Stocks Bear B Wave Rally or New Bull Market?

Stock-Markets / Elliott Wave Theory Oct 30, 2011 - 04:16 AM GMTBy: Tony_Caldaro

Another positive week for US equities as they gained ground for the fourth week in row. The majority of the gains occurred on thursday after the ECU had agreed upon a solution to their credit crisis wednesday night. Most of the economic reports swung to the positive side this week after remaining negative to neutral for months. On the downside: consumer confidence, FHFA housing prices, durable good orders, pending home sales, PCE prices and the M1-multiplier. On the uptick: Q3 GDP, Case-Shiller, new home sales, personal income/spending, consumer sentiment, the WLEI, the monetary base, and weekly jobless claims downticked. The SPX/DOW gained 3.7% and the NDX/NAZ were +3.3%. Asian markets soared 6.6%, European markets gained 4.3%, the Commodity equity group soared 7.6%, and the DJ World index gained 5.7%. Next week’s economic events will highlighted by the FOMC meeting, the monthly Payrolls report, ISM and monthly Auto sales. Best to your week!

Another positive week for US equities as they gained ground for the fourth week in row. The majority of the gains occurred on thursday after the ECU had agreed upon a solution to their credit crisis wednesday night. Most of the economic reports swung to the positive side this week after remaining negative to neutral for months. On the downside: consumer confidence, FHFA housing prices, durable good orders, pending home sales, PCE prices and the M1-multiplier. On the uptick: Q3 GDP, Case-Shiller, new home sales, personal income/spending, consumer sentiment, the WLEI, the monetary base, and weekly jobless claims downticked. The SPX/DOW gained 3.7% and the NDX/NAZ were +3.3%. Asian markets soared 6.6%, European markets gained 4.3%, the Commodity equity group soared 7.6%, and the DJ World index gained 5.7%. Next week’s economic events will highlighted by the FOMC meeting, the monthly Payrolls report, ISM and monthly Auto sales. Best to your week!

RECAP of WEEKEND REPORTS

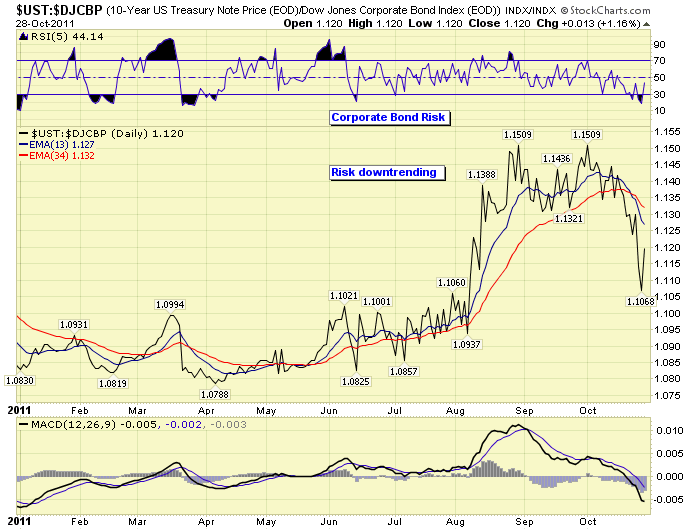

The past several weekend updates have included specific historical references to the current market. On 10/08 http://caldaro.wordpress.com/2011/10/08/weekend-update-313/ we described Secular bull/bear cycles and discussed the current corporate bond risk environment verses the risk in 2008. We stated the market has been in a Secular bear cycle since 2000, detailed how today’s market fits into that cycle, and there would not be a double dip recession. We also noted, corporate bond risk appeared to be less than 2008 and should be contracting during the current uptrend. Overall, we concluded this is not 2008! Earlier that week, thursday Oct 6th, we identifed a potential diagonal triangle downtrend low, and suggested the market could now retrace 50% to 61.8% of the entire bear market. An update on corporate bond risk is below.

