The E.U. is Over Banked, Chaos in the Land of Oz (Part 2)

Stock-Markets / Credit Crisis 2011 Oct 25, 2011 - 01:17 AM GMTBy: PhilStockWorld

Elliott: In Part 1 of our interview, we agreed that by not allowing the too-big-to-fail (TBTF) banks to fail, the federal government is continuing its environment of corruption and moral hazard. Case in point - the scheme to force taxpayers to insure Bank of America’s worthless debt via the FDIC.

Elliott: In Part 1 of our interview, we agreed that by not allowing the too-big-to-fail (TBTF) banks to fail, the federal government is continuing its environment of corruption and moral hazard. Case in point - the scheme to force taxpayers to insure Bank of America’s worthless debt via the FDIC.

So, Russ, it will get worse, until TBTF banks get decapitalized?

(Note: “Recapitalize” banks is code for pulling it out of the hide of German (and other) taxpayers and future generations. “Decapitalize” means: do the crime, do the time - take the losses.)

Russ: Right. Take the investors out, the bondholders, and shrink the sector. Banking globally should be cut in half. That means the capital backing these institutions needs to go to money heaven. The word for it is "losses." Right now we have "too big to let lose" because of fear of a bad hair day.

I was very disappointed last week when they started shilling for more bailouts. The bankers resist the restructuring, and the market rallies on that news. The market is hooked on bailouts and socializing losses. That was the basis of the 2009-2011 bull market. That can’t go on forever. All these money managers are chasing stocks because they expect another bailout. It's nonsense!

Elliott: As an investor, I like to look for value. But it's so hard to find real value when so much has been gimmicked by the Fed.

Russ: That's my view entirely.

Ilene: What do you expect the outcome will be?

Russ: I’m highly cynical. We’re like deer in the headlights, but we have to protect ourselves from the pump-and-dumps and avoid the herd mentality of jumping on these bailout rumors. I’d be ready to jump in [to the stock market] if the right outcome occurs - big haircuts for bond holders and decapitalizing the financial sector.

Ilene: But then after Greece, there are other Eurozone countries. Are we going to go through all this again with Italy, and Spain?

Russ: Most likely. All of these countries may have some kind of debt restructuring. They can't pile the debt on the remaining few healthy countries. Look at the debt-to-GDP of Germany, for example. (Is Germany the Savior of Europe?) So who is the next patsy for the banksters? Answer: not many are left.

Russ: Most likely. All of these countries may have some kind of debt restructuring. They can't pile the debt on the remaining few healthy countries. Look at the debt-to-GDP of Germany, for example. (Is Germany the Savior of Europe?) So who is the next patsy for the banksters? Answer: not many are left.

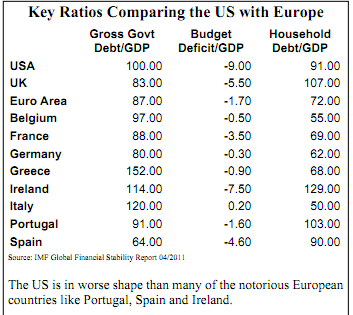

Elliott: Every country on the list has a gross gov't debt-to-GDP of greater than 60%; most are running at close to 100% or more.

Russ: Well, it's worse than that (and that's just the sovereigns). I wrote an article called "The EFSF plan in Europe is no free ride." The gross debt to GDP of the United States Government has reached 100%. The U.S. doesn't have any bullets left for this kind of policy. Politicians are talking about cutting Medicare and Medicaid and safety nets, so that they can bail out the banksters.

Ilene: It looks like they're going to do exactly that, doesn’t it?

Russ: It kind of does. We have Presidente "Hopium", Wizard Ben, and a bunch of morons running the policy. All we need is a bankster showing up with the dynamite strapped on, and here we go again.

These guys are not familiar with economic history and apparently don't understand that banks fail; banks have failed for centuries. Sometimes it triggers an economic crisis, but usually things clear up after a while. The market clears, and we get back to business as usual.

Ilene: Do you think they may very well understand this, but it’s not in their interests to act in favor of the country, but rather in favor of themselves?

Russ: Precisely, and they have largely captured government. They finance government too, in a corrupt alliance. Lots of fees underwriting trillions in debts.

Elliott: I think the people in Congress are failing to understand a key tenant of Mises - "economics is human action." People doing stuff. That's economics. If a bank blows up, that entity called the bank goes away, but people live on.

