After SPXU Has its Day - UPRO is Next

Stock-Markets / Stock Markets 2011 Oct 18, 2011 - 08:25 AM GMTBy: George_Maniere

Several weeks ago, for the second time, I called for a buy of SPXU too early. The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. Conversely, Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day.

Several weeks ago, for the second time, I called for a buy of SPXU too early. The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500. Conversely, Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day.

If you believe as I do that we are setting up for a leg down on the S&P then SPXU is the best way to profit from this trade. Of course it goes without saying that timely trading makes all the difference in a stop order getting executed and a day of raising my stop. I and I am sure a few have my readers have experienced both and the latter scenario is not only more satisfying but it is also very profitable.

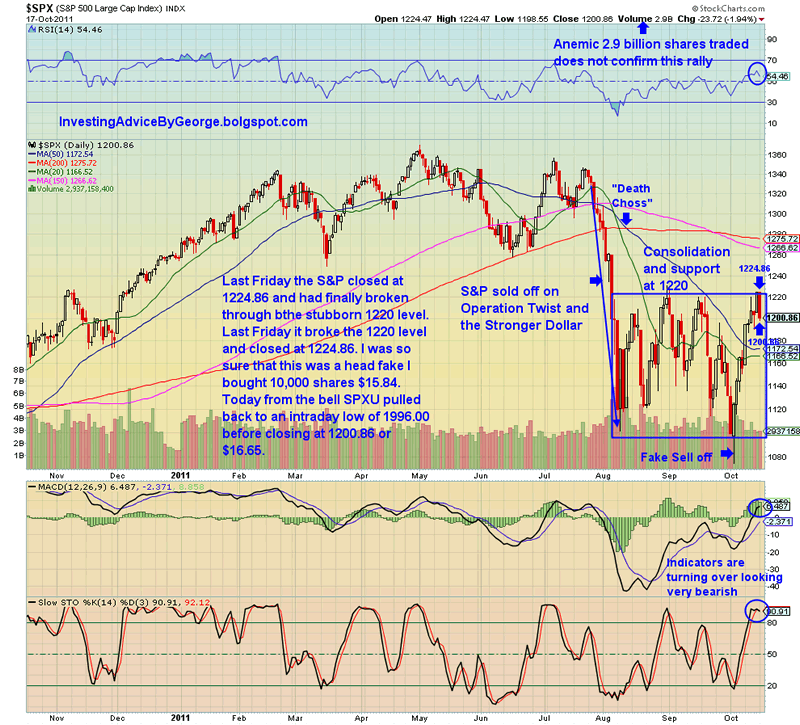

Please see the chart below.

A look at this chart will show that although it the S&P n closed at 124.86 on Friday I knew that it was a fake out and it gave it all back today. This also confirms that the breakout we saw on Friday was not for real and I conclude that we will go back and test the 1100 level. If we were to break the 1100 level we would have resistance at 1050 / 1020 and finally 960 before complete capitulation.

I do not see us going past 1050 but it is important to bear in mind that this is a factor of many things. For one we have the recapitalization of the European banks and most economists have come to the consensus that it would cost seven trillion Euro. The bad news is that Europe does not have seven trillion Euro to recapitalize the banks. So as I wrote in a recent article Europe is Broke! Add to this that so far the earning reports have been disappointing, gold is forecast to drop another $12.00 today and Angela Merkel has been complaining that the contagion in the European banks is due to the US banks. All of this adds up to one certainty – the US markets are going to sell off. I believe that yesterday was a prelude to the sell off that has just begun.

As I have written, I saw this coming two weeks ago and yes I was early with my prediction and got stopped out three times. This time, however, I see no white knight riding to save the day. Last night Asian stock markets dropped as a slowdown in China's economy added to fresh concerns about the ability of Europe's leaders to substantially contain the euro-zone debt crisis. As investors look toward a meeting on Sunday October 23rd of European leaders for a sweeping solution to Europe's debt crisis, a spokesman for German Chancellor Angela Merkel on Monday warned against hoping that all the euro-zone's debt woes would be resolved by then. Chancellor Merkel reminded everyone that the dreams that on Monday everything will be resolved and everything will be over will again not be fulfilled.

Going forward, I believe that the market is more likely to turn over the next few weeks than gain ground, as it will experience some hard tests. As I have written, the market risks further disappointment October 23 as it has priced in a solution to the problems as if somehow everything negative that has been lingering unsolved for the past 2 years will miraculously disappear in one week.

My regular readers know that I do not use this forum as a bully pulpit to espouse any political views. I see a chance to write as a way to help people learn how to profit from whatever events come our way. I see the best way to profit from this event is to short the S&P by using SPXU. When the market bottoms (which it will) then sell SPXU and go long the S&P by moving to UPRO.

In conclusion, at this moment the world is falling apart at every turn. Global markets have run up too far and too fast and it’s time to pay the piper. The markets will sell off of correct (if you like) and we will find our footing and move on. After this sell off we will rally until the end of the year. Don’t get me wrong there will be choppy waters ahead but we will navigate these turbulent waters and come out of this storm stronger and maybe, just maybe, we may have learned a hard lesson. Don’t spend what you don’t have! Borrowing your way to prosperity has never worked and it never will.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.