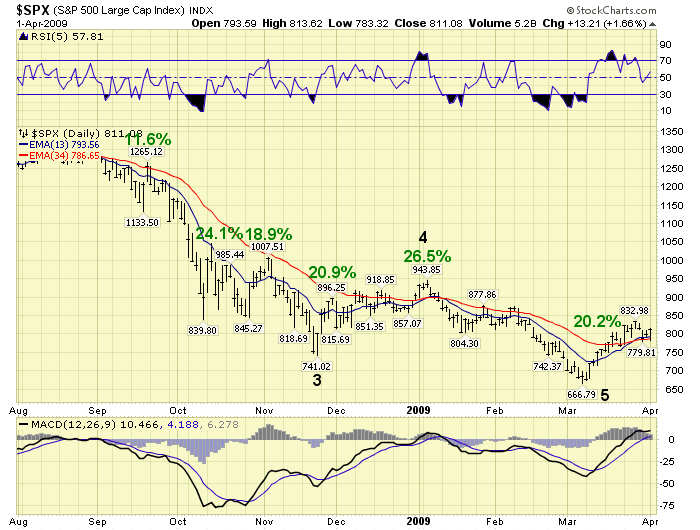

In the next report, on 10/15 http://caldaro.wordpress.com/2011/10/15/weekend-update-314/ we discussed bear market rallies and bull traps. We compared the recent 9 day, 14%, rally with four similar rallies during the 2008 bear market. The first three of those rallies, ranging from 11.6% to 24.1%, failed to produce a confirmed uptrend. The fourth rally, 20.9%, eventually did. That was the Nov08 low. Our current market is also in a confirmed uptrend. We also noted, a fifth rally of 20.2% in 9 days signalled the end of the bear market in Mar09. Our current market has rallied 20.3% in 18 trading days, as of thursday.

Last weekend, on 10/22 http://caldaro.wordpress.com/2011/10/22/weekend-update-315/ we discussed the Grand Supercycle, Supercycles, Cycles and Primary waves. We placed our current market in a multi-century rising GSC3 from July 1932, and a multi-decade rising SC3 from March 2009. We also suggested Cycle wave [1] of the new SC3 was currently underway, and Primary wave I had just concluded at SPX 1371 in May 2011. A review of all the historical Primary II waves, though the sample was small, revealed some interesting statistics.

