The Unfortunate Truth About an Overbought Stock Market

Stock-Markets / Stock Markets 2011 Oct 30, 2011 - 04:30 AM GMTBy: J_W_Jones

Writing about financial markets is probably the most challenging endeavor I have ever immersed myself into. I am a trader first and a writer second, but I have really come to enjoy scribing missives about financial markets because it really forces me to concentrate on my analysis.

Writing about financial markets is probably the most challenging endeavor I have ever immersed myself into. I am a trader first and a writer second, but I have really come to enjoy scribing missives about financial markets because it really forces me to concentrate on my analysis.

Writing for the general public has really enhanced my perception of the market and forced me to dig deeper and learn new forms of analysis. I find myself learning more and more every day and the beauty of trading is that even for the most experienced of traders there is always an opportunity to learn more. As members of my service know, I strive to be different than most of my peers as my focus is on education and being completely transparent and honest.

I want readers to know that I was wrong about my recent expectations regarding the European sovereign debt summit. I was expecting the Dollar to rally based on the recent price action and quite frankly I expected stocks to falter after running up nearly 15% into the announcement. My expectations could not have been more untimely and incorrect.

I share this with you because as I read and listen to market pundits discussing financial markets I find that too many writers and commentators flip-flop their positions to always have the appearance of accuracy. In some cases, there have been television pundits that stated we were possibly going to revisit a depression in 2012 no more than 5 weeks ago. These so-called experts have now changed their positions stating that we have started a new bull market in recent weeks. How can anyone take these people seriously?

Financial markets are dynamic and consistently fool the best minds and most experienced traders out there. Financial markets do not reward hubris. If a trader does not remain humble, Mr. Market will happily handle the humbling process for him. I was humbled this week. I was reminded yet again that financial markets do not take prisoners and they show no mercy. I am sharing this with readers because I want you to know that I refuse to flip-flop my position without first declaring that I was wrong.

When I am wrong, I will own up to it purely out of sense of responsibility. My word and my name actually mean something to me, and while I strive to present accurate analysis I am fallible and I will make mistakes. The key however to the mistakes that I make is my ability to learn from them and the past week was a great learning opportunity.

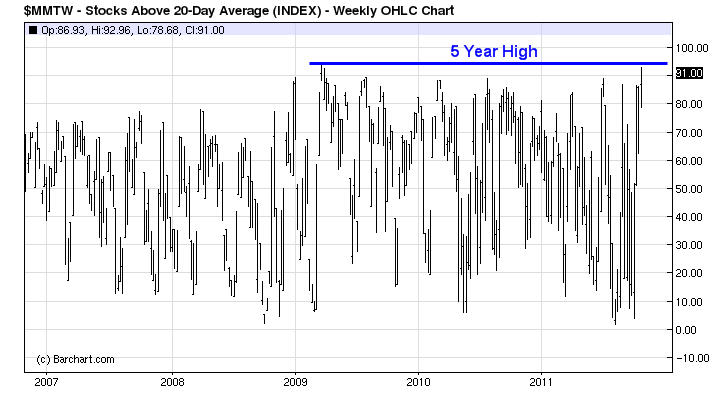

After regrouping and stepping back after the price action on Thursday, a few key elements really stood out to me regarding recent price action. First of all, in the short-term we are extremely overbought. The chart below illustrates the number of stocks in domestic equity markets trading above their 20 period moving averages over the past 5 years:

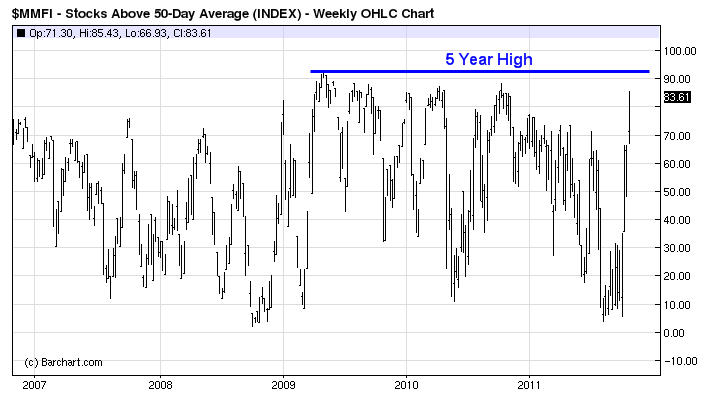

What is apparent from the chart above is that prices are almost as overbought right now as they have been anytime in the past 5 years. The number of domestic equities trading above their 50 period moving average over the past 5 years is also nearing the highest levels seen during the same period as the chart below illustrates:

Equities trading above the 100, 150, and 200 period moving averages are somewhat subdued by comparison meaning in the short run a possible correction appears likely. The longer-term time frames are no longer oversold, but they have considerable upside to work with before we could declare that they are overbought.

