Gold Breaks Out and Consolidates Above $1,700/oz, Financial Alchemy Risks Severe Inflation

Commodities / Gold and Silver 2011 Oct 26, 2011 - 10:52 AM GMTBy: GoldCore

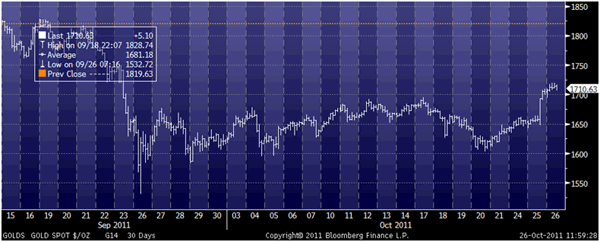

Gold is trading at USD 1,708.20, EUR 1,230.11, GBP 1,071.37, JPY 129,700, AUD 1,650 and CNY 10,864 per ounce.

Gold is trading at USD 1,708.20, EUR 1,230.11, GBP 1,071.37, JPY 129,700, AUD 1,650 and CNY 10,864 per ounce.

Gold’s London AM fix this morning was USD 1,713.00, GBP 1,070.69 and EUR 1,229.54 per ounce.

Yesterday’s AM fix was USD 1,656.25, GBP 1,036.19 and EUR 1,187.96 per ounce.

Gold in USD – 30 (Tick)

Gold has extended yesterday’s 4% rise in the US, with further gains seen overnight in Asia and consolidation in Europe. Safe haven demand continues due to increasing risk of a failed outcome from the European Union leaders' meeting scheduled later today and due to significant macroeconomic and monetary risks.

The cancellation of a European finance ministers meeting and downplaying of expectations by euro-zone officials about the outcome of the EU summit is adding to investor concerns about contagion emanating from the nexus of European banks and large sovereigns including Italy. There are conflicting reports that Berlusconi has agreed to step down.

US Treasury Secretary, Timothy Geithner warned of the “catastrophic risk” posed by the turmoil.

The Bank of England dismissed the chaotic efforts to save the eurozone from financial meltdown as a temporary solution to the region’s woes.

Governor Sir Mervyn King said long term issues such as towering levels of debt and structurally weak economies still needed to be tackled.

‘The aim of the measures to be introduced over the next few days is to create a year or possibly two years ’breathing space,’ he said.

King’s warning follows that of former Fed Chairman Alan Greenspan who warned on CNBC two weeks ago that the EU was doomed to fail because the divide between the northern and southern countries is just too great.

The key problem facing bureaucrats and bankers of massive swathes of debt in the European and global financial system is not being tackled. They are attempting to rectify a problem of too much debt by further electronic and paper money creation and the creation of even more debt.

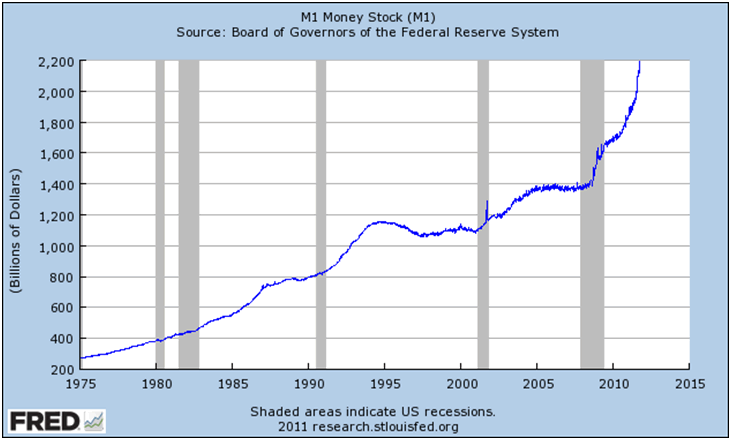

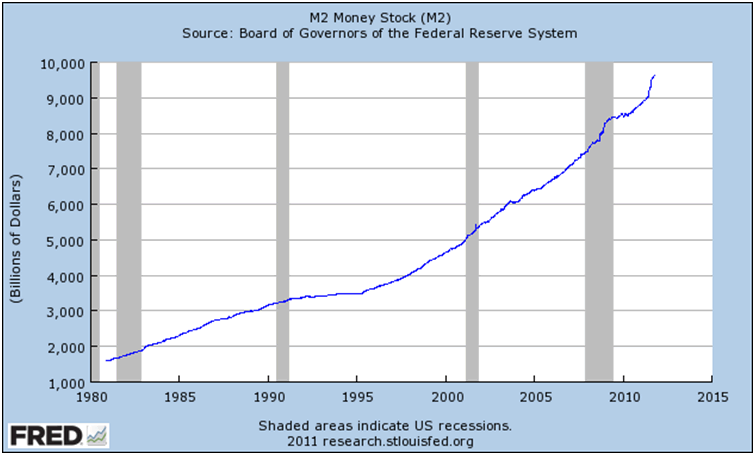

The growing risk now is that in a desperate attempt to solve the crisis, bankers and bureaucrats in the EU, US and elsewhere are practicing an extreme form of financial alchemy which risks stagflation and possibly in a worse case scenario hyperinflation.

Monetary economics and history shows that there will be costs and ramifications for the creation of billions and trillions of euros, dollars, pounds, yen and other fiat currencies.

The European Monetary Union (EMU) rightly expressly forbid the printing and electronic creation of money to bail out banks and sovereign nations.

A look at a history of currencies—including the mighty Deutsche Mark—shows the unavoidable results of currency debasement.

Other News

Bild reported, without citing how it obtained the information, that the Bundesbank’s gold reserves may be used as collateral in the event that the European Financial Stability Facility can’t meet its payment obligations.

SILVER

Silver is trading at $33.29/oz, €23.89/oz and £20.83/oz

PLATINUM GROUP METALS

Platinum is trading at $1,567.70/oz, palladium at $642/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.