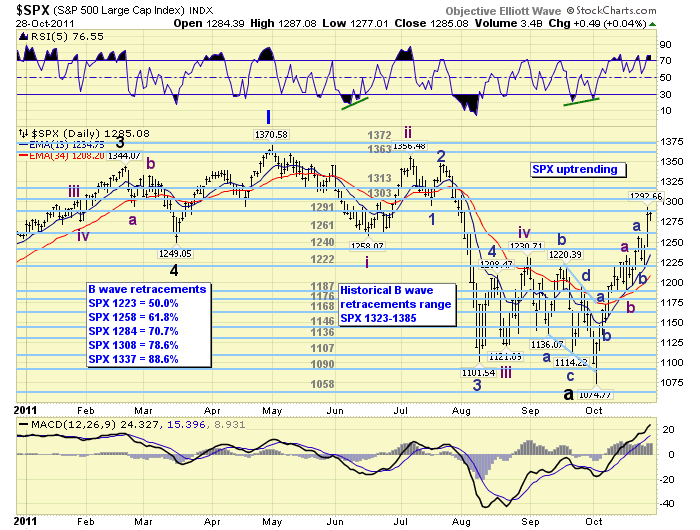

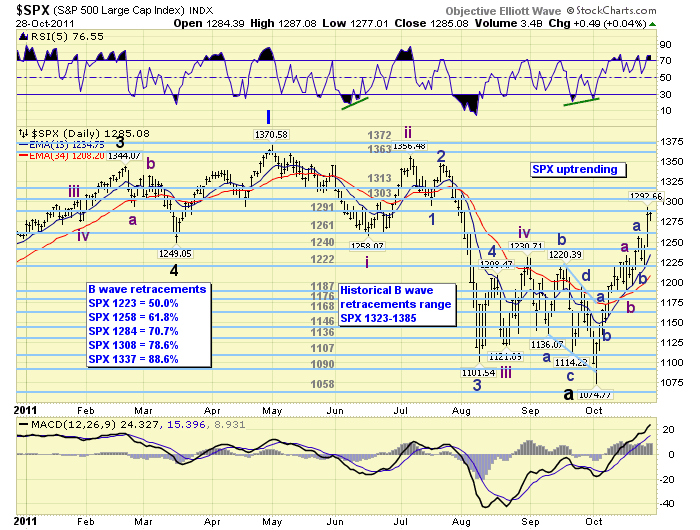

All rising Primary waves lasting 5 months to 18 years, our was 26 months, were followed by a declining Primary wave of 1 to 6 years. We also uncovered, and we quote; “No less than 80% of the time, the Primary wave bull market high was retested, (within -3.5% to +1%), at some point during the B wave portion of the declining Primary wave.” On October 4th, at SPX 1075, our market ended the A wave portion of Primary wave II, and the B wave portion is currently underway. Continuing the quote; “This would suggest the current B wave rally could rise to within 3.5% (SPX 1323) of the SPX 1371 bull market high, or even surpass it by 1% (SPX 1385). Then the C wave of the bear market would take over, returning the market to the A wave low or lower. Most of the time, 60%, the final bear market wave structure is a flat. It appears, should this B wave exceed the 61.8% retracement level at SPX 1258 by 1% or 2%, the market is likely going to make a run at the bull market high.” On thursday of this week the market exceeded that range by rising 2.8% above the SPX 1258 61.8% retracement level. Now, a retest of the Primary wave I high is now highly likely. A retest is defined as a B wave rally uptrend high between the SPX 1323 to 1385 range noted above. We noted this range along with Fibonacci retracement levels on the daily chart below.