Russ: Right, and there's going to be losers. See, under Presidente Hopium, the philosophy is "you can't have losers." That's why he's such a bad president. Getting back to Europe, that whole Euro area has an 87% gross debt-to-GDP (in it's government sector). That's ironic; the whole euro area is better off than the United States. Yet the crisis is in Europe. We have Belgium with 97%. France, 88%. I don't think France has any more bullets for this. There’s Germany at 80%. Greece at 152%. Ireland, 114%. Italy, 120%. Once it turns to Italy, France and Germany can't do anything about that. The ECB has had to intervene four days in a row to cap bonds rates at 6% in the Italian bond market.

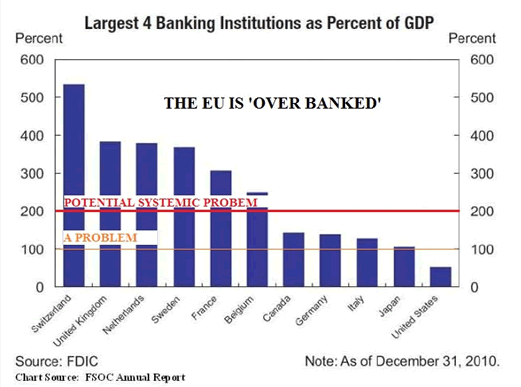

Europe is over-banked and over-leveraged, and more bailouts further socializes the losses to the already stressed sovereigns. If the banks aren’t made to take the losses, governments will be throwing whole countries under the bus. Will it be the countries or the banks? Or a unhappy mix? The discussion constantly comes back to bailing out the banks.

Europe is over-banked and over-leveraged, and more bailouts further socializes the losses to the already stressed sovereigns. If the banks aren’t made to take the losses, governments will be throwing whole countries under the bus. Will it be the countries or the banks? Or a unhappy mix? The discussion constantly comes back to bailing out the banks.

Ilene: Yes. Given the backdrop of wizardry and manipulation, how would you invest your money?

Russ: I develop strategies to try to get in the ball game. I was shorting copper because I thought the China bubble would bust. And boy, it just resisted and resisted, even though the evidence for a hard-landing was substantial. Finally copper broke, and I covered. You need to be a speculator, a contrarian around the edges, and pick your openings. It's a tough environment. I would not want to be running other people's money right now. So I don't know that I have a good answer for you.

Ilene: Are you long or short any particular stocks?

Russ: Right now, I'm shorting the "Palace of Versailles" stocks, stocks like Tiffany's, Ambercrombie-Fitch, Coach, Starbucks, that sell at rich multiples, because supposedly wealthy people are doing well. Well, rich people were losing their asses in the market in the last couple of months. If you look at the polls, rich people are just as negative as poor people now. The Palace of Versailles trade makes little sense when protesters are in front of your houses and the stores you shop at. I try to run counter to the conventional wisdom.

Elliott: I'm a fan of attempting to figure out the realistic fair value for a company, and then, when the stock goes way higher, sell; and if it goes way under, buy.

Russ: That's not bad. There are some very cheap stocks in the market.

Ilene: Are there any you’d buy now?

Russ: I would wait until the market gets very oversold, when it looks like the direction in Greece is headed towards a serious, deep, restructured default. I’d wait for the sentiment to get more negative and certainly not when the trade is lathered up about the next Merkel-Sarkowky "meeting". I call it "weekendism". Then you could probably pick off your Sanofi's (SNY). There are many cheap European stocks, Total (TOT) perhaps, and Statoil (STO). I think oil, at an equilibrium price, will be around $75. I don't think it's going to completely collapse.

At the same time, I would be shorting the Treasury market (specifically 2 and 5 year Treasuries). That's your hedge. Because if interest rates start spiking, especially U.S. Treasury rates, it's a game changer. It's going to re-value everything. I don't think we can have one-quarter percent interest rates indefinitely.

Ilene: Isn't that what the Fed is doing right now, promising that very low interest rates will continue for the next few years?

Russ: Right, but the first thing I said in this interview is that I consider the Fed to be like the "Wizard of Oz." It’s power is overrated. I don't think that the man behind the curtain is who everybody thinks he is.

How could the Fed possibly control a situation where gross government debt to GDP is 100% and climbing rapidly? How can they possibly keep interest rates down? History will show the current situation to be a fluke and a bubble.

Ilene: Do you think the Fed might just keep “printing” more money and buying more Treasuries?

Russ: That's stealing from real people and real consumers, the average guy in the street. It's just stealing. Even Dallas Fed Fischer said as much, just benefits speculators.

Ilene: Yes, but they’ve been doing that, why would they stop finding new ways?