Additionally, the details of the European Union's supposed solution have not yet been released raising questions going forward. Every move that is made will create unintended consequences. As an example, since Greece had 50% of their debt written down why would Ireland or Portugal refuse to pay their debts in full?

The Irish and Portuguese governments are going to come under pressure from their constituents to renegotiate the terms of their debt based on the agreement that was made with Greece recently. Spain politicians will likely be under pressure as well. The decisions made in these so-called bailouts reverberate across the geopolitical spectrum. Moral hazard still exists, it just evolves over time.

The risk premium of sovereign debt has to be adjusted since credit default swaps did not trigger payment as the write-downs were considered “voluntary.” Thus credit default swaps are not the answer to hedge sovereign debt as it would appear that governments have the ability to write down debt without triggering a default based on the status of the write-down. The long-term unintended consequences could be severe and are unknown at this point in time.

In addition to the unknown factors impacting the European “solution”, next week the Federal Reserve will have their regular FOMC meeting and statement. There has been a lot of chatter regarding the potential for QE III to come out of this meeting. While I could be wrong, initiating QE III right after the Operation Twist announcement would lead many to believe that Operation Twist was a failure.

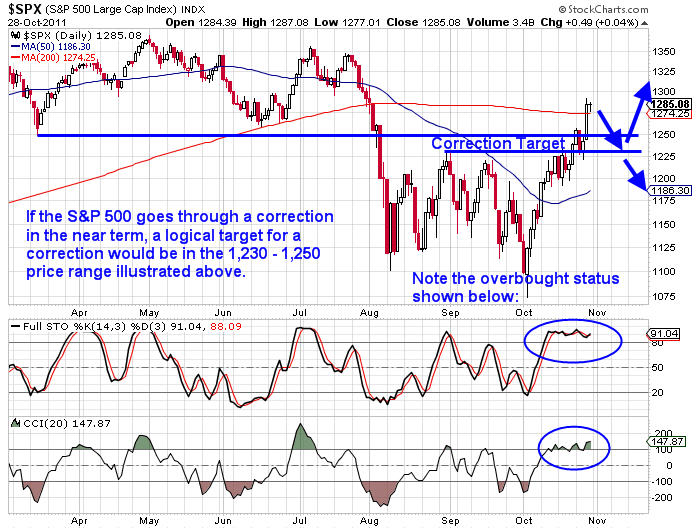

With interest rates at or near all time lows and the recent rally we have seen in the stock market, it does not make sense that QE III would be initiated during this meeting. It is possible that if QE III is not announced the U.S. Dollar could rally and put pressure on risk assets such as the S&P 500 in the short to intermediate term. If this sequence of events played out, a correction would be likely. The following is a daily chart of the S&P 500 with possible correction targets in place:

Right now it is a toss up in the financial blogosphere as to the expectations of where price action will head. Are we near a top? Is this the beginning of a new bull market? I scanned through several charts Friday evening and Saturday morning and came to this realization. If the market is going to breakout and this is not a top but the beginning of a major bullish wave higher, then the Nasdaq 100 Index (NDX) has to breakout over the 2011 highs.

The Nasdaq 100 Index is comprised of stocks such as AAPL, GOOG, INTC, and YHOO. In order for a new leg higher to transpire, hyper beta names like AAPL and GOOG have to breakout higher and show continuation with strong supporting volume. If the NDX does not breakout over the 2011 highs, a top could potentially be forming. The daily chart of the Nasdaq 100 Index is shown below:

In conclusion, the short term looks like a possible correction could play out. However, it is critical to note that the longer term time frames are more neutral at this time. Furthermore, if price action cannot penetrate the 2011 highs for the Nasdaq 100 Index, I do not believe that a new bull market will have begun. If the Nasdaq 100 Index cannot breakout above the 2011 highs, we could be putting in a potential top going into the holiday season.

In closing, I will leave you with the thoughtful muse of famed writer and minister Hugh Prather, “Almost any difficulty will move in the face of honesty. When I am honest I never feel stupid. And when I am honest I am automatically humble.”

Subscribers of OTS have pocketed more than 150% return in the past two months. If you’d like to stay ahead of the market using My Low Risk Option Strategies and Trades check out OTS at http://www.optionstradingsignals.com/specials/index.php and take advantage of our free occasional trade ideas or a 66% coupon to sign up for daily market analysis, videos and Option Trades each week.

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.