Gold to Average $1,900 Into 2012

Commodities / Gold and Silver 2011 Oct 25, 2011 - 02:37 AM GMTBy: The_Gold_Report

With investors and hedge fund managers taking flight toward cash and larger-cap equities, and the European sovereign debt crisis still hanging fire, the market is in for a bumpy ride, but in this exclusive interview with The Gold Report, Jeff Wright, an analyst with Global Hunter Securities, foresees upward trends for gold.

With investors and hedge fund managers taking flight toward cash and larger-cap equities, and the European sovereign debt crisis still hanging fire, the market is in for a bumpy ride, but in this exclusive interview with The Gold Report, Jeff Wright, an analyst with Global Hunter Securities, foresees upward trends for gold.

The Gold Report:Swiss Bank UBS recently lowered its 2011 average gold price to $1,615/ounce (oz.) to account for a stronger U.S. dollar, and predicted an average gold price in 2012 of $2,075/oz. How does that compare to Global Hunter Securities' projections?

Jeff Wright: We have a somewhat lower view of gold into 2012, closer to an average of $1,800/oz. to $1,900/oz.

In some respects, the dollar is weakening, but as the sovereign debt crisis in Europe lingers, the dollar has also strengthened. As long as you have worldwide volatility and a strengthening dollar, gold will be kept in check because its price is denominated in dollars. Once the European debt crisis resolves itself, gold will continue its upward bias and appreciate over time.

TGR: Gold recently had its best week since early September, rising a bit over 2%. Have we reached the floor at above $1,600/oz. or could we see a dip?

JW: We can certainly dip below that. When we're in a $1,660–$1,680/oz. range, we could easily drop $100/oz. based on an unforeseen event in Europe or the Middle East. On a percentage basis, I don't think going below $1,600/oz. is a big stretch.

TGR: Recently, gold has traded up on positive economic data in the United States and down on negative news. Can you hazard a guess on what's happening?

JW: When there has been negative news in the marketplace, either financial or political, investors have sought cash, not gold. We've also seen increased margin requirements in the futures market for gold, which I think caused some liquidation in gold contracts. Fund managers had to rotate out of gold to raise capital to meet their new margin requirements.

TGR: August and September were rough months for a number of precious metals companies. In the producer arena in particular, it seems like the one-mine names, like Lake Shore Gold Corp. (LSG:TSX) and Aurizon Mines Ltd. (ARZ:TSX; AZK:NYSE.A) were hardest hit, despite having stable revenues. Does this surprise you?

JW: It didn't surprise me within the junior realm particularly, as we saw a flight from equities with very robust gold prices. I think it is more of a shift to larger companies with more stable, bigger production profiles and stronger balance sheets; it is not necessarily a reflection on a junior company's ability to perform and produce. In more uncertain markets, the equity markets migrate toward larger-cap equities. That has been the case over multiple up-and-down cycles in the stock market.

What has surprised me is that the correlation between producers and development explorers has not been as sharp as I would have anticipated. I would have thought the producers, even the junior producers, would have held their ground more than they did in correlation to the junior explorers. The junior explorers are the hardest hit when people are taking flight from equities. While they were hard hit in this instance, the disparity was not as great as it had been in previous instances.

TGR: You have rerated some of the companies you cover because of how far their share prices fell in that drop. How are these turbulent markets creating buying opportunities?

JW: Given that gold and silver are at near-record levels, production companies with solid balance sheets that have increased their production profiles over the past 12–24 months will produce significant, free cash flow for the foreseeable future. From a generic financial perspective, the opportunities are attractive. The margins have increased, and while the cash costs have gone up, they have not gone up as much as the commodities have risen themselves. In some cases, you have a situation with expanding margins and expanding production. This makes a company attractive for either initiation or revaluation. A small-cap producer can make a compelling story unless it fails to execute over the longer term. If there is no reason this company should be at this price, it should go up in a sensible and rational equities market.

TGR: But do you expect the equities market to be rational in the near term?

JW: While the market is still fairly volatile, the past week has been relatively good as far as stabilizing the equity markets and some of the mining names. That doesn't mean we are out of the woods quite yet.

