Algorithms, Bullion and Criminals: The ABC’s of Understanding Gold and Silver

Commodities / Gold and Silver 2011 Oct 22, 2011 - 02:04 AM GMTBy: Rob_Kirby

At the link to the S.E.C. below – there is an archive of “fails to deliver equity” data whose original source is the DTCC [Depository Trust Clearing Corporation].

At the link to the S.E.C. below – there is an archive of “fails to deliver equity” data whose original source is the DTCC [Depository Trust Clearing Corporation].

http://www.sec.gov/foia/docs/failsdata.htm

What is presented below is an analysis of September 2011 “fails to deliver” equities which are understood to represent physical gold and silver bullion in the market place. The individual instruments are aggregated on a coloured, daily gross ounce basis to show the serial and systemic nature of the DRAMATIC SHELL-GAME build in [naked] short ounce equivalents – which, when one considers the Jeffrey Christian Constant. It was back in March, 2010 – at CFTC hearings in Washington that expert testimony was given by C.P.M. Group Chairman, Jeffrey Christian where he explained,

Precious metals are financial assets - and like currencies, T-Bills and T-Bonds they trade in paper at a multiple of a hundred times the underlying physical.

Using the “Jeffrey Christian constant” that 100 ounces of “paper metal” can expected to be transacted for every ounce of physical – we can “model” by “grossing-up” the effect of “understood-to-be” physical sales [but really a criminal, naked-short, shell game] by a factor of 100 to understand the amount of futures selling we should expect in response to any serial, systemic, pre-meditated, criminal, naked-shorting.

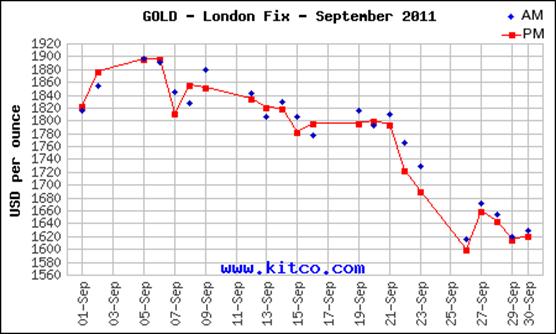

This sheds new light on the dramatic decrease of Large Commercial Net Shorts [LCNS] on COMEX we have experienced in September 2011.

We shall call this method of grossing-up what are understood-to-be physical transactions the JCGUFF [Jeffrey Christian Gross-Up Fudge Factor] to give us expected sales of COMEX paper ounce equivalents.

It’s important that everyone understand that Jane & Joe Sixpacks, as well as Hedge Fund Managers who purchase the securities listed below ACTUALLY believe that they have bought physical metal.

Note of what S.E.C. has to say about Naked Shorts / FAILS:

Here’s what the S.E.C. has to say on their website:

Please note that fails-to-deliver can occur for a number of reasons on both long and short sales. Therefore, fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or “naked” short selling. For more information on short selling and fails-to-deliver, see http://www.sec.gov/spotlight/keyregshoissues.htm, http://www.sec.gov/divisions/marketreg/mrfaqregsho1204.htm, and http://www.sec.gov/rules/final/34-50103.htm.

Response: While fails-to-deliver can occur for a number of reasons – SERIAL, SYSTEMIC, SHELL-GAMES only occur for ONE REASON brothers and sisters – and it is CRIMINAL.

Anyone reading this material is more than likely acquainted with the CFTC’s long-running discussion and stalling on the imposition of position limits in gold and silver futures. The whole world has been aware that the Large Commercials have long maintained an untenable short position in both silver and gold – and speculated on how financially ruinous it would be if they were ever forced to cover their positions.

With the CFTC making recent public overtures that position limits may be implemented and enforced in the near future – the need for the Large Commercial Shorts to reduce their positions has never been more acute.

It’s widely understood that a HUGE percentage of equity trading nowadays is conducted via algorithmic computer trading. The data below is a nuts-and-bolts break-down of what is undoubtedly an algorithmic trading program – one designed to serially and systemically naked-short physical bullion equivalents to produce the desired effect of a cascade of selling in paper bullion futures.

