The New Steel Silk Road

Commodities / Steel Sector Oct 28, 2011 - 12:08 PM GMTBy: Richard_Mills

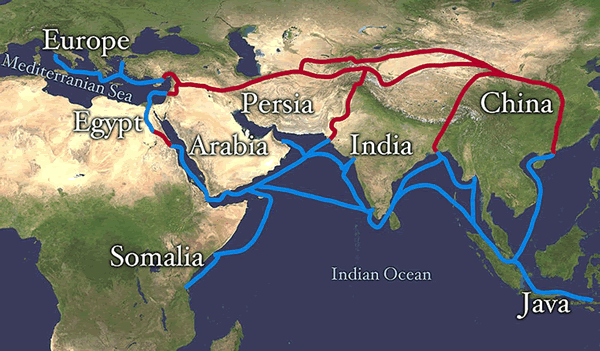

The Silk Routes, collectively known as the "Silk Road", refer to a 7000 mile network of interlinking trade routes that were used for three millennia. They connected China, India, Tibet, the Persian Empire, the Mediterranean countries and parts of North and East Africa.

The Silk Routes, collectively known as the "Silk Road", refer to a 7000 mile network of interlinking trade routes that were used for three millennia. They connected China, India, Tibet, the Persian Empire, the Mediterranean countries and parts of North and East Africa.

The Maritime Silk Road was a network of shipping lines from the Red Sea to East Africa, India, China, and Southeast Asia. The network consisted of ship routes in two general directions: the East China Sea routes and the South China Sea routes.

The East China Sea routes connected the Chinese mainland to the Northeast Asian regions of the Liaodong Peninsula, the Korean Peninsula, and the Japanese Isles. The South China Sea route heads down, then up, through the Malacca Straits into the Bay of Bengal, opening up China to the coasts of the Indian Ocean, the Red Sea, the Persian Gulf and the African continent.

These shipping lanes are still in use.

A Southern Silk Road

Willem Buiter and Ebrahim Rahbari, Citigroup Inc. economists, predict growing trade links between emerging markets will increase worldwide trade in goods and services from $37 trillion in 2010 to $149 trillion in 2030. They also estimate that China will overtake the U.S., within four years, to become the world's largest trader.

"It is the start of a new cycle. China has companies that are willing to invest, they have products that are good enough, and they are backed by abundant liquidity in the country's financial system." Ben Simpfendorfer, author The New Silk Road

Today trade is flowing on a "Southern Silk Road" connecting Asia, the Middle East, Africa and Latin America:

- Trade between China and South Asia is still growing

- China's trade with Africa is expected to double by 2015

- Africa's top trading partners, in terms of bilateral trade volume, are China and India

- Over 50 per cent of India's trade is now with other Asian countries while only 32 per cent is with the United States and Europe

- China's trade with Arab countries is growing by 30 percent annually and India's is expected to grow even quicker

- China's trade with Latin America is growing twice as fast as U.S. trade with the region and India's trade within the region has increased 10 fold in a decade

Trade between developing nations is forecast to be larger than trade among developed nations by 2015 - HSBC is calling for a ten-fold increase in developing nations intra-trade over the next four decades.

"Thick borders discourage capital inflows, keep people trapped in rural poverty and leave economies persistently underperforming. Only if they can connect with each will emerging nations be able to turbo-charge their economic futures." Stephen King, HSBC's London-based chief economist, author of Losing Control: The Emerging Threats to Western Prosperity

The MSCI Emerging Markets Index has risen 102 percent since January 2009, that's compared to the 41 percent gain in the MSCI World (MXWO) Index of 24 developed markets.

The New Steel Silk Road

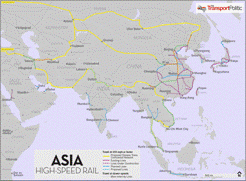

The real point of modernizing railways, and the major reason for China's global push for High Speed Rail, is the increased movement of cargo - a shift in passenger traffic to the new high speed routes frees up space on the older, now congested legacy lines for increased freight shipping.

Shippers can switch to cheaper rail transport instead of using trucks for long haul of heavy bulky cargos. According to the World Bank, because of this shift and the construction of additional freight lines, the tonnage hauled by China's rail system increased, in 2010, by an amount equal to the entire freight carried by the combined rail systems of Britain, France, Germany and Poland.