If you look at the metrics of volatility, the VIX Volatility Index remains fairly elevated. Until that volatility is taken out of the market, you could have a swing in the equity market up or down that would not be indicative of the companies' cash flow profiles.

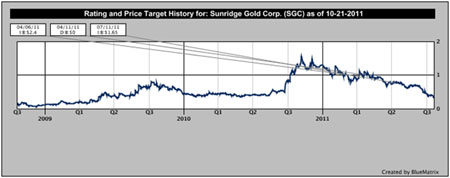

TGR: You recently launched coverage of Sunridge Gold Corp. (SGC:TSX.V), which is developing the Asmara copper, gold, zinc and silver deposit in Eritrea. Sunridge is trading at $0.37/share. As of July, your 12-month target was $1.65. In November, Sunridge plans to publish its feasibility study on the high-grade Debarwa copper, gold and zinc deposit, which is part of Asmara. Is it a coincidence that you launched coverage just a few months before Sunridge's feasibility study is due?

JW: I'm very hopeful for the feasibility study. I think it will show that the project has good economics. When I initially evaluated Sunridge, I found many aspects attractive, in particular the supergene, direct-shipment ore zone at Debarwa. It contains 15%–20% copper grades. It is very interesting and unusual to have such a rich copper zone capable of being brought into production early at substantially lower capital costs than the larger projects. That should produce very good, free cash flow for 18–24 months. In my mind, that would limit the longer-term dilution that a company such as Sunridge would incur to get the larger project financed. Was it a coincidence that I initiated in anticipation of a feasibility study? I would say it is not coincidental, but there are a number of other factors that came into play.

TGR: In your research report, you compare Sunridge to Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.A), which is an already-operating polymetallic mine in Eritrea with a market cap of about $1.1 billion. Sunridge has some ex-Nevsun management on board. Please tell us why you believe Sunridge could achieve similar success.

JW: It is not a direct correlation. Some members of the management team at Sunridge did come from Nevsun. President Mike Hopley was not at Nevsun as it initiated production; he was there much earlier. I'm really making the association that they were part of the team that discovered Bisha and began that development process. I don't want to take away from what Nevsun has been able to accomplish since that period.

Do I think Sunridge has potentially a similar growth profile? Yes, I think it has that ability to expand its projects and eventually get into production in a very similar fashion. As Nevsun is the largest operating company in Eritrea, you are going to make those obvious connections. Sunridge would like to replicate Nevsun's success; it mentions that in its presentations as well as its meetings. Sunridge certainly welcomes that comparison.

TGR: It is one thing to have geological familiarity with a certain area; does Sunridge also have a similar familiarity with government officials in Eritrea?

JW: My understanding is that Sunridge's management team has a very good relationship with the Eritrean government and with the Eritrean National Mining Co., the state-owned entity that actually takes the carried interest in projects. It takes a 10% carried interest when a project is issued its mining license.

The relationship was initially fostered years ago at Nevsun and has continued to exist. Given the challenge of working in a developing country such as Eritrea, government relations are essential. If you have a bad relationship with the government in a small developing country, that's a nonstarter for you and with investors.

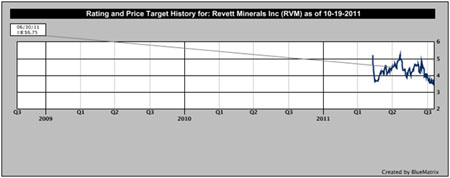

TGR: You also cover Revett Minerals Inc. (RVM:TSX; RMV:NYSE.A). Revett is having success with its Troy silver and copper mine in Montana. Revenue from production at Troy in Q211 amounted to $0.23/share, but you believe the share price could receive a significant boost if Revett receives a positive ruling on its Rock Creek silver/copper project, which is also in Montana. If you could, give us a brief history of that court battle, and tell our readers why this ruling could positively affect Revett shareholders.