The equity products listed in the data set below exhibit the following:

Field Name |

Field Description |

Maximum Size |

SETTLEMENT DATE |

SETTLEMENT DATE |

Number - 8 digits |

CUSIP |

CUSIP |

9 characters |

SYMBOL |

TICKER SYMBOL |

10 characters |

QUANTITY (FAILS) |

TOTAL FAILURE-TO-DELIVER SHARES |

Number - unlimited |

DESCRIPTION |

COMPANY NAME |

30 characters |

PRICE |

CLOSING PRICE ON PREVIOUS DAY |

Number - unlimited |

For those of you playing at home, ishares silver are measured 1 for 1 in silver ounces – same thing for ETFS Silver Trust. Sprott Phys Silver is conservatively counted as representing 1/3rd oz. of Ag. ETFS Gold and SPDR Gold are measured as being 1/10th oz. gold. ishares Gold and Sprott Phys. Gold are measured as being 1/100th of and oz. of Au. Colours are used to delineate days of the month. Under each coloured panel is the aggregate selling of physical ounces for each day and under that [the JCGUFF] - the amount of paper selling such naked shorting would be expected to yield.

………………..S.E.C. Report for the first half of September 2011………………………

20110901|46428Q109|SLV|8535|ISHARES SILVER TRUST|40.44

20110901|464285105|IAU|2681|ISHARES GOLD TRUST|17.82

20110901|78463V107|GLD|11783|SPDR GOLD TR, SPDR GOLD SHS|177.65

20110901|85207H104|PHYS|10577|SPROTT PHYSICAL GOLD TRUST UNI|15.9

20110901|85207K107|PSLV|10088|SPROTT PHYSICAL SILVER TR UIT |19.38

Sept. 1/11: Phys. Naked Short approx. 11,897 oz. Ag, 1,310 oz. Au

JCGUFF applied: 1,189,700 oz. Ag, 131,000 oz. Au

20110902|26922Y105|SGOL|345|ETFS GOLD TR SH|181.29

20110902|46428Q109|SLV|15019|ISHARES SILVER TRUST|40.52

20110902|78463V107|GLD|663|SPDR GOLD TR, SPDR GOLD SHS|177.8

20110902|85207H104|PHYS|15027|SPROTT PHYSICAL GOLD TRUST UNI|15.95

20110902|85207K107|PSLV|11937|SPROTT PHYSICAL SILVER TR UIT |19.48

Sept.2/11: Phys. Naked Short approx. 18,998 oz. Ag, 184 Oz. Au

JCGUFF applied: 1,899,800 oz. Ag, 18,400 Oz. Au

20110906|26922X107|SIVR|976|ETFS SILVER TR SHS|42.98

20110906|78463V107|GLD|8494|SPDR GOLD TR, SPDR GOLD SHS|183.23

20110906|85207H104|PHYS|8589|SPROTT PHYSICAL GOLD TRUST UNI|16.48

20110906|85207K107|PSLV|31458|SPROTT PHYSICAL SILVER TR UIT |20.22

Sept. 6/11: Phys. Naked Short approx. 11,462 oz. Ag, 935 oz. Au

JCGUFF applied: 1,146,200 oz. Ag, 93,500 oz. Au

20110907|26922X107|SIVR|34537|ETFS SILVER TR SHS|41.88

20110907|26922Y105|SGOL|79|ETFS GOLD TR SH|186.46

20110907|46428Q109|SLV|798|ISHARES SILVER TRUST|41.00

20110907|85207H104|PHYS|4375|SPROTT PHYSICAL GOLD TRUST UNI|16.55

20110907|85207K107|PSLV|43668|SPROTT PHYSICAL SILVER TR UIT |19.79

Sept. 7/11: Phys. Naked Short approx. 36,793 oz. Ag, 412 oz. Au

JCGUFF applied: 3,679,300 oz. Ag, 41,200 oz. Au

20110908|26922X107|SIVR|114086|ETFS SILVER TR SHS|41.37

20110908|26922Y105|SGOL|800|ETFS GOLD TR SH|180.51

