Global Depression, Sovereign Default and Hyperinflation Are Top “Extreme Risks” Today

Commodities / Gold and Silver 2011 Nov 01, 2011 - 08:11 AM GMTBy: GoldCore

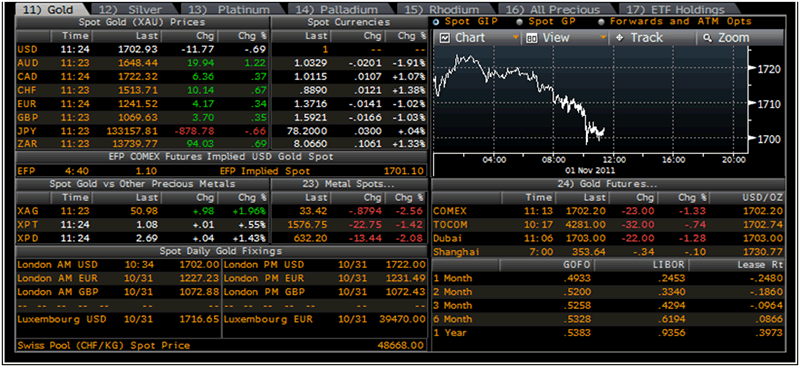

Gold is trading at USD 1,702.93, EUR 1,241.52, GBP 1,069.63, JPY 133,157, AUD 1,648 and CHF 1,513.71 per ounce.

Gold is trading at USD 1,702.93, EUR 1,241.52, GBP 1,069.63, JPY 133,157, AUD 1,648 and CHF 1,513.71 per ounce.

Gold’s London AM fix this morning was USD 1,702.00, GBP 1,067.69 and EUR 1,243.06 per ounce.

Yesterday's AM fix was USD 1,718.00, GBP 1,072.88 and EUR 1,227.23 per ounce.

Gold Prices, Gold Rates, Gold Fixes and Gold Vols

Gold prices are lower in dollars but marginally higher in euros and most currencies. The dollar and gold are seeing safe haven flows due to the risk of contagion developing from the Eurozone debt crisis. Greece’s surprise decision to have a referendum on the latest Eurozone ‘bailout’ has sent markets into panic mode with equities falling sharply and peripheral Eurozone bonds again coming under pressure.

The MF Global bankruptcy increases the risk of contagion. It is the seventh largest bankruptcy in US history and there are fears that it could potentially lead to a Lehman Brothers style systemic crisis. Thousands of MF Global clients including brokerages internationally may be exposed and unable to access their funds - it is believed that US clients’ assets alone are over $7 billion.

Increased counterparty risk will likely result in safe haven flows into physical gold.

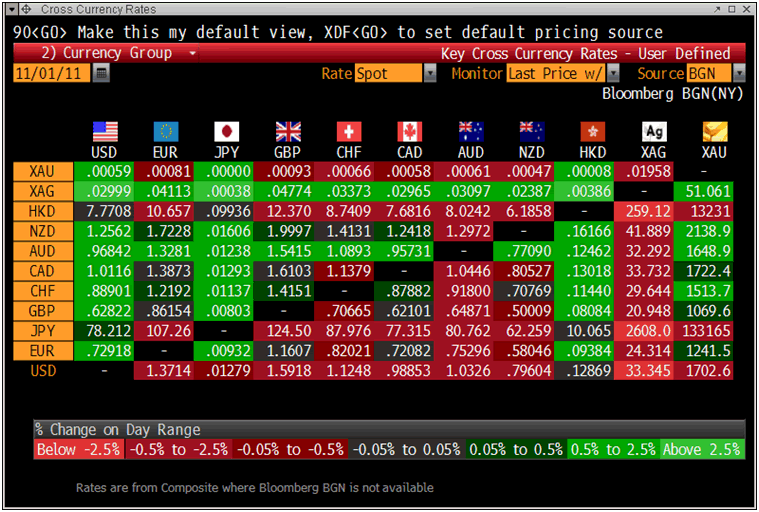

Cross Currency Table

The massive liabilities of the US, European and global banking and financial sectors are coming home to roost and this in conjunction with the sovereign debt crisis in Europe appears to be leading to contagion.

A problem of too much debt and leverage is being addressed by created more debt and leverage. The already massively indebted and over leveraged financial sector is not being deleveraged or downsized and therefore the root cause of the problem continues not to be addressed.

The MF Global bankruptcy has led to sharp decline in trading volumes in certain markets and counterparties have described attempting to transfer positions as ‘chaos’.

It will likely lead to a further distrust of paper assets and assets that have counter party risk and will provide a further boost to physical bullion and assets with less or without counter party risk.

This failure to address the root cause of the debt crisis should lead to gold being propelled to much higher prices in the coming months.

Global Depression, Sovereign Default and Hyperinflation Are Top “Extreme Risks” Today Towers Watson, the global consulting firm specializing in risk management consulting, has updated their ranking of the top 15 extreme risks (see commentary).

According to Towers Watson's ranking of the top 15 extreme risks, economic depression is the top global economic risk followed by the risk of sovereign default and the threat of hyperinflation.

The rankings list possible economic events that would have a high impact on global economic growth and asset returns if they occurred.

The change of ranking reflects a change of view regarding both impact and likelihood of each individual risk.

The survey reflects the sluggish economic recovery in the developed world during the past two years which the authors say increases the likelihood of further economic shocks.

The threat of sovereign default has increased from “medium” to “high”. Recent economic and political developments in the eurozone suggest that a break-up of the euro was more likely.

Tim Hodgson, head of the company’s "thinking ahead" group, says the global environment continued to display significant imbalances and would not be in good shape to withstand more major shocks.

Since the last report in 2009 the research added two extreme risks: resource scarcity and infrastructure failure.

Resource scarcity covers energy, metals, water or arable land. It assesses the likely mismatch between resources and rising demand from a growing population.

Infrastructure failure includes the risks posed by the dependence of modern economies on computer networks and power grids. The cost of such a failure would rise exponentially the longer the networks remained unoperational, the research said.

Not all extreme risks can be hedged. Any hedge used is likely to be imprecise, according to Towers Watson’s research.

It is interesting that this respected global consultancy firm now sees hyperinflation as the third highest extreme risk.

While hyperinflation remains a monetary ‘black swan’ dismissed by the majority of the marketplace, it can no longer be completely ruled out given the continuing highly inflationary policies of policy makers and central bankers.

Driven by potential new rounds of QE, the real risk of major currency devaluations and global currency debasement, gold remains an essential asset to own today.

SILVER Silver is trading at $32.87/oz, €24.02/oz and £20.64/oz

PLATINUM GROUP METALS Platinum is trading at $1,558.20/oz, palladium at $625/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely, Mark O'Byrne Exective Director

IRL 63 FITZWILLIAM SQUARE DUBLIN 2 |

UK NO. 1 CORNHILL LONDON 2 EC3V 3ND |

IRL +353 (0)1 632 5010 UK +44 (0)203 086 9200 US +1 (302)635 1160 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.