JW: The Rock Creek project is one of the larger undeveloped silver and copper projects in America. You are looking at a project in excess of 200 million ounces (Moz.) of silver and a couple billion pounds of copper in western Montana, close to the current operating mine at Troy that is 100% owned by Revett. Revett Minerals has an inferred resource only on Rock Creek; it's not at a feasibility stage on this project.

The Montana regulatory authorities have signed off on most of the permitting. The U.S. Fish & Wildlife Service (FWS) issued a positive Record of Decision for Rock Creek. There has been litigation for five to six years with the Sierra Club and the Rock Creek Alliance opposing FWS on its decision, particularly in regards to the bull trout and the grizzly bears.

Last year, the Federal District Court in Montana upheld the FWS, and the Rock Creek Alliance appealed to the Ninth Circuit Court of Appeals. A three-judge panel held oral arguments on July 14, 2011. Revett itself is not one of the litigants, but it is clearly an interested party. At the end of the day, it owns the project and is the most affected economically. We anticipate a ruling from the Ninth Circuit in the next six months. I don't want to handicap, but my feeling is that the court will rule predominantly in favor of Revett, although maybe not a direct win. The judges could ask Revett to set aside more land for the grizzly bears or take additional measures not to disturb the bears. We think that would be the best case, where the environmentalists come away with a partial victory in that they are able to help the bears, and the company would come away being able to proceed with the project.

TGR: What would that do to Revett's share price?

JW: If you look Revett Minerals' valuation, it has gotten little to no value for the Rock Creek project while it is tied up in litigation. This is a large, world-class project. If you could take it out of a nondevelopment scenario into a normal timeline, you would begin to derive value from Rock Creek's eventual development. That is the basis of my thesis, where I think you can get a significant increase to the equity valuation over time. It won't happen overnight. Even with a positive ruling, you won't wake up and see the company worth $2–$3 more a share. But you have removed a halting factor, and the company can begin the hard work of evaluating and building a larger project.

TGR: If the ruling goes against the company, is there still a thesis that would push Revett's share price higher?

JW: Probably not. The thesis for pushing the share price higher with a negative ruling is predicated solely on the Troy mine and deriving greater cash flow, which would mean a much larger production profile at Troy. While Troy is an efficient, profitable mine, it is not a large-scale mine. I would anticipate the company would be significantly affected to the downside by a negative ruling.

TGR: You just started covering Aurizon Mines. You have an "accumulate" rating on Aurizon with a 12-month target of $7.75. Aurizon has been producing gold for several years from Casa Berardi, its mine in Québec. Why are you launching coverage now?

JW: The decision to launch coverage on Aurizon is twofold. First, Casa Berardi is a very good underground gold mining project in Québec, a very good jurisdiction, with nice cash costs and a good revenue profile going forward with the ability to incrementally expand production. Looking at my coverage universe, I wanted a larger, small- to mid-cap producer in the precious metals, particularly the gold space.

Second, the management team at Aurizon had a significant transition over the past couple of months. David Hall, one of the founders and the chairman/CEO, wanted to retire and focus exclusively on the chairmanship role. The board brought in George Paspalas, formerly the COO of Silver Standard Resources Inc. (SSRI:NASDAQ), to run the company as the new CEO. I find Paspalas' background and track record at Placer Dome Inc. and then at Silver Standard fairly impressive. While Dave Hall had done a very good job of building Aurizon to where it was, I thought a fresh perspective would benefit the company over the long run, drive shareholder value and increase production over time. I thought that was a really good reason and good timing on Paspalas' part to come into a company that is already established as a midtier producer and take it to new production records.

TGR: It also has some projects in the pipeline.

JW: Aurizon has the Joanna open-pit project, also in Québec. While the feasibility study has been delayed, it is a good project. It would provide the new management team the opportunity to organically increase Aurizon's production to 250–300 thousand ounces by 2015. At this point, that decision has not been made. I factored that into my price target and my valuation. At current gold prices, I'm very interested to see what the optimized production revenue scenarios and cash costs would be at Joanna.

TGR: It is not very far from Casa Berardi, so there are some synergies there as well.