20110908|46428Q109|SLV|80461|ISHARES SILVER TRUST|40.50

20110908|464285105|IAU|232474|ISHARES GOLD TRUST|17.75

20110908|78463V107|GLD|6428|SPDR GOLD TR, SPDR GOLD SHS|177.08

20110908|85207H104|PHYS|9866|SPROTT PHYSICAL GOLD TRUST UNI|16.04

20110908|85207K107|PSLV|30233|SPROTT PHYSICAL SILVER TR UIT |19.43

Sept. 8/11: Phys. Naked Short approx. 204,624 oz. Ag, 3,144 oz. Au

JCGUFF applied: 20,462,400 oz. Ag, 314,400 oz. Au

20110909|26922X107|SIVR|228145|ETFS SILVER TR SHS|42.03

20110909|26922Y105|SGOL|16570|ETFS GOLD TR SH|185.28

20110909|46428Q109|SLV|54809|ISHARES SILVER TRUST|41.22

20110909|78463V107|GLD|74191|SPDR GOLD TR, SPDR GOLD SHS|181.78

20110909|85207H104|PHYS|27175|SPROTT PHYSICAL GOLD TRUST UNI|16.45

20110909|85207K107|PSLV|516|SPROTT PHYSICAL SILVER TR UIT |19.80

Sept. 9/11: Phys. Naked Short approx. 283,126 oz. Ag, 12,179 oz. Au

JCGUFF applied: 28,312,600 oz. Ag, 1,217,900 oz. Au

20110912|26922X107|SIVR|2807|ETFS SILVER TR SHS|41.37

20110912|26922Y105|SGOL|1713|ETFS GOLD TR SH|184.20

20110912|46428Q109|SLV|45389|ISHARES SILVER TRUST|40.52

20110912|464285105|IAU|39863|ISHARES GOLD TRUST|18.12

20110912|78463V107|GLD|10228|SPDR GOLD TR, SPDR GOLD SHS|180.70

20110912|85207H104|PHYS|44786|SPROTT PHYSICAL GOLD TRUST UNI|16.31

20110912|85207K107|PSLV|125488|SPROTT PHYSICAL SILVER TR UIT |19.56

Sept. 12/11: Phys. Naked Short approx. 90,025 oz. Ag, 1,118 oz. Au

JCGUFF applied: 9,002,500 oz. Ag, 111,800 oz. Au

20110913|26922X107|SIVR|8276|ETFS SILVER TR SHS|39.98

20110913|26922Y105|SGOL|900|ETFS GOLD TR SH|180.13

20110913|46428Q109|SLV|15915|ISHARES SILVER TRUST|39.14

20110913|464285105|IAU|500|ISHARES GOLD TRUST|17.72

20110913|78463V107|GLD|193839|SPDR GOLD TR, SPDR GOLD SHS|176.67

20110913|85207H104|PHYS|1225|SPROTT PHYSICAL GOLD TRUST UNI|15.87

20110913|85207K107|PSLV|45340|SPROTT PHYSICAL SILVER TR UIT |18.86

Sept. 13/11: Phys. Naked Short approx. 86,113 oz. Ag, 2,045 oz. Au

JCGUFF applied: 8,611,300 oz. Ag, 204,500 oz. Au

20110914|26922X107|SIVR|122|ETFS SILVER TR SHS|40.69

20110914|26922Y105|SGOL|25532|ETFS GOLD TR SH|182.00

20110914|46428Q109|SLV|10545|ISHARES SILVER TRUST|39.87

20110914|78463V107|GLD|5651|SPDR GOLD TR, SPDR GOLD SHS|178.54

20110914|85207H104|PHYS|601625|SPROTT PHYSICAL GOLD TRUST UNI|16.13

20110914|85207K107|PSLV|226339|SPROTT PHYSICAL SILVER TR UIT |19.24

Sept. 14/11: Phys. Naked Short approx. 39,304 oz. Ag, 9,134 oz. Au

JCGUFF applied: 3,930,400 oz. Ag, 913,400 oz. Au

………………..2nd half of Sept……………………

20110915|26922X107|SIVR|74711|ETFS SILVER TR SHS|40.42

20110915|26922Y105|SGOL|42017|ETFS GOLD TR SH|180.63

20110915|46428Q109|SLV|24267|ISHARES SILVER TRUST|39.59

20110915|464285105|IAU|24488|ISHARES GOLD TRUST|17.77

20110915|78463V107|GLD|157115|SPDR GOLD TR, SPDR GOLD SHS|177.21

20110915|85207H104|PHYS|93462|SPROTT PHYSICAL GOLD TRUST UNI|15.88