Russ: Well, then we're going to keep having worse and worse economic conditions, more wealth transfers to criminals and kleptocrats and speculators. And 99% of the population will continue to sink, and you will soon see pitchforks.

Ilene: Would allowing Bank of America to transfer derivatives from its Merrill Lynch unit to the retail bank subsidiary with insured deposits, count as another indication that the stealing goes on. It doesn’t get much more blatant than that does it?

Russ: Yes, it’s absolutely outrageous, and to quote George Carlin, "nobody cares."

Ilene: So Bernanke will continue this strategy of saving the banks, stealing from the taxpayers, until something forces him to stop. What might that be?

Russ: It's not just Bernanke, it is a whole scheme of bankster officials and apparatchiks. He’s probably going to stop when some major holder of Treasuries finally goes on strike. It's a prisoner's dilemma. You got all these entities like China trapped in the system. They’ve lent so much money to the United States that they're now trapped. Finally somebody at the margin will jump ship. That's how Ponzi schemes unravel. Someone eventually says, "Holy crap, let me out of here."

I'm surprised the government's been able drag things out this long, except throwing trillions down the rat lines has some effect. It's probably because of the myth of the Wizard of Oz, that the Fed can control the economy, stock prices, and bond yields. People keep speculating on what the Fed will do, and sometimes it works and sometimes it doesn't. But the Fed’s running out of string. When things get bad enough, other countries will help their own people over helping Bernanke. In Europe, Germany will use it's last resources for German banks, not Italian and French.

Elliott: Bernanke is giving press conferences now, which is unprecedented. They've taken this entity that was remote and mysterious before, and they're putting it in the limelight. This does not strike me as a reassuring move, this strikes me as desperation.

Russ: Well, the other thing is that these booms and bubbles go bust, and it pisses people off. I noticed that CNBC did a poll asking their viewers what they thought of the Fed, and 70% of viewers were negative.

Elliott: Gee, I can't imagine why.

Russ: The Fed (and Troika in Europe) is not very popular. But many traders are still caught up in this Wizard of Oz mentality. It seems like the hot money at the margin drives stock prices day to day. I have to admit, I thought it would end a while ago. Meanwhile, the government debt just keeps spiraling and spiraling, and many people are holding "Old Maid" cards. If there's a debt trap in the United States, would you want to be holding a bunch of 10-year Treasuries yielding 2%? Sometimes I wonder if the mom and pa investor, let alone their money managers know about prices inversing to yield.

I grew up in the business in the 70's and 80's. I was a broker, and can remember quoting people: "Well, I could get you a 10-year treasury for 12%.” And they'd say “no, no, I don't want that, what do you got in a one or two year?” And I’d say, “I could get you 16%.” They’d take that.

You could have done well locking in the 10-year at 12%. But now it's the opposite. It doesn't make sense. Any rational person looking at that would know it's a bad investment decision. The only reason someone would make that kind of investing decision is that they think the Fed has their back. And they thought the Fed had their back on the emerging market trade they had going nine months ago. They lost 30% on that. They thought the Fed had their back on commodities, now they're losing money on that, and they're going to lose money on this one.

This is fun, you guys are letting me rant here. The Austrian school instinctively looks at trouble every time the government gets heavily involved in something. What the government needs to do is to be a policeman. It's a damn shame Eliot Spitzer got in trouble. Those are the kind of guys who are necessary today, people who will ride herd over these guys, sheriffs in the wild west so to speak.

Elliott: If you're going to go after the big boys, you've got to be squeaky clean. You gotta be like a hermit, practically, a monk.

Russ: Yeah, they'll get rid of you one way or another. I like to use the analogy of the old Soviet Union, the Soviet Union used what's called "negative selection." You go through any organization, and get rid of anybody that's a critical thinker, anybody that asks questions, anybody that has a moral compass, anybody that's highly intelligent, you get rid of them. Then you end up with these organizations that are littered with sycophants. That's what happened.

Elliott: Right, a galloping mob of mediocrities, to do whatever their bosses say, without question.

Russ: That's the system. Plus all the politicians are bought. That the crux of Occupy Wall Street.

Elliott: The comfort that I take is the certain knowledge of "that which cannot continue, does not continue."

Ilene: Why do you think it can't continue?

Elliott: Because eventually when parasites get too much in control, they kill the host.

Ilene: But they may survive and jump to some other host.

Russ: Well, yeah, they’ll find something to steal. This is the debate we're having. Do you really want to be bullish on a system like that? Even if the parasites have a little more staying power? Do you want to trade on that? Do you want to jump on board like the last two days of another rumor, because it seems like the parasites are going to win again?

