Stocks Bear Market Rally or New Bull Advance?

Stock-Markets / Stock Markets 2011 Oct 17, 2011 - 03:14 AM GMTBy: Donald_W_Dony

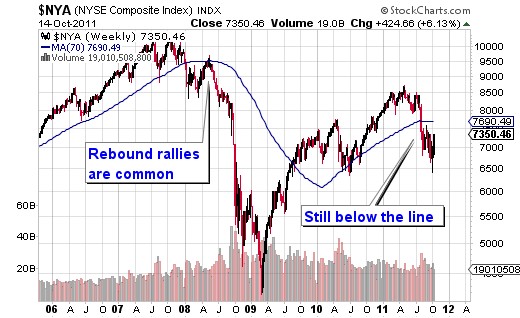

Broader global markets have rallied substantially since the start of the new cycle. The NYSE Composite has advanced 14% from October 4th (Chart 1), the EURO 100 has climbed over 11% and many Asian indexes have jumped 12%-17%. But is this the start of a new bull market or just a rebound rally within a longer bear trend?

One gauge of the market strength is the number of stocks rising within an index. Markets require more than half of the securities within their index to be advancing before a sustained bull market can occur.

Currently there is only 22.49% of the stocks on the NYSE trading above their 200-day moving average. In comparison, the deep mid-2010 correction saw the percentage dropped to 32.44% only to quickly rebound back to a bullish 50%-60%.

The present 22% in the NYSE is similar to the levels seen in the second half of 2002. World markets bottom later that year and in early 2003.

Bottom line: The broad based NYSE Composite requires a higher percentage of rising stocks before a new bull market can develop. The present level of 22.49% indicates the current rally will wade as the vast majority of stocks are still declining.

Investment approach: Investors may wish to remain on the side lines until evidence indicate that there is is enough supportive strength for a new bull market.

More market research will be in the upcoming November newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.