20110915|85207K107|PSLV|61668|SPROTT PHYSICAL SILVER TR UIT |19.07

Sept. 15/11: Phys. Naked Short approx. 119,534 oz. Ag, 20,772 oz. Au

JCGUFF applied: 11,953,400 oz. Ag, 2,077,200 oz. Au

20110916|26922X107|SIVR|908|ETFS SILVER TR SHS|39.60

20110916|26922Y105|SGOL|38256|ETFS GOLD TR SH|177.74

20110916|464285105|IAU|2646|ISHARES GOLD TRUST|17.47

20110916|46428Q109|SLV|1080|ISHARES SILVER TRUST|38.79

20110916|78463V107|GLD|318763|SPDR GOLD TR, SPDR GOLD SHS|174.39

20110916|85207H104|PHYS|62061|SPROTT PHYSICAL GOLD TRUST UNI|15.75

20110916|85207K107|PSLV|157808|SPROTT PHYSICAL SILVER TR UIT |18.65

Sept. 16/11: Phys. Naked Short approx. 54,590 oz. Ag, 36,347 oz. Au

JCGUFF applied: 5,459,000 oz. Ag, 3,634,700 oz. Au

20110919|26922X107|SIVR|1409|ETFS SILVER TR SHS|40.19

20110919|26922Y105|SGOL|5808|ETFS GOLD TR SH|179.38

20110919|46428Q109|SLV|106835|ISHARES SILVER TRUST|39.39

20110919|78463V107|GLD|535732|SPDR GOLD TR, SPDR GOLD SHS|176.03

20110919|85207K107|PSLV|120471|SPROTT PHYSICAL SILVER TR UIT |18.9

20110919|85207H104|PHYS|20|SPROTT PHYSICAL GOLD TRUST UNI|15.88

Sept. 19/11: Phys. Naked Short approx. 148,404 oz. Ag, 54,153 oz. Au

JCGUFF applied: 14,840,400 oz. Ag, 5,415,300 oz. Au

20110920|26922X107|SIVR|72311|ETFS SILVER TR SHS|39.48

20110920|26923A106|PALL|21983|ETFS PALLADIUM TR SHS BEN INT |70.71

20110920|464285105|IAU|32675|ISHARES GOLD TRUST|17.36

20110920|78463V107|GLD|8549|SPDR GOLD TR, SPDR GOLD SHS|173.27

20110920|85207H104|PHYS|105769|SPROTT PHYSICAL GOLD TRUST UNI|15.48

20110920|85207K107|PSLV|106607|SPROTT PHYSICAL SILVER TR UIT |18.70

Sept. 20/11: Phys. Naked Short approx. 107,846 oz. Ag, 2,237 oz. Au

JCGUFF applied: 10,784,600 oz. Ag, 223,700 oz. Au

20110921|26922W109|GLTR|13387|ETFS PRECIOUS METALS BASKET TR|108.72++

20110921|26922X107|SIVR|98556|ETFS SILVER TR SHS|39.60

20110921|464285105|IAU|33264|ISHARES GOLD TRUST|17.62

20110921|78463V107|GLD|273369|SPDR GOLD TR, SPDR GOLD SHS|175.78

20110921|85207H104|PHYS|12430|SPROTT PHYSICAL GOLD TRUST UNI|15.85

20110921|85207K107|PSLV|87333|SPROTT PHYSICAL SILVER TR UIT |18.90

Sept. 21/11: Phys. Naked Short approx. 127,667++ oz. Ag, 27,792++ oz. Au

JCGUFF applied: 12,766,700++ oz. Ag, 2,779,200++ oz. Au

20110922|26922X107|SIVR|150536|ETFS SILVER TR SHS|39.32

20110922|46428Q109|SLV|8496|ISHARES SILVER TRUST|38.56

20110922|464285105|IAU|11404|ISHARES GOLD TRUST|17.40

20110922|78463V107|GLD|44716|SPDR GOLD TR, SPDR GOLD SHS|173.59

20110922|85207K107|PSLV|38815|SPROTT PHYSICAL SILVER TR UIT |19.04

20110922|85207H104|PHYS|1707|SPROTT PHYSICAL GOLD TRUST UNI|15.75

Sept. 22/11: Phys. Naked Short approx. 171,970 oz. Ag, 4,602 oz. Au

JCGUFF applied: 17,197,000 oz. Ag, 460,200 oz. Au

20110923|26922X107|SIVR|100|ETFS SILVER TR SHS|35.66

20110923|26922Y105|SGOL|12333|ETFS GOLD TR SH|172.41

