US Money Supply Surges Surges 33%, Gold Heading for $10,000/oz?

Commodities / Gold and Silver 2011 Oct 21, 2011 - 09:34 AM GMTBy: GoldCore

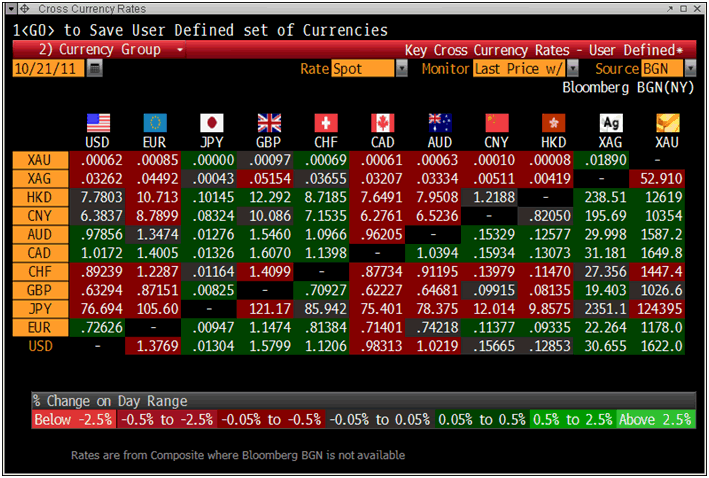

Gold is trading at USD 1,623.80, EUR 1,177.95, GBP 1,027.01, JPY 124,535.72, AUD 1587.39 and CNY 10,354 per ounce.

Gold is trading at USD 1,623.80, EUR 1,177.95, GBP 1,027.01, JPY 124,535.72, AUD 1587.39 and CNY 10,354 per ounce.

Gold’s London AM fix this morning was USD 1,623.00, GBP 1,027.02 and EUR 1178.14 per ounce.

Yesterday’s AM fix was USD 1,629.00, GBP 1,033.24 and EUR 1,180.17 per ounce.

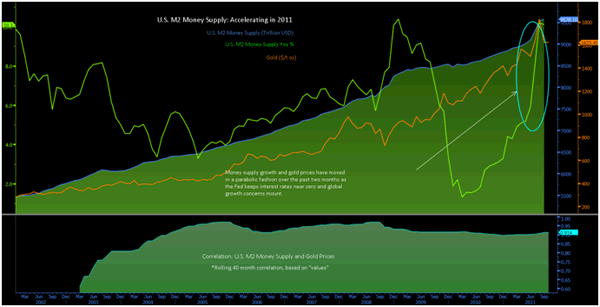

U.S. M2 Money Supply: Accelerating Sharply in 2011

Gold prices are mixed today as markets remain on edge due to increasing divisions amongst European leaders on how to solve the intractable Eurozone debt crisis. There continues to be very strong demand for physical bullion globally and support is strong at the $1,600 level due to this demand.

The sharp fall of copper yesterday, by 6%, is an indication that the US, Chinese and indeed global economy is very fragile and may soon begin to contract.

Physical demand in Asia, mainly India and China, has entered the traditional peak season with Indian festivals and the increasingly important Chinese New Year.

This is reflected in premiums in Asia which remain good. There are reports of massive physical buying out of China on gold’s fall close to $1,600 yesterday. The most active Shanghai gold futures traded at a premium of more than $10 over spot prices earlier today. The contract stood at 335.22 yuan a gram, or $1,634 an ounce, at a premium of $3.

Cross Currency Table

Premiums in Hanoi, Hong Kong, Singapore and Mumbai remain robust on continuing physical demand.

Demand from Asia is due primarily to concerns about fiat currencies – both domestic or local currencies but also the current reserve currencies of the euro and of course the global reserve currency, the dollar.

