Krugman Warns of “Gigantic Bank Run”, “Emergency Bank Closing” and “New Lira”

Commodities / Gold and Silver 2011 Nov 02, 2011 - 07:09 PM GMTBy: GoldCore

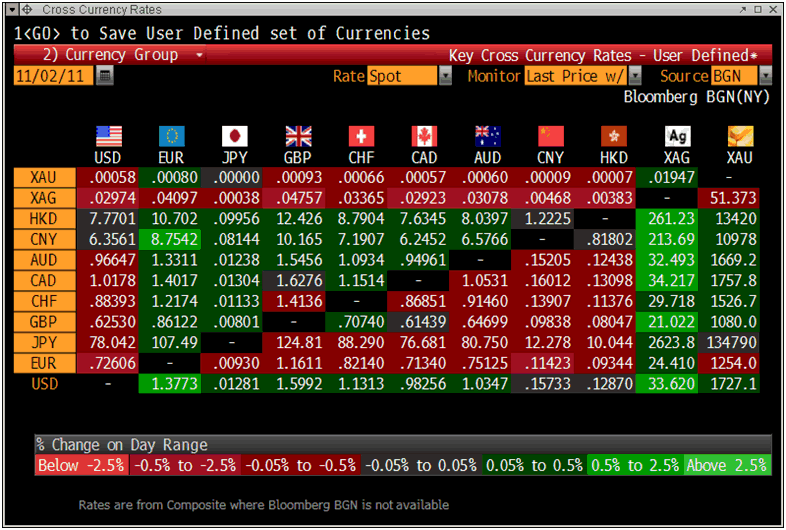

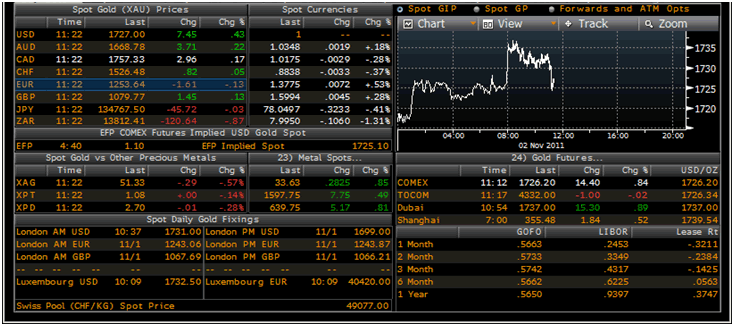

Gold is trading at USD 1,727.10, EUR 1,254, GBP 1,080, JPY 134,790, AUD 1,669.20 and CNY 10,978 per ounce.

Gold is trading at USD 1,727.10, EUR 1,254, GBP 1,080, JPY 134,790, AUD 1,669.20 and CNY 10,978 per ounce.

Gold’s London AM fix this morning was USD 1,731.00, GBP 1,081.27 and EUR 1,257.35 per ounce.

Yesterday's AM fix was USD 1,702.00, GBP 1,067.69 and EUR 1,243.06 per ounce.

Cross Currency Table

Gold is higher in most major currencies but especially the US dollar this morning. Although gold has lost some of its early gains in Europe as the euro and equity indices have stabilized.

The shock and uncertainty regarding Prime Minister George Papandreou's call for a referendum on a European Union bailout deal continues to reverberate in international markets leading to a renewed safe haven bid.

Greece's cabinet decided early on Wednesday to back Papandreou's proposal for a referendum on the EU deal – according to government spokesman. Papandreou is sticking to plans to hold the vote despite signs his government may collapse.

Greek Referendum to Lead to Return of the Drachma?

The possibility of a return to the drachma has raised its head after Papandreou said a referendum on Europe’s rescue package will confirm Greece’s membership of the euro.

There are increasing calls in Greece for a return to the drachma – polls show 33% in favour of a return to the Greek drachma at this time.

The fact that it is impossible for Greece to regain competitiveness while clinging to the euro is becoming increasingly evident. Prominent economists such as Nouriel Roubini, as well as investor George Soros have said as much and influential voices in Greece are now questioning the wisdom of clinging to the euro.