20110923|46428Q109|SLV|4602|ISHARES SILVER TRUST|34.9

20110923|78463V107|GLD|30680|SPDR GOLD TR, SPDR GOLD SHS|169.05

20110923|85207K107|PSLV|90889|SPROTT PHYSICAL SILVER TR UIT |17.37

Sept. 23/11: Phys. Naked Short approx. 34,998 oz. Ag, 4,301 oz. Au

JCGUFF applied: 3,499,800 oz. Ag, 430,100 oz. Au

20110926|26922X107|SIVR|207|ETFS SILVER TR SHS|30.57

20110926|26922Y105|SGOL|30234|ETFS GOLD TR SH|162.92

20110926|46428Q109|SLV|3800|ISHARES SILVER TRUST|29.98

20110926|78463V107|GLD|59049|SPDR GOLD TR, SPDR GOLD SHS|159.80

20110926|85207H104|PHYS|18772|SPROTT PHYSICAL GOLD TRUST UNI|14.11

20110926|85207K107|PSLV|94913|SPROTT PHYSICAL SILVER TR UIT |14.52

Sept. 26/11: Phys. Naked Short approx. 10,264 oz. Ag, 9,114 oz. Au

JCGUFF applied: 1,026,400 oz. Ag, 911,400 oz. Au

20110927|46428Q109|SLV|39014|ISHARES SILVER TRUST|29.77

20110927|464285105|IAU|31146|ISHARES GOLD TRUST|15.79

20110927|78463V107|GLD|85955|SPDR GOLD TR, SPDR GOLD SHS|157.58

20110927|85207K107|PSLV|63863|SPROTT PHYSICAL SILVER TR UIT |14.40

20110927|85207H104|PHYS|1776|SPROTT PHYSICAL GOLD TRUST UNI|13.87

Sept. 27/11: Phys. Naked Short approx. 60,301 oz. Ag, 8,923 oz. Au

JCGUFF applied: 6,030,100 oz. Ag, 892,300 oz. Au

20110928|26922X107|SIVR|1027|ETFS SILVER TR SHS|31.79

20110928|46428Q109|SLV|27773|ISHARES SILVER TRUST|31.18

20110928|464285105|IAU|42370|ISHARES GOLD TRUST|16.11

20110928|78463V107|GLD|3476|SPDR GOLD TR, SPDR GOLD SHS|160.63

20110928|85207H104|PHYS|2694|SPROTT PHYSICAL GOLD TRUST UNI|14.32

20110928|85207K107|PSLV|2148|SPROTT PHYSICAL SILVER TR UIT |14.99

Sept. 28/11: Phys. Naked Short approx. 29,516 oz. Ag, 796 oz. Au

JCGUFF applied: 2,951,600 oz. Ag, 79,600 oz. Au

20110929|26922X107|SIVR|927|ETFS SILVER TR SHS|29.41

20110929|46428Q109|SLV|25192|ISHARES SILVER TRUST|28.85

20110929|464285105|IAU|37771|ISHARES GOLD TRUST|15.65

20110929|78463V107|GLD|621|SPDR GOLD TR, SPDR GOLD SHS|156.20

20110929|85207H104|PHYS|656|SPROTT PHYSICAL GOLD TRUST UNI|13.92

20110929|85207K107|PSLV|13822|SPROTT PHYSICAL SILVER TR UIT |13.6

Sept. 29/11: Phys. Naked Short approx. 30,726 oz. Ag, 445 oz. Au

JCGUFF applied: 3,072,600 oz. Ag, 44,500 oz. Au

20110930|26922X107|SIVR|54979|ETFS SILVER TR SHS|30.55

20110930|26922Y105|SGOL|5657|ETFS GOLD TR SH|160.74

20110930|464285105|IAU|30299|ISHARES GOLD TRUST|15.81

20110930|78463V107|GLD|17156|SPDR GOLD TR, SPDR GOLD SHS|157.70

20110930|85207H104|PHYS|4238|SPROTT PHYSICAL GOLD TRUST UNI|14.06

20110930|85207K107|PSLV|7169|SPROTT PHYSICAL SILVER TR UIT |14.25

Sept. 30/11: Phys. Naked Short approx. 57,368 oz. Ag, 2,624 oz. Au

JCGUFF applied: 5,736,800 oz. Ag, 262,400 oz. Au

Look at how the serial NAKED SHORT was rotated through the “physical” exchange traded gold and silver bullion instruments over the course of September 2011 – creating the reactive selling of paper ounces on COMEX of 5+ million ounces naked short gold on Sept. 21 and 17+ million ounces of silver on Sept 22.

