Gartman: EU Debt Plan to Hurt Currencies - Buy Gold in USD, GBP and EUR as “Is a Currency”

Commodities / Gold and Silver 2011 Oct 25, 2011 - 07:32 AM GMTBy: GoldCore

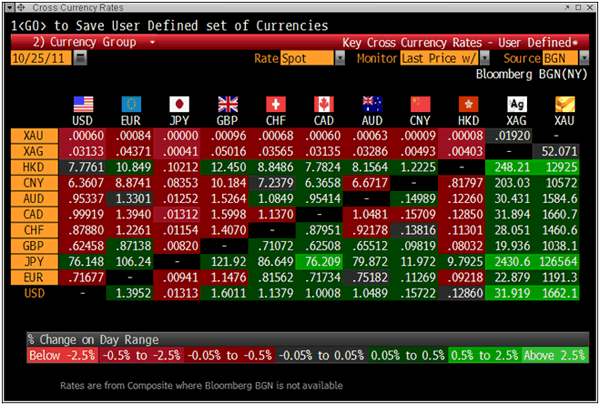

Gold is trading at USD 1,662.10, EUR 1,191.70, GBP 1,038.50, JPY 126,592.0, AUD 1585 and CNY 10,572/oz.

Gold is trading at USD 1,662.10, EUR 1,191.70, GBP 1,038.50, JPY 126,592.0, AUD 1585 and CNY 10,572/oz.

Gold’s London AM fix this morning was USD 1,656.25, GBP 1,036.19 and EUR 1,187.96 per ounce.

Yesterday’s AM fix was USD 1,651.00, GBP 1,035.56 and EUR 1,191.37 per ounce.

Cross Currency Table

Gold has edged higher in all major currencies again today as concerns about the European debt crisis and the risk of contagion is leading to demand for gold for wealth preservation purposes.

The likelihood of the Eurozone sorting out their intractable problems has come into question again as bankers in Europe’s largest banks have clashed with politicians about the size of losses they will have to take on their Greek debt.

Another bullish factor is more dovish sounds from the Federal Reserve regarding driving down mortgage rates to support the housing sector and another round of quantitative easing which was suggested by William Dudley, president of the New York Federal Reserve Bank.

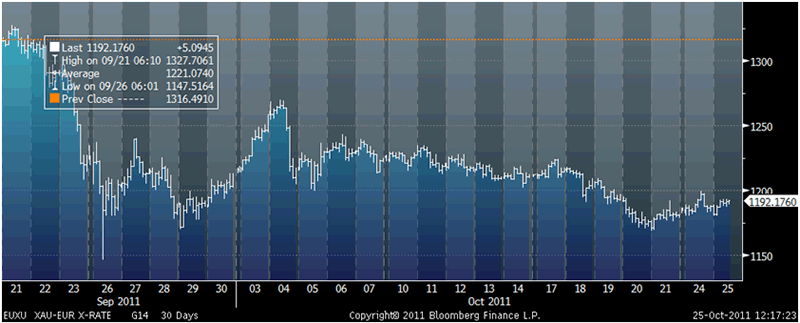

Gold in USD – 30 Days (Tick)

Physical demand out of Asia remains robust as seen in healthy premiums with gold premiums in Vietnam gold at a $28.07 premium over world gold of $1,642.65 and Shanghai gold closed at a premium of $12.89 to world gold of $1,652.25 (see LeMetropolecafe.com for Asian premiums).

Diwali is tomorrow and Indian demand has fallen somewhat but remains robust despite very significant demand in recent days and weeks.

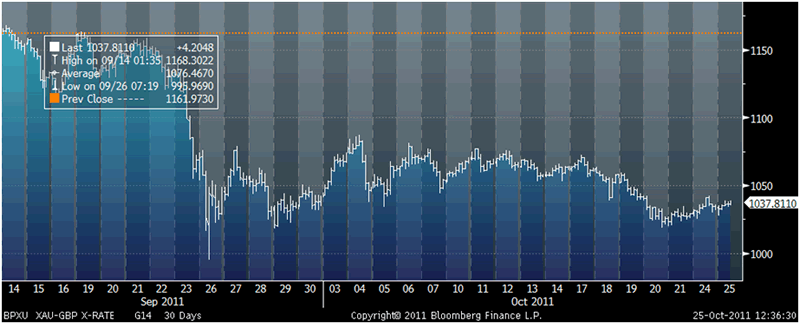

Newsletter writer Dennis Gartman has done a swift about turn and is now adding to his gold position by buying the metal priced in dollars, pounds and euros, he wrote today in his daily Gartman Letter.

Only last Tuesday, Gartman wrote that the gold market is suffering "very real damage." His comments were picked up very widely making headlines in the financial media internationally. Gartman warned that he feared that the rally from September's lows is "now under assault."

Today, Gartman said in his newsletter that he was certain gold prices would break upwards sooner rather than later.

Gartman said that the EU debt plan would hurt currencies. Therefore, gold will rally as currencies fall.

"The authorities have no choice but to inflate their way out of the morass that they’ve found themselves falling into and that shall mean the diminution of currencies generally and the advancement of gold as the only currency not diminished", he said.

Gold in EUR – 30 Days (Tick)

"Gold is a currency; it has been for years and it shall be for years going forward. A move upward through EUR 1,200 for gold today or tomorrow or this week or next shall be impressive and important," he said in the newsletter.

Gartman’s about turn may be important as he has been good in recent years in being long when gold has been rising in price despite a number of incorrect bearish calls at key junctures. Also, he is followed by major banks, hedge funds and institutions who trade in gold on Wall Street and may influence their trading activities.

The swift about turn is indicative of the near impossibility of trading these markets in the short term. It is evidence that even the most experienced and respected of Wall Street analysts can make incorrect calls which can cost people money.

This is why we encourage ordinary investors and savers to adopt a widows and orphans approach to investing in these uncertain times by buying quality assets with real diversification and adopting a buy and hold approach.

Timing markets is only for professionals and even they often get it wrong.

We make a market in buying and selling bullion and it is not in our interest, from a short term profit point of view, to discourage trading and ‘churn’ as this leads to commissions.

Gold in GBP – 30 Days (Tick)

However, we take our fiduciary duty seriously and believe we will have relationships with clients and their families and friends for life if we look after their interests. We do this through protecting their wealth by adopting a ‘buy and hold’ approach with regard to their bullion holdings.

It is advisable to ignore the noise of traders, hedge funds, commodity brokers and more speculative elements. In these uncertain times, it remains crucially important to focus on the importance of gold as a portfolio diversifier and a safe haven asset.

SILVER

Silver is trading at $31.77/oz, €22.82/oz and £19.86/oz

PLATINUM GROUP METALS

Platinum is trading at $1,547.50/oz, palladium at $637/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.