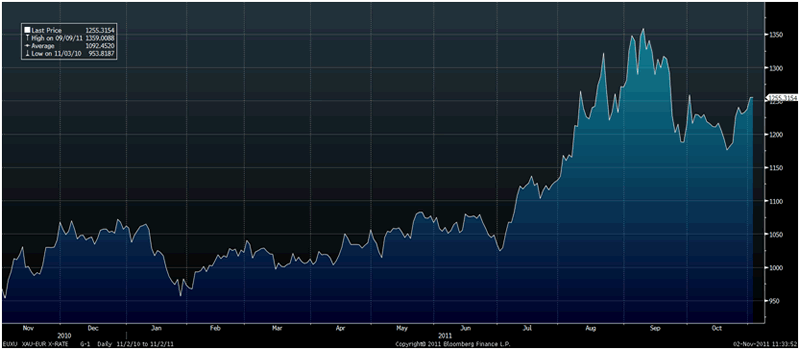

XAU-EUR Exchange Rate (G1-Daily)

Krugman Warns of “Gigantic Bank Run”, “Emergency Bank Closing” and “New Lira”

Paul Krugman’s latest post is extremely bearish and he warns that “things are falling apart in Europe; the center is not holding”

Krugman warns that this could lead to a “gigantic bank run” and “emergency bank closing”.

Not only does Krugman warn of a massive bank run and emergency bank holidays but he warns of the euro breaking up and Italy returning to the Italian lira and even warns of similar problems confronting France.

“The question I’m trying to answer right now is how the final act will be played. At this point I’d guess soaring rates on Italian debt leading to a gigantic bank run, both because of solvency fears about Italian banks given a default and because of fear that Italy will end up leaving the euro. This then leads to emergency bank closing, and once that happens, a decision to drop the euro and install the new lira.”

“Next stop, France.”

Uber Keynesian Krugman, has been one of the most vocal gold bears in recent years and his opinion on gold has been biased and uninformed.

It will be interesting to see if his attitude towards gold has changed given the appalling vista he is now warning of.

An important question we have posed for some time, “What price is gold in drachma, lira, pesetas, escudos and punts?“

What should the ordinary people in European countries do to protect themselves from currency debasement and devaluations?

Unfortunately, we may find out the answer to these questions in the coming months.

Gold Prices, Gold Rates, Gold Fixes

Gold’s Safe Haven Status Being Shown

Gold’s safe haven status has again been clearly shown in recent days despite continuing skepticism from the sadly misinformed.

Gold’s recent sell off led to renewed doubt and a new bout of questioning with regard to gold as a safe haven. While gold was 0.9% lower yesterday in US dollar terms, it was higher in the majority other fiat currencies.

Its 0.9% fall in dollar terms was an impressive performance given the scale of the losses seen in equity and commodity markets.

In euro terms, gold has risen from €1,215/oz on Monday to €1,256/oz or a rise of some 3%. European equity indices have fallen sharply since Monday showing gold’s proven status as a hedging instrument and a safe haven.

October Market Review

Despite the dramatic new flow of recent days it is as always crucial to keep an eye on the long term performance of major assets.

In October, currency markets saw the US dollar fall against major currencies except for the Japanese Yen.

The Euro climbed 3.3% in October against the dollar. GBP was up 3.0%, CAD up 4.91%, and CHF up 3.33%. Hong Kong dollar was 0.23% higher against US dollar, and Chinese Yuan was 0.51% higher. The Japanese Yen lost 1.5%.

Bonds markets had varied performance. US Treasuries ended 1.4% lower in October, the biggest loss since December 2010. German bunds have fallen 1.5%. However, the risky bonds flourished as equities did. The Barclays Capital US high yield index gained 6.2%, while US investment grade bonds climbed 1.1%.

There was a huge rally in global major stock indices in October, making it the best month for equities since 2009.

The benchmark S&P 500 was up 10.77% while the Dow Jones Industrial Average ended the month 9.54% higher.

In Europe, the FTSE 100 ended 8.11% higher, Germany’s Dax up 11.26%, the CAC rose 8.75% and Ireland’s ISEQ was 8.85% higher.

In Asia, the Hang Seng Index was up 12.92%, while NIKKEI 225 had a relatively weaker performance, ending 3.31% higher.

Oil ended the month 17.5% higher.

Precious metals also had strong performance. Gold finished at around 5.7% higher, while silver surged 15.1%. The strong gains suggest that gold and silver’s recent sharp correction and period of consolidation may be coming to a close.

Platinum and palladium gained 6.2% and 5.4%, respectively.

Liquidity continues to slosh around global markets which is supportive of risk assets and saw risk appetite return in October - in what had the hallmarks of an inflationary “crack up boom”.

The shock Greek and MF Global news since Halloween and brutal start to November is already challenging risk appetite and November looks set to be a volatile month.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $33.92/oz, €24.59/oz and £21.19/oz

PLATINUM GROUP METALS

Platinum is trading at $1,602.20/oz, palladium at $639/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.