China's total investment in high speed rail was first reported to be about US$300 billion - the Chinese planned a 12,000km high speed passenger network supplemented by 20,000km of mixed traffic lines capable of 200-250kph.

Recent reports indicate that over US$600 billion will be spent on rail construction during the 2011-2015 Five Year Plan. By 2020 there would be at least 16,000 km of passenger dedicated high speed rail. The total rail network by 2020 would be 120,000 km - 80% of it electrified.

China has plans to construct its high speed rail line through Asia and Eastern Europe in order to connect to the existing infrastructure in the European Union (EU). Additional rail lines are planned into South East Asia as well as Russia - this will likely be the largest infrastructure project in history.

The project will include three major high speed lines:

- UK/Europe to Beijing (8,100 km) and then extend south to Singapore

- A second line will connect into Vietnam, Thailand, Burma and Malaysia

- The third line will connect Germany to Russia, cross Siberia and then back into China

Financing and planning for this monumental project is being provided by China - who is already in negotiations with 17 countries to develop the project. In return the partnering nation will provide natural resources to China.

"We will use government money and bank loans, but the railways may also raise financing from the private sector and also from the host countries. We would actually prefer the other countries to pay in natural resources rather than make their own capital investment." Wang Mengshu, a member of the Chinese Academy of Engineering and a senior consultant on China's domestic high-speed rail project

The exact route of the three lines has yet to be decided, but construction for the South East Asian line had already begun in the Chinese southern province of Yunnan and Burma is about to begin building its link. China offered to bankroll the Burmese line in exchange for the country's rich reserves of lithium, a metal widely used in batteries.

Russia

Russian Railways, the state rail monopoly, plans to build a €15bn high speed railway line between Moscow and St Petersburg that will eventually reach at least ten Russian cities in the European part of the country.

China sees Russia as a land bridge to Europe and has urged the country to extend its planned HSR network further east to connect the two countries.

Russia and China have announced plans to build a new trans-Siberian link.

Russia wants to build a $65 billion railway from Siberia to North America. This line would extend the proposed Chinese-Russian rail line across 3/4 of the Northern Hemisphere.

Tibet, Iran, Pakistan and India

China has already built a line linking Tibet to the rest of China - it crosses 550km of continuous permafrost and experiences extreme temperatures swings.

Iran, Pakistan, and India are each negotiating with China to build domestic rail lines that would link into the overall transcontinental system. Iran's Press TV reported that the two countries had signed a $13bn contract for China Railways to build 5,000km of track in Iran.

Vinay Mittal, the Chairman of the Indian Railway Board, told Indian media that high-speed trains were feasible and necessary for India, especially for freight corridors.

Planning Commission Deputy Chairman Montek Singh Ahluwalia said if India is looking at a GDP growth rate of 5 per cent, the present rail infrastructure is fine, but if it wants to grow by 9 per cent, it needs the high-speed rail networks.

Turkey

The Turkish State Railways started building high-speed rail lines in 2003 and are targeting a 1500 km network of high-speed lines by 2013 and a 4000 km network by the year 2023.

The Marmaray project is a rail transport network around Istanbul and the world's deepest immersed railway tunnel under the Bosphorus strait.

Marmaray is an important junction as it will act as the connector between subway and railway lines in the European and Asian parts of Turkey.

South-East Asia

China is laying tracks to mainland South-East Asia. It has recently signed agreements to build new lines in Laos and Thailand, while it extends its network from Kunming to the China-Laos border.

These lines are meant to be ready by 2015.

Laying lines into Myanmar would add an Indian Ocean port - a railway into Myanmar would give China access to the Indian Ocean and allow it to bring oil supplies up into its southwest without going through a vulnerable choke point in the narrow Straits of Malacca.

Greater Mekong Sub-region

Trains already run between China and Vietnam, which has a north-south railway. This existing linkage opens up a circuitous eastern route into South-East Asia, via Cambodia and Thailand.

By 2014, once this route is operating, it would carry almost 7m tonnes of cargo among Greater Mekong countries, rising to 26m tonnes by 2025.