The only thing that will rally the market is another bailout rumor. Nobody asks who's going to pay for it. A couple weekends ago, Standard and Poor said, "if you do this kind of program, we're going to downgrade the countries of Europe." They just stated it! Nobody reported that as news. Everybody reports the bailout. Not the consequences. Just the bailout. That's the trade.

Elliott: You had just mentioned the point when the big players start jumping off the fringes, because they just can't play any longer. Could it be that the ratings agencies might be the first ones to jump?

Russ: Ultimately they end up having to do their job. They can see that we're in a debt trap. I notice that Standard and Poor's managing director got fired, or moved on. That's an example of negative selection at work.

Ilene: But now they seem to be calling it like they seeing, and getting ample criticism for that…

Russ: They're actually calling it late. And everybody's mad at them because they're finally taking action. The U.S. went on full offensive, pulled a big public relations campaign, put out false data, reacting to the downgrade. Instead of just fessing up, the U.S. attacked Standard and Poor. Presidente Hopium didn't do it himself, he had his hacks do it, like Geithner.

Ilene: What else do you think, Russ?

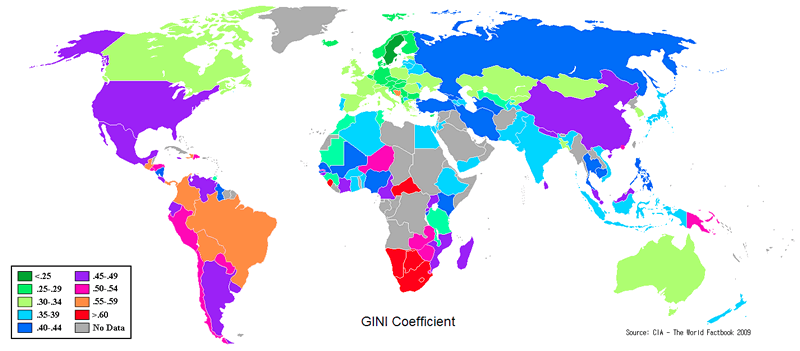

Russ: I think the weather has to be considered, I think that's increasingly entering into the equation. When you have two of the hottest summers in a row, in a century, that screws things up. I'm becoming a little bit more of an environmentalist now. Big pieces of ice breaking off in the arctic melt. Those are things people don't really seem to care about, until all of a sudden you get a category 6 hurricane. But then it's too late. I think there’s risk. It's not something that happens next week, but don't be surprised if all of a sudden something weird happens next year and it wipes out crops, creates instability. That's just part of the whole global "slash and burn" mentality. That's where government has to step in. So I'm not an Austrian when it comes to environmental protection. We need a big kid on the block to limit the negative effects of “free market” economics run amuk. That's missing. We had Bush, gutting the protections, and then Hopium enabling more looting. Another factor worth mentioning is that there are huge wealth gaps, measured by the GINI coefficient.

Elliott: Oh, I know, it's distressingly high now.

Russ: It amazes me, I wonder when are the riots coming? We have the "Occupy Wall Street" movement, it's getting some press now. I've been predicting more social unrest. Finally we have negative demographics, people who need their money. They're getting zero income on savings, and many people are retiring. There's a headwind against capital formation. People will be taking their money out of savings to live because they're getting zero returns. That could happen rapidly and be a big drain on pension funds. That's all part of my picture.

Elliott: Rounds of quantitative easing (QE1 and 2) have pumped additional capital into the economy, but it hasn't really been moving. Once that capital starts getting some velocity, will we start seeing inflation pick up?

Russ: Maybe, but so far, it's just caused maladjustments. One of the things that happened last spring is that producers began over producing, for example, creating extra fertilizer and extra potash, etc. to sell to farmers, because the farmers were worried about the inflation and were double ordering. That creates a boom. The next year, they didn't need the product. That's a maladjustment. That's prevalent. The analysts the claimed the company from which the double orders were placed was having a fantastic quarter, but the double ordering, the hoarding, was unsustainable. (See Inflation causing economic boom, then bust)

There's very little good analysis available. Why? Negative selection. If the sycophants and the negative selection guys are running the show and controlling the money - and they are - they'll gun this stuff any way they want. That's another danger.

Ilene: Will Dorothy find her way back to Kansas?

Russ: As L. Frank Baum once said, “Everything has to come to an end, sometime.” (The Marvelous Land of Oz)

Russ writes an Actionable Subscription service, click here for more details.

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.