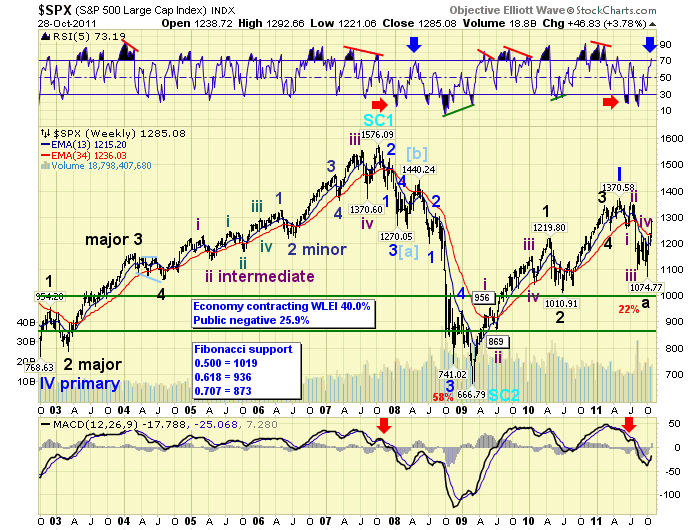

LONG TERM

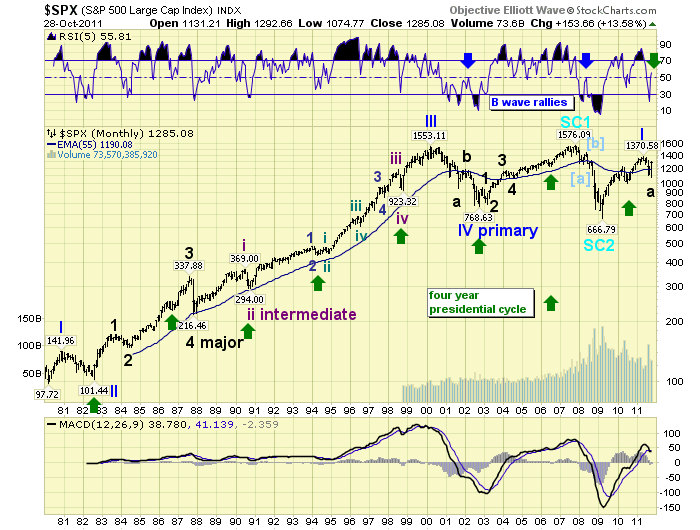

In recent weeks we had noted the RSI readings during B wave bear market rallies typically stopped at a neutral 50 reading . We posted the monthly chart of the SPX, noting this relationship with the blue arrows in the RSI section of the chart. Observe, with one trading day to go in this month, where the RSI is now. It has risen above the neutral 50 reading to 55.8 as noted by the green arrow. This may be an indication our current uptrend is more than just a B wave rally in a bear market. Project, monitor and adjust when necessary.

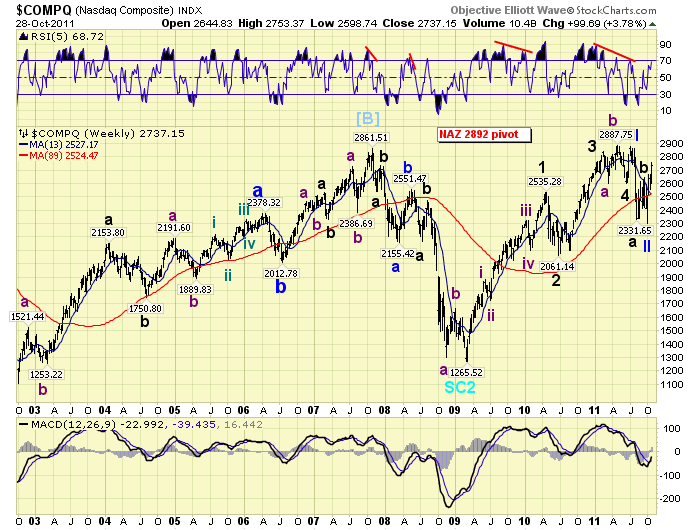

We have been carrying an alternate SPX count on the NAZ charts. This count suggests the recent 21.6% decline ended Primary wave II in a flat at the Oct 4th SPX 1075 low. And, the market has just entered Primary wave III. Let’s see if we can find some evidence supporting this potential scenario.

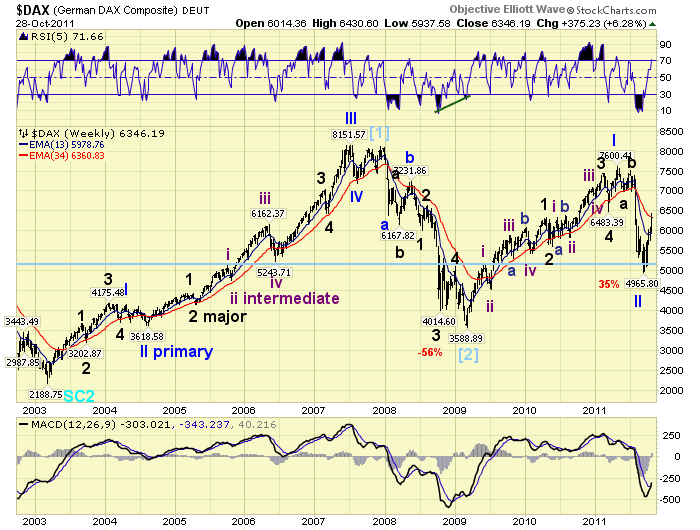

Since this bear market started in the foreign markets that, naturally, would be the first place to look for potential completed bear wave patterns. Upon review we find we have already labeled completed bear market patterns in 6 of the 14 indices: the DJW, DAX and SMI with completed zigzags; the ASX and BVSP with completed irregular flats lasting 18 months; and the FTSE with an irregular flat lasting over a year. Also there are three indices with potentially completed patterns: the HSI and TSX with zigzags; and the RTSI with a very unusual irregular flat. That makes 9 of the 14 foreign indices we track. Then if we place the SPX in the potential category we have 40% (6 of 15) with completed bear market patterns, and a total of 67% (10 of 15) with potentially completed bear market patterns. Since the recent world economic problems were centered in Europe, and Germany’s DAX was one of the most volatile markets during that period we display its chart below.

