Metals Strong on Supply Demand Fundementals

Commodities / Metals & Mining Dec 18, 2007 - 10:11 AM GMTBy: Gold_Investments

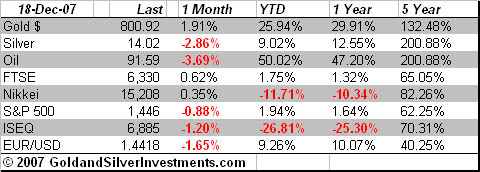

Gold was up $1.50 to $794.50 per ounce in New York yesterday and silver was unchanged at $13.81 per ounce. Gold was flat in Asia but has since rallied in Europe and the London AM Fix was at $796.25.

Gold was up $1.50 to $794.50 per ounce in New York yesterday and silver was unchanged at $13.81 per ounce. Gold was flat in Asia but has since rallied in Europe and the London AM Fix was at $796.25.

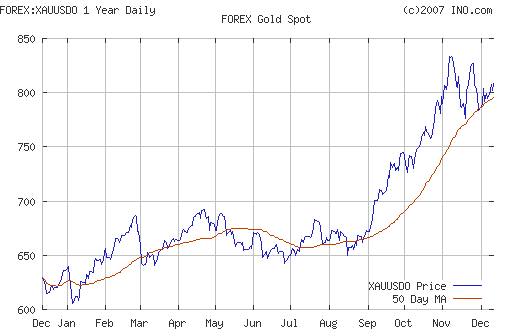

At the London AM Fix gold was trading at £395.67 GBP (marginally up from yesterday's London AM Fix at £395.38) and €553.53 EUR (up from yesterday's London AM Fix at €549.53 ). Gold has remained flat in sterling and actually increased in euros. The recent record highs for gold at the London AM Fix on the 7th of November were $841.75, £400.47 and €573.55. At the start of the year we predicted gold would reach $850 and close the year at around $800. We remain confident that the recent non inflation adjusted highs would be surpassed early in 2008 given the extremely strong fundamentals.

Interestingly and of relevance is the fact that the other precious metal - platinum - hit new record highs this morning at $1510. While platinum is not a monetary metal like gold it does have similar tight supply demand fundamentals. The forwards have tightened and there are real and ongoing supply concerns from Russia and South Africa. The market looks very strong with supply worries, strong jewellery demand particularly from Asia, industrial demand for catalytic converters and increasing investment demand in the form of the platinum ETF. Platinum holdings in the ETF Securities fund jumped 3,200/ozs yesterday to a record 116,160/oz. There are real worries that Russia may not renew its export licenses.

Gold bounced strongly off support at $786 yesterday and $786 and support at $776 look like strong support with good physical demand at these levels. Gold may trade in a range between $786 and $815 prior to a likely decisive break out to the upside early in the New Year. Gold was strong over the Christmas period last year and may be again. Last year it was strong at Christmas, sold off early in the New Year and then rallied from mid January until early March.

The credit crisis looks set to evolve from a serious liquidity crisis to an even more serious solvency crisis. If the solvency of major banks becomes an issue as seems increasingly likely then gold's safe haven credentials will really come into their own. The FT reports that emergency help for financial markets entered new territory on Monday night as the European Central Bank announced that it would on Tuesday offer unlimited funds at below-market interest rates in a special operation to head off a year-end liquidity crisis. The surprise move, which follows last week's co-ordinated barrage of measures by the world's central banks to increase market liquidity, suggests the ECB is still frustrated at the failure to ease market tensions.

Gordon Brown is to host a 'credit squeeze summit' in London with the leaders of Germany and France in order to try and address global "financial turbulence". Gordon Brown has said he wants a "better early warning system" for the global economy.Another case of closing the door after the horse has bolted.

Silver

Silver is trading at $14.00/14.02 at 1200 GMT after yesterday's sideways movement. Silver remains the most undervalued of all the precious metals and will likely outperform all other commodities in the coming year and years. It remains the investment opportunity of a lifetime and the non inflation adjusted high of $50 per ounce will almost definitely be seen by 2012.

PGMs

Platinum was trading at $1505/1510 as per above (1200 GMT).

Spot palladium was trading at $356/361 an ounce (1200 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and was trading at over $91.60 a barrel.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.