Relative Strength Analysis is Important for Gold Stocks

Commodities / Gold & Silver Stocks Oct 26, 2011 - 01:53 AM GMTBy: Jordan_Roy_Byrne

Relative strength is defined as the measuring of one market against another over a specific period of time. Relative strength is an important concept in any bull market. After all, if you’ve found the bull market why not find the leaders? We consider relative strength particularly important when analyzing gold and silver stocks. There are hundreds of gold and silver stocks and despite the larger trend, they won’t always trend in the same direction. As a result, you need to be a stock picker in this sector if you want to earn the best returns.

How do you apply this analysis?

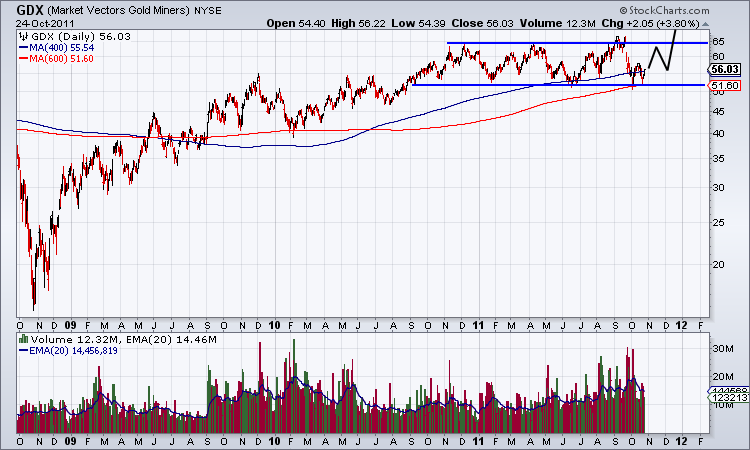

We use GDX and the HUI as our indicator for the large gold stocks. Lets take a look at GDX. The market has been in a trading range for the past year. A weekly close above $58 should confirm the bottom.

When the market is in a trading range, you need to buy relative strength and avoid the weak performers. The stocks that are weak can break support while the strongest stocks will either trend higher or remain comfortably above support. The present time is a perfect opportunity to employ this analysis. GDX remains in a long consolidation though may now be heading for a breakout in the next few months. As an investor you need to be aware of the strongest stocks and the weakest stocks.

Let me give a few examples.

A well known and well supported company very recently saw its stock plummet more than 20% on account of bad news. Production at one of its mines is ceasing indefinitely. Yes, this is bad news and cannot be predicted. However, we completely avoided this company due its poor relative strength. The shares were in a clear downtrend for most of 2011. As a result, its long-term moving averages were flattening and the shares fell below the moving averages. Sure, the bad news was random. The stock could have put in a bottom. However, it’s consistent poor performance for the majority of the year was a warning sign.

On the other side is one of my favorite companies, currently up 34% year to date. This company has great management and its shares benefited from a recent resource increase at one of its projects. The shares have trended higher for most of the year though declined almost 30% in September, yet remained above support from early 2011. As we pen this the shares are within 10% of a new all-time high and would likely benefit from a further move higher in GDX.

In this type of environment of a long and large consolidation one needs to employ relative strength analysis to find the winners and avoid the losers. This will not always be our strategy. If and when GDX breaks to a new high and the sector gains big momentum then we will want to find the undervalued companies that are starting to move and have huge upside potential.

It has been a difficult year for the gold and silver stocks as a whole. However, there have been winners here and there. In our premiumservice we’ve focused on relative strength and as a result our performance has crushed GDXJ and GDX in a difficult year. Now that GDX appears to be bottoming, investors need to choose the stocks which will benefit. The stocks with the best relative strength will be the first to breakout and will perform the best over the next couple of months. That is where your performance should come from. At the same time, we are recommending a few juniors and are keeping our eyes open for the big winners of 2012.If you’d be interested in professional guidance then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.