollar – must read: ‘The Creature of Jekyll Island”), has managed to destroy 95% of the purchasing power of the dollar. Does anyone really believe the remaining 5% is safe?

Currencies in a number of countries are being inflated at double digit rates, while the gold supply can only be increased at about 1.6% per year. All the gold ever mined, piled up, would form a cube of less than 20 meters, growing by 12 cm per year. Most of the gold in this hypothetical cube is in the form of jewelry. The driving force behind the current bull market in gold is the fact that fiat money is being created some twelve times faster than gold. In 1980, when gold topped out at 850.00, the US M3 money supply was 1.8 trillion dollars. Today gold is pegged at 800.00, but M3 is now 13 trillion dollars ( www.nowandfutures.com ). A ratio similar to 1980 puts the potential gold price at $5,600.00.

Central banks are battling the gold price, and they are capable of slowing down its ascent, but they cannot stop it. If they could stop it, gold would still be selling at 260.00 an ounce, the price where Gordon Browne made his last ditch effort, by selling 25 tonnes of British Government gold.

Following are just a few reasons why gold will rise:

- Annual deficit between production vs consumption.

- Federal Reserve is printing dollars.

- USA government is running a fiscal deficit.

- Congress does not worry about deficit spending.

- U.S. private debt is at a record high.

- Many large banks are over-exposed to derivatives.

- The world is at war against militant Islam. Wars cost money. Wars always last longer than anticipated. Wars are inflationary.

- The US has gone from a net creditor to a net borrower.

- The US dollar is in a bear market.

- Real' interest rates are negative. Whenever the true rate of price inflation rises to or above interest rates, gold rises.

- Gold is rising in virtually every currency.

- Central banks, including the USA , are overstating their gold reserves ( www.gata.org )

Featured is the daily gold chart. Price is working out a pennant formation. Pennants formed atop ‘flagpoles' in bull markets most often resolve to the upside. The green arrows point to ‘upside reversals' (bullish). The RSI is finding support at the 50 level (green line). A close above the blue arrows will cause a lot of short covering, and will send gold upwards, to challenge the previous top at 850.00

Featured is the gold price expressed in Canadian dollars. Despite a strong dollar, gold has just broken out on the upside of an Advancing Right Angled Triangle (ARAT).

The 50DMA is in positive alignment to the 200DMA (bullish). The RSI and MACD are positive (thin black lines). The target for this move is $1,000.00 (10.00 on the chart).

Featured is the gold price expressed in Australian dollars. The cup with handle formation is a common and reliable chart pattern. The breakout is expected from the handle, and most often occurs on the upside. The RSI and MACD are positive (green lines).

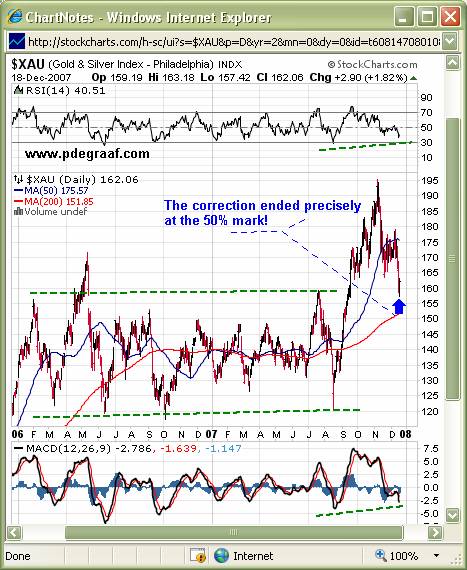

Featured is the XAU gold and silver stocks index. In September the XAU broke out from a multi-month trading range. It appeared that the breakout had been tested several weeks ago, but alas another test came along. This test took price back to the line of breakout. Today the index produced an upside reversal (blue arrow), at the 50% correction mark. That is a bullish signal, another green flag. The RSI and MACD are positive (top and bottom of chart).

Featured is the daily silver chart. Price pulled back to the 50% correction mark, just above 13.67 before turning positive today. It is a ‘first sign'. A close above the blue arrow will turn silver bullish again. The 50DMA is in positive alignment to the 200DMA (green arrow), another bullish sign. The RSI is ready to turn up from 40 (top of chart).

=======================================================

“The great merit of gold is precisely that it is scarce. Its quantity is limited by nature. It is costly to discover, mine and process. It cannot be created by political fiat or caprice.” Henry Hazlitt.

“Gold is durable, not like wheat; Gold is divisible, not like diamonds, Gold is convenient, not like lead, Gold is constant, not like property.” Aristotle 384 – 322 BC.

Happy trading!

By Peter Degraaf.

Peter Degraaf is an on-line stock trader, with 50 years of investing experience. He issues a weekly Email alert. For a 60 day free trial, send him an Email at ITISWELL@COGECO.CA , or visit his website: WWW.PDEGRAAF.COM

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.