Today Europe Promised Stock Market Investors a Profitable Christmas

Stock-Markets / Stock Markets 2011 Oct 27, 2011 - 04:29 AM GMTBy: George_Maniere

On Wednesday night EST, Euro zone leaders struck a deal with private banks and insurers for them to accept a 50 percent loss on their Greek government bonds under a plan to lower Greece's debt burden and try to contain the two-year-old euro zone crisis.

On Wednesday night EST, Euro zone leaders struck a deal with private banks and insurers for them to accept a 50 percent loss on their Greek government bonds under a plan to lower Greece's debt burden and try to contain the two-year-old euro zone crisis.

The agreement was reached after more than eight hours of hard-nosed negotiations involving bankers, heads of state, central bankers and the International Monetary Fund and aims to draw a line under spiraling debt problems that have threatened to unravel the European single currency project.

Under the deal, the private sector agreed to voluntarily accept a nominal 50 percent cut in its bond investments to reduce Greece's debt burden by 100 billion Euros, cutting its debts to 120 percent of GDP by 2020, from 160 percent now.

At the same time, the euro zone will offer credit enhancements to the private sector totaling 30 billion Euros. The aim is to complete negotiations on the package by the end of the year, so that Greece has a full, second financial aid program in place before 2012.

The value of that package, EU sources said, would be 130 billion Euros -- up from 109 billion Euros when a deal was last struck in July, an agreement that subsequently unraveled.

The summit allowed the EU to adopt an ambitious and credible response to the crisis that is sweeping across the Euro zone.

As well as the deal on deeper private sector participation in Greece Euro zone leaders also agreed to scale up the European Financial Stability Facility (EFSF), their 440 billion euro ($600 billion) bailout fund set up last year.

The fund has already been used to provide help to Ireland, Portugal and Greece, leaving around 290 billion Euros available. Around 250 billion of that will be leveraged 4-5 times, producing a headline figure of around 1.0 trillion Euros, which will be deployed in a variety of ways.

Leaders hope that this will be enough to stave off any worsening of the debt problems in Italy and Spain, the region's third and fourth largest economies respectively.

The EFSF will be leveraged in two ways, either by offering insurance, or first-loss guarantees, to purchasers of euro zone debt in the primary market, or via a special purpose investment vehicle that will be set up in the coming weeks and which is aimed at attracting investment from China and Brazil. The methods could be combined, giving the EFSF greater flexibility.

The leverage could be up to one trillion (Euros) under certain assumptions about market conditions and investors' responsiveness in view of economic policies.

As with the July 21 agreement, which quickly broke down when it became difficult to secure sufficient private sector involvement and market conditions rapidly worsened, the concern is that Thursday's deal will only work if the fine print can be promptly agreed with the private sector.

Charles Dallara, the managing director of the Institute of International Finance (IIF), said those he represented were committed to making the deal work.

On behalf of the private investor community, the IIF agreed to work with Greece, euro area authorities and the IMF to develop a concrete voluntary agreement on the firm basis of a nominal discount of 50 percent on notional Greek debt held by private investors with the support of a 30 billion euro package.

As part of efforts to attract investors into the special purpose vehicle attached to the EFSF, Sarkozy said he would talk to Chinese President Hu Jintao in the coming days. Beijing has so far been a big buyer of bonds issued by the EFSF, which is triple-A rated by credit agencies.

Earlier, U.S. stocks rallied after news emerged of the intention to boost the power of the EFSF fund, while the euro fell as investors awaited details that are unlikely to be forthcoming until next month.

Leaving the summit venue at 4.30 a.m., Jean-Claude Trichet, the outgoing head of the European Central Bank, said he was cautiously optimistic that the deal could help stabilize the unrest in European financial markets and economies.

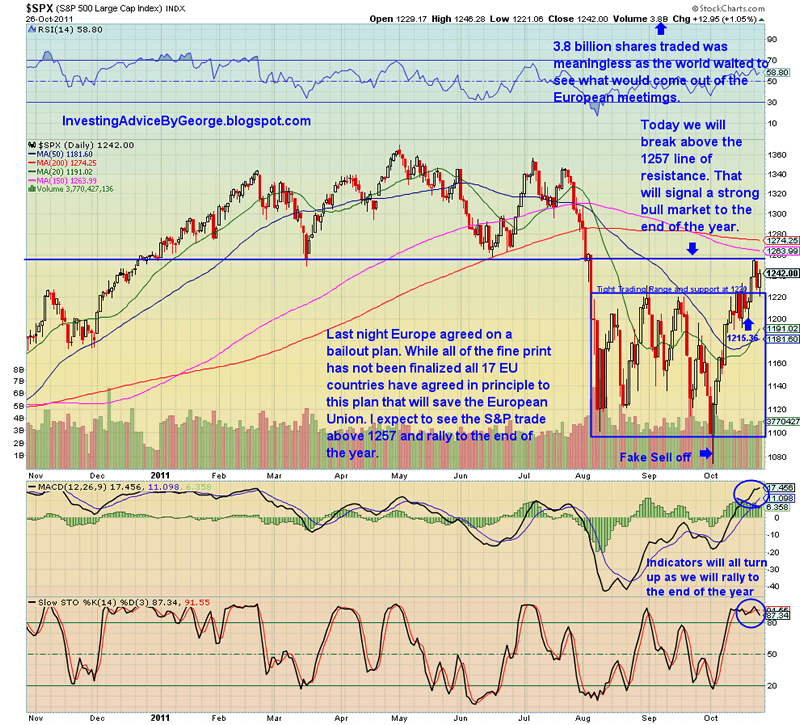

So where does this leave our economy and how do we move forward from here? As soon as the deal was announced our dollar sold off and money immediately began to pile back into equities. The Asian and European Markets were all up strongly and the risk on play is back. In the futures commodities are up big while it looks like gold and silver will take a break. Please see chart below.

The most telling sign is that The S&P futures are set to open at 1258.9 which is one point over the resistance that the S&P had steadfastly held on to. A break above 1257 is a very bullish indication and signals that we will rally to the end of the year.

We are in a strong earnings season, the CPI is up, there seems no chance of another recession and now with the European contagion seemingly worked out it would appear that the market will rally to at least the end of the year. While there will be some speed bumps along the way I will not be surprised to see 1350 by the end of the year. So get out your shopping list and on any pullbacks it’s time to wade into the water. Today Europe promised me a profitable Christmas.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.