Now, let’s remember how the REMARKABLE decrease in LCNS [Large Commercial Net Shorts] on COMEX as described by Gene Arnsberg:

“In the five reporting weeks just since September 6, as the price of gold fell as much as nearly $350 at one point, before snapping back up to settle a net $213.19 or 11.4% lower (as measured on Tuesdays, from $1,874.87 to $1,661.68) the combined commercial traders have covered or offset an eye-opening 59,236 contracts or 26% of their collective net short positioning. Indeed last week‟s COT report (Oct 4), showing 164,751 contracts of LCNS was the lowest net short stand by the commercial traders since the post 2008-crash positioning of April, 2009.”

Each COMEX gold contract is 100 oz. 50,000 x 100 = 5 million.

Moving on to Silver: There are 5,000 ounces of silver in a COMEX contract.

17 million / 5,000 = 3,400

Mr. Arnsberg reminds us in a recent piece that LCNS for silver dropped by some 26,478-contracts [or 56%] – we would do well to remember that the silver market is smaller and trades much thinner than gold [i.e. the silver market reacts much more to stimulus on a percentage basis than gold] and is much less leveraged than gold due to countless margin increases already in place. In layman’s terms: a gold COMEX player needs to put up $U.S. 11,475 in margin for a 100 oz. contract controlling $U.S. 160,000.00 worth of product while a silver investor must put up $U.S. 24,875 in margin for a 5,000 oz. contract worth a little less than $U.S 160,000 at today’s prices.

Conclusions:

The data above outlines an algorithmic, naked-shorting, shell-game which has been perpetrated on our Capital Markets in a co-ordinated fashion with the complicity of the CFTC, the U.S. Treasury, The Federal Reserve and quite possibly the S.E.C. as well. The object of this criminal exercise is/was to create a plausible path for bullion banks to reduce their systemic, serial gold and silver short positions while hopefully maintaining some illusion of “free markets”.

The large, main-line precious metals ETFs [the ones sponsored by the likes of J.P. Morgan, Barclays, HSBC et al] were created for a reason folks. They were developed to serve as “tools” to enable ongoing manipulation of the traditional inflation sanctuary metals – suppressing their prices in the face of MASSIVE, GLOBAL, FIAT CURRENCY DEBASEMENT.

The shell-game outlined above is VERY REAL, is being conducted by depraved lunatics we call our “leaders” and has severe geo-political and economic implications.

We better start dealing with this in a more transparent manner or humanity has a date – in the very near future – with Armageddon.

Got physical gold and/or silver yet?By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.