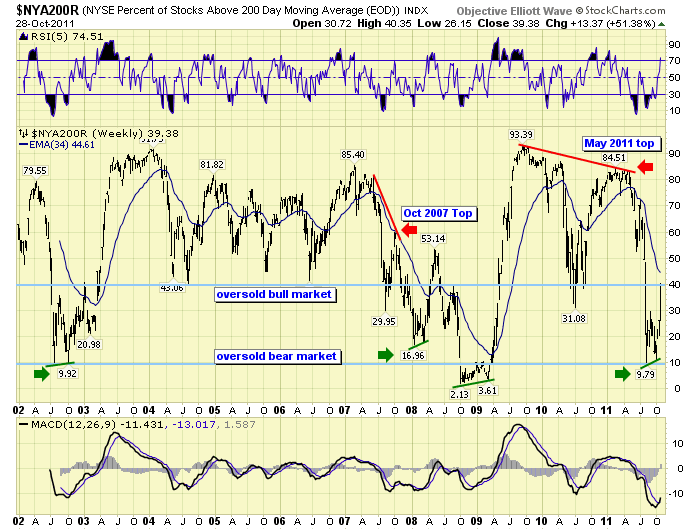

The next area to consider are the technicals in the US market. We had posted this internal market strength chart in late spring. Notice the negative divergence as the market made the Primary wave I high in May. Then we noted the oversold condition at the August low, which suggested this bear market would not be like 2008. Now notice the positive divergence at the October low, a clear sign of the end of a significant wave. However, the A wave low in 2008 also displayed this positive divergence. And, internal market strength has not risen more than 40% above its 10% low which would indicate further upside strength. Inconclusive.

Next we review our weekly chart. Notice during bull markets the RSI gets extremely overbought and barely oversold. Then during bear markets it gets extremely oversold and barely overbought. Observe how the B wave rally in 2008 barely hit overbought, and quickly retreated to start that nasty C wave decline. Our current uptrend just broke through that barely overbought 70% level with a reading of 73%. This is a positive.

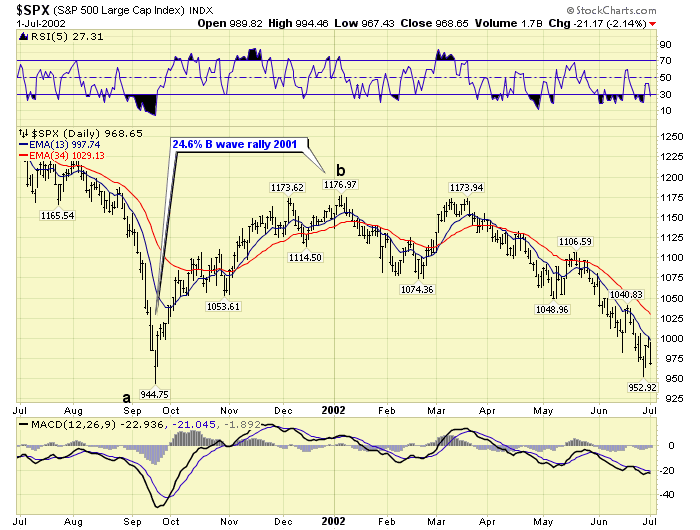

The next thing to review is the price strength of the rally itself. This can best be done by observing the daily chart, just above the Long Term section, in relation to fibonacci moving averages. Notice how this uptrend has been tracking the 13EMA. Once it cleared it, on the third day of the uptrend, it has used it as support four times during this uptrend. The daily SPX chart of the 2008 bear market rallies, near the beginning of this update, did not display this tendency until the bear market was over in March 2009. In fact, the 2001 B wave rally, despite its 24.6% rise, was also quite choppy in its relative price strength. This is a definite positive.