JW: That all changed because Joanna would be a standalone operation. That is why Aurizon is redoing the numbers, to see what it looks like as a standalone operation, not an open-pit feeding lower-grade ore into Casa Berardi. There are a lot of unknowns: how is it going to look, how is it going to work and what is it going to cost?

TGR: What's your near-term outlook for the precious metals space?

JW: I think the junior miners and the midtier miners will see share price appreciation over the next 12 months. Is it going to be a steady progression? If it were only that easy. It could be a bumpy ride until the volatility subsides in the marketplace. But over the long term, I think it will be an upward momentum.

I think you'll see institutional investors return to natural resource and precious metals equities just based on the substantial price improvement and top-line/bottom-line improvement over where we were a couple years ago. The great thing is it makes a CEO and management team's job a little easier at $1,600/oz. gold than it was at, say, $1,200/oz. gold, which just a couple years ago was a very good price.

TGR: Jeff, thank you for your time and your insights.

Jeff Wright joined Global Hunter Securities with more than 15 years of capital markets experience, most recently as a managing director and head of the natural-resource practice at Shoreline Pacific LLC. Previously, he was vice president at Montgomery & Co. and was a leader on the team that launched a capital markets business in a historically mergers and acquisitions-focused investment bank. Wright was formerly a vice president at Robertson Stephens in the equity financial products group. He received his Master of Business Administration degree from the University of Southern California and his Bachelor of Arts degree in political science from North Carolina State University.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Aurizon Mines Ltd., Sunridge Gold Corp., Revett Minerals Inc.

3) Jeff Wright: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family am paid by the following companies mentioned in this interview: None.

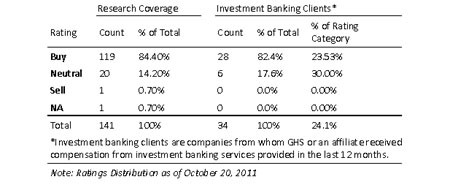

IMPORTANT DISCLOSURES:

Global Hunter Securities makes a market in the public securities of Sunridge Gold Corp.

You can also refer to https://ghsecurities.bluematrix.com/sellside/Disclosures.action for price charts, as well as specific disclosures for covered companies.

Aurizon Mines Ltd.

Revett Minerals Inc.

Sunridge Gold Corp.

Buy - The stock should be purchased aggressively at current prices. The stock is expected to trade higher on an absolute basis and be a top performer relative to peer stocks over the next 12 months.

Speculative Buy - The stock is expected to trade higher on an absolute basis and be a top performer relative to peer stocks over the next 12 months; however, there is higher than average risk associated with the investment that could result in material loss.

Accumulate - The stock should be purchased at current prices. The stock has an attractive risk/reward and is expected to outperform peer stocks over the next 12 months.

Neutral - The stock has average risk/reward and is expected to perform in line with peer stocks over the next 12 months.

Reduce - The stock should be sold at current prices. The risk/reward has become less attractive and is expected to underperform peer stocks over the next 12 months.

Sell - The stock should be sold aggressively at current prices. The stock is expected to trade lower on an absolute basis and be a top underperformer relative to peer stocks over the next 12 months.

NA - A rating is not assigned.

This material has been prepared by Global Hunter Securities, LLC, a registered broker-dealer, employing appropriate expertise, and in the belief that it is fair and not misleading. Information, opinions or recommendations contained in the reports and updates are submitted solely for advisory and information purposes. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, we cannot guarantee its accuracy. Additional and supporting information is available upon request. This is not an offer or solicitation of an offer to buy or sell any security or investment. Any opinions or estimates constitute our best judgment as of this date, and are subject to change without notice. Global Hunter Securities, LLC and our affiliates and their respective directors, officers and employees may buy or sell securities mentioned herein as agent or principal for their own account. Not all products and services are available outside of the U.S. or in all U.S. states. Copyright 2011.

Streetwise - The Gold Report is Copyright © 2011 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

The Gold Report does not render general or specific investment advice and does not endorse or recommend the business, products, services or securities of any industry or company mentioned in this report.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email: jluther@streetwisereports.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.