Gold ready to attack prior highs in the 1900’s

Commodities / Gold and Silver 2011 Nov 02, 2011 - 07:14 PM GMTBy: David_Banister

It’s been several weeks since I’ve written about Gold and we have had a wild ride since the 1910-1920 highs in August. At the time as we approached I forecasted a major correction was nigh and we were shorting the rise from 1862-1910 prior to a huge $208 drop that took place over just a few days. We covered our short at $1725 and then Gold rallied back to a double top at $1920 and then fell back to $1531.

It’s been several weeks since I’ve written about Gold and we have had a wild ride since the 1910-1920 highs in August. At the time as we approached I forecasted a major correction was nigh and we were shorting the rise from 1862-1910 prior to a huge $208 drop that took place over just a few days. We covered our short at $1725 and then Gold rallied back to a double top at $1920 and then fell back to $1531.

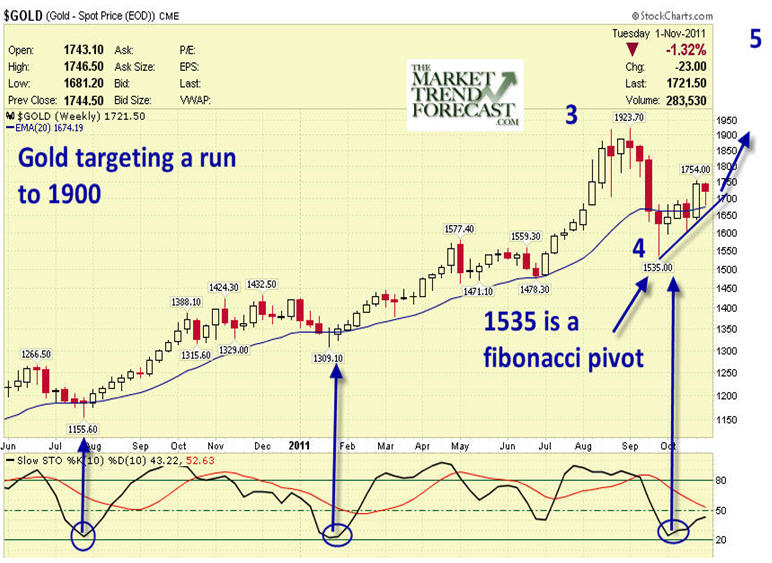

That pullback to $1531 qualifies as a Fibonacci retracement of the 34 month rally from $681 to $1920, and would also qualify for a price low for a 4th major wave correction that I discussed in prior forecasts. My initial targets for the Gold pullback were $1480-$1520 if the $1650 area was violated. Most recently we have seen Gold run up to 1681 which is another Fibonacci resistance zone a few times and then back off to the low $1600’s.

With the recent push over $1681, we can now confirm the 4th wave is over at $1531 lows and that the 5th wave is likely in the very early stages, but beginning to build steam. I will say that we want to make sure the 1650-1680’s areas are defended by Gold on any pullbacks in order for this forecast to remain valid. During this 5th wave up, eventually we should see the $2380 ranges in Gold, but it will not take place overnight. In the next few months I am looking for Gold to attack the $1900 range, possibly even by year end, and then in 2012 attacking the $2000 plus ranges.

With all of the Macro events in Europe changing on an almost daily basis, the whipsaws in both the precious metals and equities markets are difficult to forecast and trade for most investors. However, Gold has been moving in defined Fibonacci and wave patterns for ten years now, and has about three years left in a 13 year bull cycle if I’m right.

Below is the updated weekly chart of Gold. You can see prior low’s as they related to oversold indicators, and where we just came off the 1531 lows and its Fibonacci pivot along with the oversold indicators below.

Look for Gold to attack 1775 first, then 1800, 1840, then 1900 in the coming 6-10 weeks or so.

You can get 3-5 updates a week on Gold, SP500, and Silver by visiting www.MarketTrendForecast.com

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2011 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.