As a result of this finding we reviewed all the bull market kickoffs since 1982. Seven in all: 1982, 1984, late 1987, 1990, 1998, 2002 and 2009. Everyone one of them displayed this type of positive price relationship. Some uptrended only 12% to 14%, (1984 and 1990), in a matter of months. While others, (1982 and 2009), uptrended 40% in the first few months. The more important the low the more significant the rise in the first uptrend.

To summarize. This is the first uptrend after a significant low. We identified its low a few days after the event. Initially the wave pattern suggested a new uptrend was underway, probably a B wave, that would retrace 50% to 61.8% of the entire May11-Oct11 decline. That level was exceeded this week. An historical review suggests this B wave can now continue into the SPX 1323-1385 range. The market closed at SPX 1285 on friday. Today’s analysis suggests the current uptrend may be a bull market kickoff of Primary wave III. This would suggest much, much higher prices ahead in the months to come. While the market is currently in the first uptrend off the Oct 4th SPX 1075 low. We have no way of determining which of these two counts is the most probable, and working, count. At least not until this uptrend ends and the following downtrend concludes as well. Therefore, we currently have to rate both counts will equal weight, pending further market price activity, and are shifting to neutral long term.

MEDIUM TERM: uptrend high SPX 1293

After the market completed what appeared to be five waves down earlier this month it quickly rallied and confirmed a new uptrend. We received a WROC buy signal the week of Oct 10th, and have now received another buy signal this week. In the past four years we have had repetitive monthly buy signals only five times: Mar08, Mar09, July09, July10 and this Oct11. Three of the first four were kickoffs to major rallies in the bull market. The other was a B wave rally in the 2007-2009 bear market.

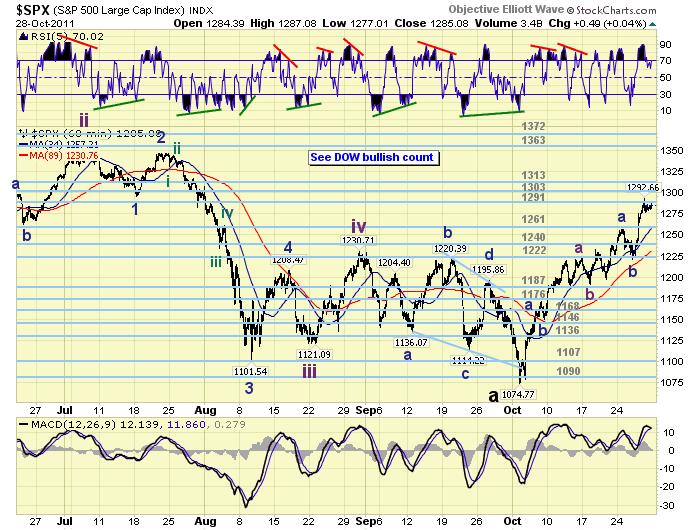

This uptrend, off the early October SPX 1075 low, has risen 20.3% in just 18 trading days. Quite impressive. During the advance to SPX 1293 there have been six pullbacks between 21 and 36 points, and seven rallies between 28 and 92 points. The market rallied from SPX 1075 to 1220, 13.5%, with only two pullbacks and then ran into price congestion and started to overlap waves on the hourly chart. Initially the uptrend looked quite impulsive until this event, then it started to look correctively choppy. Recently, we have been tracking it as a series of zigzags on the hourly chart. Upon further review, as noted above with the daily 13 EMA analysis, the overall appearance could also be considered impulsive on this larger timeframe.