Latin America

China is proposing to build a new, and dry alternative to rival the almost century old Panama canal - a 220km railway.

The rail link would connect the northern Atlantic coast of Colombia with its Pacific coast. The plan also includes a proposal to build a new city south of Cartagena to assemble Chinese exports.

This is just one of several transportation projects the Chinese and Colombians are looking at. The most advanced is a 791 km railway and expansion of the Pacific port of Buenaventura.

If the US ratifies the negotiated free trade agreement with Colombia the country would become an important access point for exports to the U.S. market.

Last year China National Petroleum Corp. struck deals with Venezuela's national oil company (PDVSA) to develop the Orinoco Belt oil field and to explore for oil in southern Venezuela. The output will need to be transported to Pacific ports for shipment to Asian markets using Colombia's proposed rail lines.

China has already started building a railway in Venezuela and recently signed a deal with Argentina to construct another.

Africa

"All across Africa, new tracks are being laid, highways built, ports deepened, commercial contracts signed--all on an unprecedented scale, and led by China, whose appetite for commodities seems insatiable. Do China's grand designs promise the transformation, at last, of a star-crossed continent?" Howard W. French

The National Railways of Zimbabwe has begun replacing 144 km of permanent way with rail secured from China.

Botswana is looking for an infusion of Chinese money for its proposed Trans-Kgalagadi railway linking Botswana with Namibia.

The rail line between Angola's southern port of Namibe and the frontier provinces of Huila, Namibe and Kuando-Mubango has been almost completely rebuilt with Chinese help.

The Caminhos de Ferro de Benguela (CFB) rail line is also being rebuilt with help from the Chinese. Its over 1300km long and crosses Angola from west to east joining up with the rail network in the Democratic Republic of Congo, which is being rebuilt with Chinese help.

The 1900km Tanzania-Zambia Railway, linking half of Africa - from Cape to Cairo - was built and funded by the Chinese. The Chinese government recently cancelled 50 per cent of the unpaid loan and gave a new loan of $39.9 m to the Tanzania and Zambia Railways Authority.

Fixed Asset Investments

China's economic development to date has been largely driven by fixed asset investments (FAI). Fixed assets include items such as land and buildings, motor vehicles, and plant and machinery - meaning China's annual growth has been fueled by energy-intensive heavy industry and infrastructure construction, not yet by consumer demand.

"Especially in the U.S., consumer spending is essential: It drives about 70 percent of economic activity -- more than for most European nations and well above the rates in developing countries such as China." Martin Crutsinger Associated Press

China's fixed-asset investments rose 25 percent year-on-year to hit 18.06 trillion Yuan (2.83 trillion U.S. dollars) during the first eight months of 2011.

China is able to invest so much into FAI because, in addition to the inflow of foreign direct investment (FDI is a measure of foreign ownership of productive assets, such as factories, mines and land) its citizens have a very high savings rate as a percentage of income. Because of controls on how and where they can invest that money, Chinese savers have little choice but to invest at home.

As trade along the Steel Silk Road builds and intensifies Chinese savings will increasingly be used for infrastructure investment in foreign lands, not the buying of US Treasuries. Deep-sea ports, rail lines, airports, roads, bridges and power generation will be the investments of choice.

"Rail lines not only function as the circulatory system for a national and global economy, but are the backbone for internal development. The rail lines proposed are not simple railroad lines, no matter how they might appear on a map, but are designed to be "infrastructure corridors." The New Federalist, Newspaper, 1995

Conclusion

"From a western perspective, it's tempting to believe that either the eurozone debt crisis or the US slowdown is the greatest show on earth. That temptation should be resisted. The greatest show on earth is happening elsewhere: the creation of a southern Silk Road, a network of new "South-South" trading routes connecting Asia, the Middle East, Africa and Latin America." Stephen King, Time to put the Southern Silk Road on the Map, ft.com

There's been a shift in global trade taking place with developing countries increasingly interacting with each other instead of their old trading partners, the developed nations.

Given the fact that Eurasia, Latin America, the Middle East and Africa comprise most of the world's population will The New Steel Silk Road be the building block for a truly developed global economy? It's something that's definitely on my radar screen. Is it on yours?

If not, maybe it should be.

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.