The Fed’s Forecast Begs for Action, Bernanke Hints at QE3

Interest-Rates / US Interest Rates Nov 04, 2011 - 01:06 AM GMTBy: Asha_Bangalore

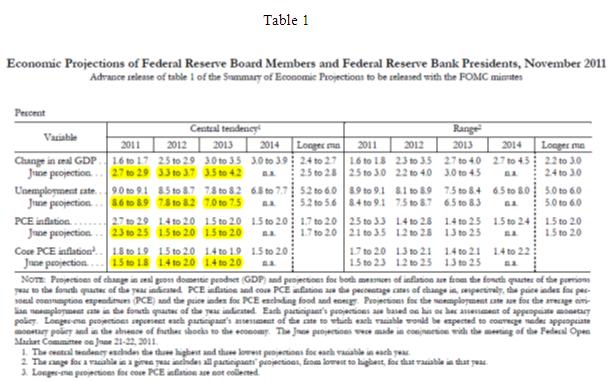

The main conclusion from Bernanke’s press conference on November 2 is that the Fed has two choices. QE3 (quantitative easing) is one option given the Fed’s gloomy forecast (see Table 1). The precise timing, magnitude and composition of QE3 are unknown but Bernanke’s responses suggest that there is a willingness to engage, if essential. Large asset purchases are likely to be a combination of Treasury securities and mortgage-backed securities. The second alternative is its communication strategy much like the August announcement that the federal funds rate would be held at the current rate at the least until mid-2013. In other words, it would entail tying interest rate decisions to economic conditions in policy communications.

The main conclusion from Bernanke’s press conference on November 2 is that the Fed has two choices. QE3 (quantitative easing) is one option given the Fed’s gloomy forecast (see Table 1). The precise timing, magnitude and composition of QE3 are unknown but Bernanke’s responses suggest that there is a willingness to engage, if essential. Large asset purchases are likely to be a combination of Treasury securities and mortgage-backed securities. The second alternative is its communication strategy much like the August announcement that the federal funds rate would be held at the current rate at the least until mid-2013. In other words, it would entail tying interest rate decisions to economic conditions in policy communications.

Bernanke described the circumstances under which the Fed would consider policy easing as follows: Additional policy support would follow if economic growth is insufficient or inflation is below the level consistent with price stability. Chairman Bernanke also noted that the Fed had taken aggressive steps in the past two meetings and would act again if required. Essentially, the Fed is buying time, for now. The Fed will have more data about business conditions in October and November prior to the December 13 FOMC meeting.

The Fed would need a higher unemployment rate, noticeably tepid increase in payrolls, weak retail sales, and the tone of economic reports leaning towards a further weakening of economic conditions to consider new policy action. Incoming economic data – ISM manufacturing survey, auto sales, housing starts, new home sales, orders of durable goods – do not suggest that the U.S economy is on the brink of another recession. The October employment data could change this assessment; employment numbers are reputed to offer surprises of all sorts. Our forecast is a 9.2% jobless rate and an increase in payroll employment of 100,000.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.