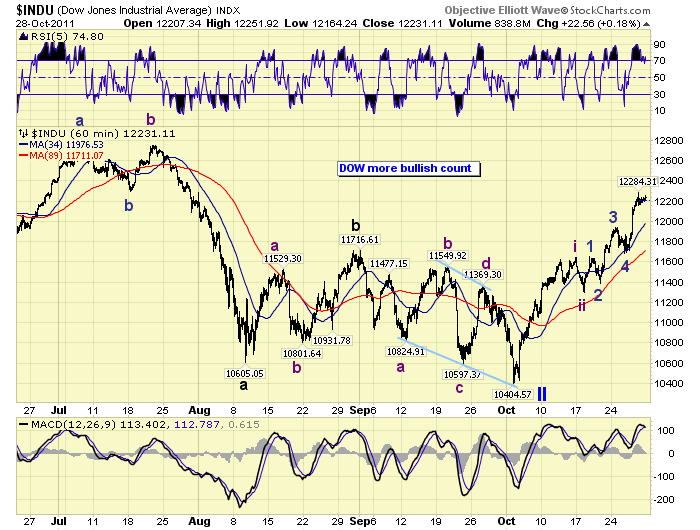

As a result of this current technical situation we will continue to carry the B wave bear market rally scenario on the SPX charts. But we are shifting, the Primary wave II over and Primary wave III underway scenario, from an alternate count to an equally weighted count. This second count will now appear on the DOW charts, as well as, the NAZ charts and several others previously noted.

SHORT TERM

Short term support is the at 1261 and 1240 pivots, with resistance at the 1291 and 1303 pivots. Short term momentum is sitting right around overbought.

Under the complex zigzag scenario, we have been tracking in the SPX, we are expecting another 20+ point pullback before the market completes this last Minor wave zigzag. All the pullbacks, thus far, have been between 21 and 36 points. On thursday/friday the market pulled back 16 points from the SPX 1293 uptrend high to 1277. While we have been expecting something larger, that may have been it. We shall see in the next day or so.

Under the impulsive DOW scenario we can count Intermediate waves i and ii completed at the Oct 18th low. Then Minor waves 1 thru 4 completed at the Oct 26th low. The market should now be in Minor wave 5 of Intermediate wave iii. Either way, the market should experience a fairly sizeable pullback, possibly 36 SPX points or more, after the current short term rally concludes. With a cluster of resistance between the OEW 1291 and 1313 pivots: Feb low, April low, May low, and mid-July low. The end of Intermediate wave iii should be only days away. Best to your trading!

FOREIGN MARKETS

The Asian markets rallied 6.6% on the week. The ASX and BSE are in confirmed uptrends, and the other three have nearly confirmed as well.

The European markets are/have been all in uptrends and gained 4.3% on the week.

The Commodity Equity group gained 7.6% on the week. The BVSP is in a confirmed uptrend and the other two are nearly there as well.

The DJ World index is now in a confirmed uptrend and it gained 5.7% on the week.

COMMODITIES

Bond prices continue to downtrend losing 0.5% on the week.

Crude is uptrending again in what appears to be the launch of Major wave 5. It gained 7.0% on the week.

Gold has nearly confirmed an uptrend as well as it gained 6.2% on the week.

The USD appears to be downtrending as it has sold off from DXY 80 to 75 while the equity rally has been underway. The USD lost 1.7% on the week, while the EUR gained 1.8% and the JPY gained 0.7%. Risk on.

NEXT WEEK

A busy economic week ahead. Monday kicks it off at 9:45 with the Chicago PMI. On tuesday the FED starts its 2 day FOMC meeting, ISM manufacturing, Construction spending, and monthly Auto sales will all be reported. Wednesday, the ADP index in the morning, and the FOMC statement in the afternoon. On thursday, weekly Jobless claims, Factory orders and ISM services will be released. Then on friday, the monthly Payrolls report and Unemployment rate. Also on friday FED governor Tarullo gives a speech in Wash, DC. Sorry for the delay in publishing the report, but wanted to make sure everything of importance was covered. Best to your weekend and week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.