RENN, The Facebook of China

Companies / China Stocks Oct 31, 2011 - 03:32 AM GMTBy: George_Maniere

Every weekend I go through a different sector and I pull up companies and then I go through their chart. Going through the technical analysis portion process usually takes the list down to 20 stocks or so. I will then take those 20 stocks and do the fundamental analysis on the companies. I look for market capitalization, revenue, growth, P/E and get a feeling if this company is something that interests me.

Every weekend I go through a different sector and I pull up companies and then I go through their chart. Going through the technical analysis portion process usually takes the list down to 20 stocks or so. I will then take those 20 stocks and do the fundamental analysis on the companies. I look for market capitalization, revenue, growth, P/E and get a feeling if this company is something that interests me.

This weekend I went through the technology sector and came across a company called Renren (RENN).

Renren Inc. (Renren), formerly Oak Pacific Interative, is a social networking Internet platform in China. Renren generates revenues from online advertising and Internet value-added services (IVAS). The Company's platform enables its users to connect and communicate with each other, share information and user-generated content, play online games, listen to music, shop for deals and a range of other services. Its platform includes: Renren.com, Game.renren.com, Nuomi.com and Jingwei.com. The Company is also a developer and operator of Web-based games and offers the games through game.renren.com. Renren.com is the Company's primary social networking Website in China. Game.renren.com is its online games center. Nuomi.com is Renren's social commerce sites in China. Nuomi.com is an independent new business of Oak Pacific Interactive Co. (OPI) that offers a daily deal on the local services and cultural events. I’ve dubbed it the Facebook of China.

What really caught my eye was that there is a company Tencent Holdings Limited that is an investment holding company that is principally engaged in the acquisition of an Internet value-added services, mobile and telecommunications company. They want to gain access to more white-collar professionals and compete with Sina Corporation.

SINA Corporation (SINA) is an online media company. The Company provides services through five business lines, including SINA.com (online news and content), SINA Mobile (MVAS), SINA Community (Web 2.0 and social networking-based services and games), SINA.net (search and enterprise services), and SINA E-Commerce (online shopping). These business lines provide an array of services, including region-focused online portals, MVAS, social networking service (SNS), such as micro-blog and album, blog, audio and video streaming, album, online games, e-mail, search, classified listings, fee-based services, e-commerce and enterprise e-solutions.

While they had a 52 week high of $147.12 they closed on Friday at $87.39. After doing my due diligence I realized that while this company has a market cap of $5.8 billion it is an all purpose social site and is sort of played out and are headed down because the appeal of the company is too broad. The Chinese are looking for a company that will appeal to the professional white collar class. Renren fits this demographic perfectly.

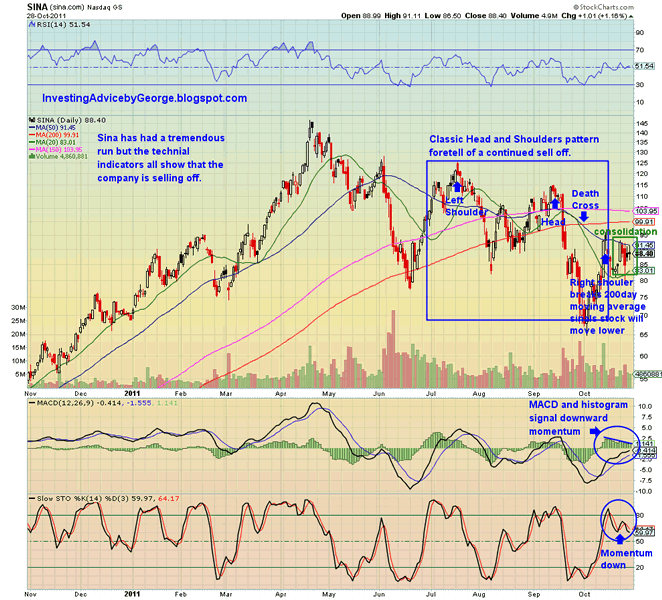

Let’s take a look at the chart of Sina below.

As we can see in this chart of Sina this appears to be a company that has had its day. The classic head and shoulders pattern, the death cross and a month of consolidation under the 200 day moving average all signal that this stock will continue to sell off.

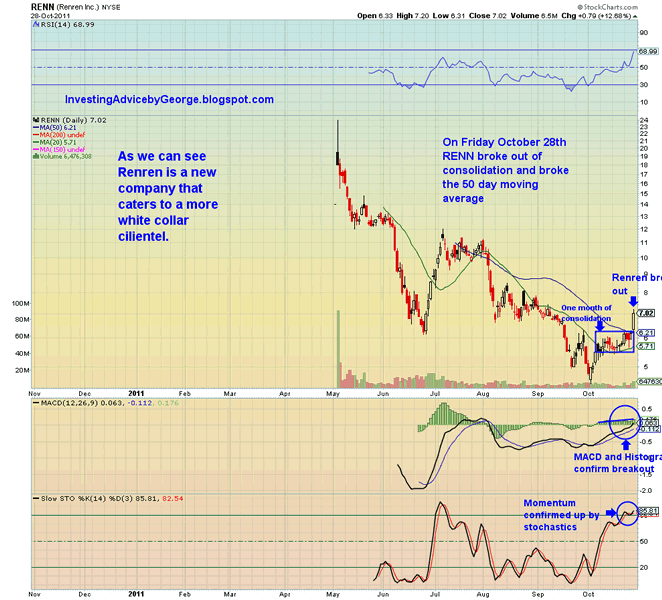

On the other hand let’s take a look at the chart of Renn below.

As we can see this is a relatively new company that did what most IPO’s do they opened and then sold off. After a month of consolidation in October on Friday October 28th it broke the 50 day moving average in convincing fashion and shows all of the technical signs of breaking out.

In conclusion, while Sina has proven to be a fine company, I believe their day is past. If I may borrow an analogy from our markets past does anyone remember Yahoo trading for $400.00 a share? Well now it is Google’s turn. Renren will come out of this battle the winner because they appeal to a more affluent and younger demographic. Today Monday, October 31, 2011 I will open a position in REN at $7.01. In suggest you take a look at these two holdings and if you agree with me open a position too.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.