Stock Market Entering the Flash Crash Zone

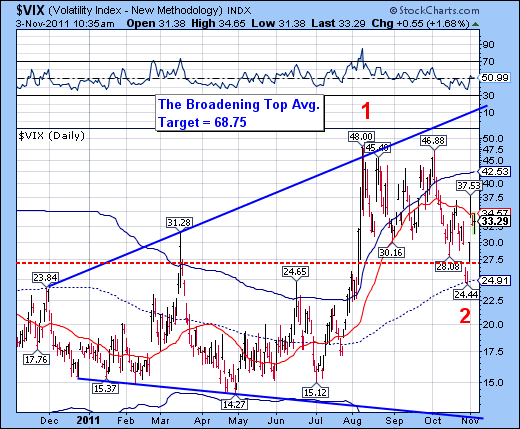

Stock-Markets / Financial Crash Nov 03, 2011 - 07:59 AM GMTThe VIX completed a 47% retracement of its impulse off its Master Cycle low at 24.44. It now has the ability to rally through the end of December, according to the predominant cycle patterns. It is probable the VIX may put in its 13-year cycle high in December, or possibly early next year. This is something that I have been saying for the better part of the last year.

The Broadening Bottom formation forecasts a panic high soon after the final breakout above its upper trendline at 55-60. The VIX has already broken above its intermediate-term Trend Support at 34.57. Today is appears to be retesting that support. A rally back above that level is a confirmed buy signal and should put us on high alert for a breakdown in the equities market.

The SPX has completed a 45% retracement of its decline from Thursday’s high. Today is a turn date, so it appears the turn will be to much lower lows. However, the SPX is also due for a Primary Cycle low, which I believe will be the target for the lesser Broadening Wedge formation in the hourly chart (968). The next probable turn will be on the ½ cycle, due on Monday, so I am anticipating the Primary Cycle low to occur in that time frame.

But I would also be on the alert for a flash crash starting immediately. The May 6, 2010 Flash Crash was at a ½ cycle turn, so there may be some similarities being re-created in this cycle as well. The Market top in 2010 was on April 26. The Flash Crash occurred on May 6, 11 calendar days later.

I would also like to point out that The top-to-bottom decline in the NDX ending on August 9, 11 trading days later. Additionally, 3 of the 4 major lows this year were on Primary Cycle dates.

Based on this information and more that I cannot divulge, the chances for a Flash Crash are elevated. The probability of the alert going to an extreme elevation would be at the point the SPX crosses its intermediate-term Trend Support at 1095.73

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.