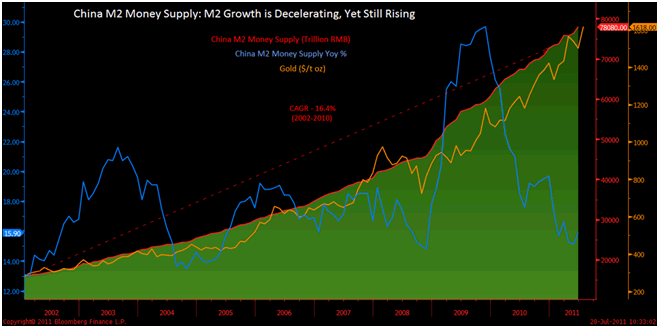

China M2 Money Supply: M2 Growth is Decelerating, Yet Still Rising

While all the focus has been on the Eurozone debt crisis recently, the US is suffering a stealth debt crisis of its own which is being ignored - for the moment. As is the burgeoning debt crisis in China.

The US fiscal position is appalling with a $1.6 trillion deficit projected for fiscal 2012 alone. For those who have lost count, the US national debt has risen to over $14.8 trillion. The latest updated projections reveal that the US will reach a 100 percent debt to GDP ratio by Halloween – in 10 days time.

Gold’s recent weakness has coincided with a period of dollar strength but with trade and budget account deficits as far as the eye can see, this dollar strength is likely to be brief.

Indeed, the dollar’s recent strength is due to the fact that while the dollar’s fundamentals are very poor – its competing fiat currencies such as sterling and the euro have similar if not worse outlooks due to imprudent monetary policies.

The possibility that gold could surge to as high as $10,000/oz is gaining traction amongst some respected market participants.

Paul Brodsky, co-founder of QB Asset Management Company has again warned regarding the risks posed to US Treasuries and the possibility of a sharp revaluation of gold that could see gold reach $10,000/oz.

A twenty-year veteran of the bond market in his own right, Brodsky told King World News that the US may return to some form of Gold Standard in order to restore faith in the US dollar.

Proponents, including Steve Forbes and Ron Paul, argue a gold standard would prevent what they see as irresponsible money creation and force the US to live within its means by limiting the amount of money monetary authorities can create.

The idea that the US could revalue gold and devalue the dollar (as was done by Roosevelt in the Great Depression) is gaining increasing currency.

Gold prices would hit $10,000 an ounce or even more should current calls for a return to the gold standard become reality, according to Brodsky.

In conversation with King World News, money manager, Stephen Leeb, said that gold is remarkably undervalued and “is going to add another digit over the next five to ten years there is very little doubt about that.”

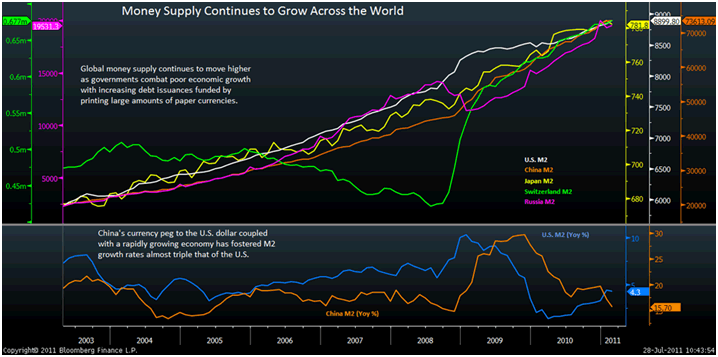

Global Money Supply Chart

Leeb recently said that gold could rise to $12,500/oz. He concluded this based on many of the factors documented by GoldCore in recent years such as gold in terms of financial assets, the monetary base and surging money supply globally.

As the ‘U.S. M2 Money Supply: Accelerating Sharply in 2011’ chart shows, US money supply (M2) has surged in a parabolic manner in the last few months and is up by more than 50% year to date and up 33% in just 4 months - from June 1st to October 1st.

SILVER

Silver is trading at $30.01/oz, €22.44/oz and £19.50/oz

PLATINUM GROUP METALS

Platinum is trading at $1,499.25/oz, palladium at $610/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.