Europe still looking for the Bazooka

Currencies / Forex Trading Oct 20, 2011 - 07:38 AM GMTBy: Regent_Markets

Title: Europe still looking for the BazookaThis morning financial markets are on the back foot following last night's evening session sell off. Markets are still looking European officials to bring out the 'Bazooka', a plan that will put to bed the Eurozone worries once and for all. Up until now officials have provided solutions that do little more than buy time, but now its crunch time and markets are demanding a meaningful solution. The omens weren't good last night when an FT story suggested that European banks would only have to raise 100 bn euros, less than a third of what the market things they really need. In addition, European lawyers have questioned the legality of proposals to leverage up the EFSF under the 'no bailout' clause.

Gold is being hit hard this morning, down 1.90% on the day. The precious metal is certainly no safe haven in the current climate thanks to over leveraged speculators (and possibly banks) offloading at times of stress.

Similarly, the Australian dollar is feeling the heat with the AUD/USD down 0.65% and the AUD/JPY off by 0.82%.The euro is also down this morning with the EUR/USD down 0.47% and the EUR/ JPY down 0.62%.Coming up today we have UK retail sales at 09.30, expected to come in flat.

US unemployment claims follow at 13.30 with a slight drop to 401k expected. The heavy data sets continue with US existing home sales and the Philly Fed Manufacturing Index at 15.00.

European headlines will probably dominate trading well into the weekend. It is almost impossible to predict what might come out next and more importantly, what market reaction might be. If past behavior is anything to go by, European officials might put out a grand rescue plan that sends markets higher in the short and medium term, only for the cracks to re-appear because the plans do not address the problems inherent in the Eurozone's faulty architecture.

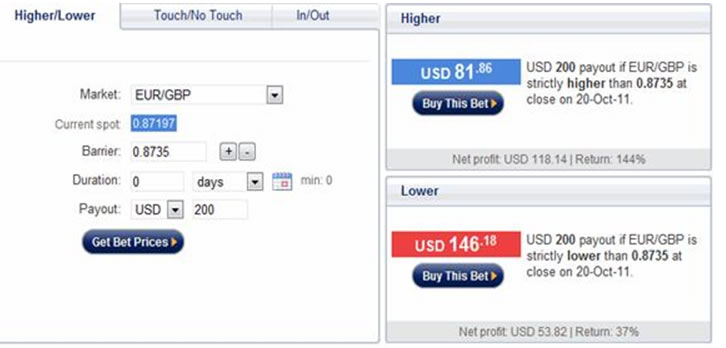

In the short term then, anything can happen and the EUR/GBP might be a good pair to focus on. Follow through has been lacking on this pair since August with an up day more likely to be followed by a down day and vice versa. Yesterday's EUR/GBP sell off could be a buy signal for today therefore, especially with the pair range bound between 0.8700 and 0.8800.A good way to play this might be a HIGHER trade predicting that the EUR/GBP closes today above 0.8735 for a potential return of 144% at Betonmarkets.

Summary:

Dave Evans

Email: editor@my.regentmarkets.com

Url: www.BetOnMarkets.com

With BetOnMarkets, you can trade an ever increasing list of globally traded stocks, indices, commodities and forex currency pairs from one account using a uniquely LOW RISK trading platform that lets you lock in your level of risk and exact return BEFORE you commit to a trade. You can bet on over 100 currency pairs, indices, commodities and stocks with bets ranging from 30 seconds up to 360 days. You can fund your account with as little as $5 and bet for just $1 and its unique "fixed returns" service means you know exactly how much you stand to win or lose before you commit any money. If you are looking for a low cost, low risk way to participate in the markets, then BetOnMarkets is for you. Check us out now at www.BetOnMarkets.com

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Regent Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.