U.S. Dollar Index, The Big Picture

Currencies / US Dollar Oct 20, 2011 - 05:49 AM GMTBy: Colin_Twiggs

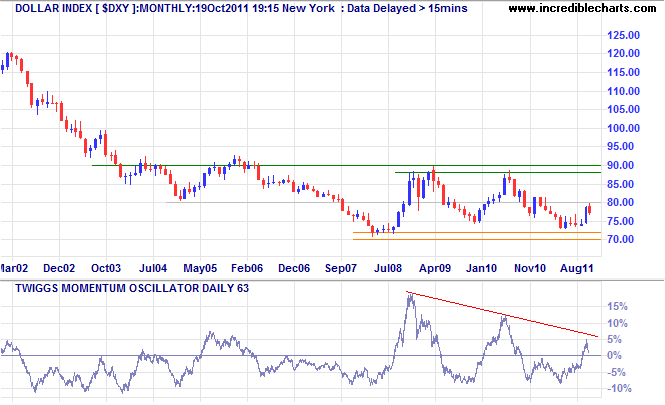

When markets are volatile it often pays to take a step back and look at the big picture. A monthly chart shows the Dollar Index ranging between 70 and 90 since 2003, with the 80 level alternating as mid-range support/resistance. The index recently pulled back from resistance at 80 and will now either re-group for another attempt or medium-term support will give way, signaling a test of long-term support.

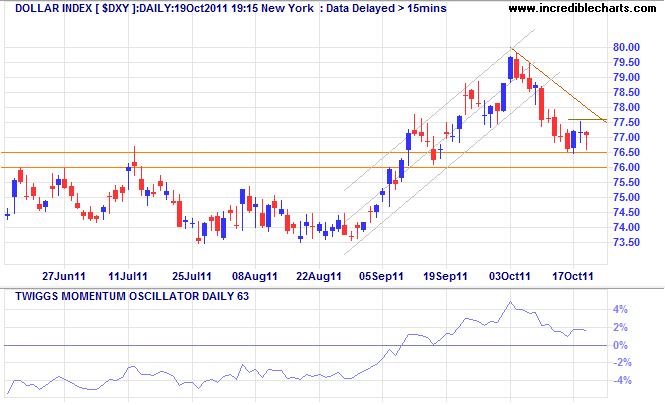

Zooming in to the daily chart shows narrow consolidation above medium-term support at 76.50. Breakout above 77.60 and the descending trendline would signal another test of 80, while failure of support at 76 would mean a decline to 73.50*.

* Target calculation: 76.5 – ( 79.5 – 76.5 ) = 73.5

In the long term, breach of 73.50 would test 70, while breakout above 80 would signal an advance to 90. If support at 70 fails, gold will rocket through $2000/ounce, but that is only likely to occur if the Fed rolls out QE3.

By Colin Twiggs http://www.incrediblecharts.com

Colin Twiggs is the leading commentator at Incredible Charts where he writes the Trading Diary , with more than 70,000 subscribers. His specialty is blending fundamental analysis of the economy with technical analysis of stocks, markets, commodities and currencies. Focusing on the role of the Fed and banking credit as primary drivers of the economic cycle, Colin successfully forecast the October 2007 bear market — eight months ahead of the sub-prime crisis.

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use .

© 2008 Copyright Colin Twiggs - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.