Currency Intermarket Insights, YEN, UST2Y, DXY, EURO

Currencies / Forex Trading Oct 16, 2011 - 01:20 PM GMTBy: Capital3X

Key counter trends this week has challened many of the established trends of the last 3 months. We will look at key pairs and intermarket to understand on their trends.

Key counter trends this week has challened many of the established trends of the last 3 months. We will look at key pairs and intermarket to understand on their trends.

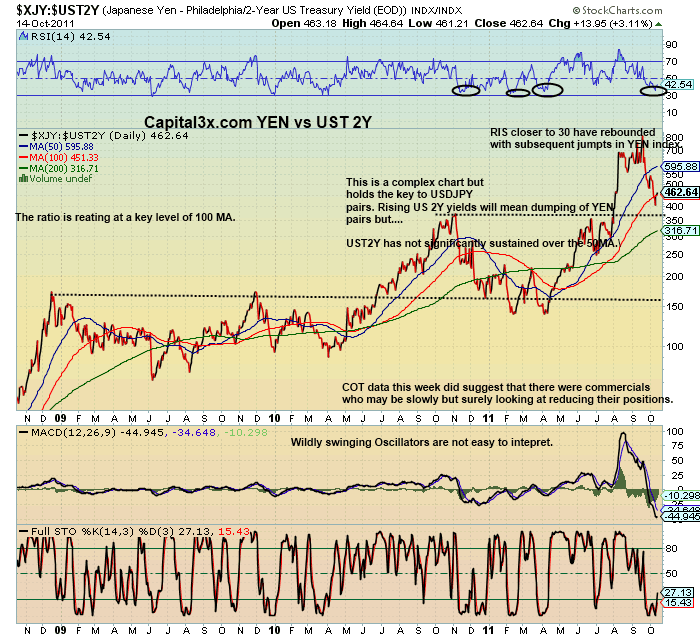

YEN vs 2Y yield on UST

YEN relation to US treasury Yield is well established. We see the rising YEN index against the backdrop of falling US yieldS esp on shorter end of the curve. But given that the US 2y yield has broken above the 50 MA, we may finally be in the early stages of YEN Index to have topped off.

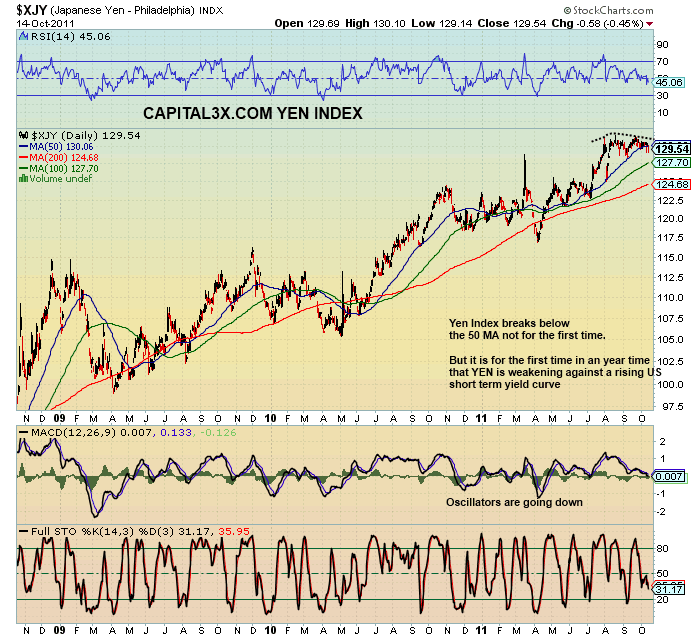

YEN Index

Yen weakness is coming on the back of rising US short term yield curve as it breaks below the 50 MA.

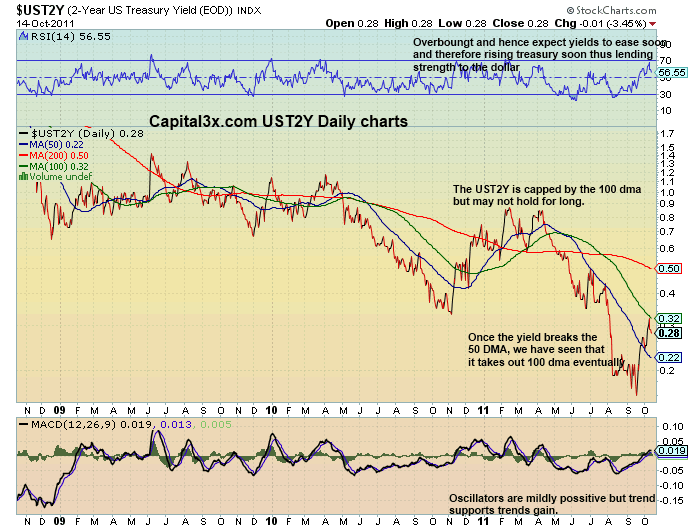

UST 2Y Yield

The US treasury 2y yield gives a strong feeling that short term yield may have crossed over beyond the 50 MA for good this time as FED twist operation is pulling it away. A major casualty of the 2yYield is Gold and YEN both of which drive of the US yield curve.

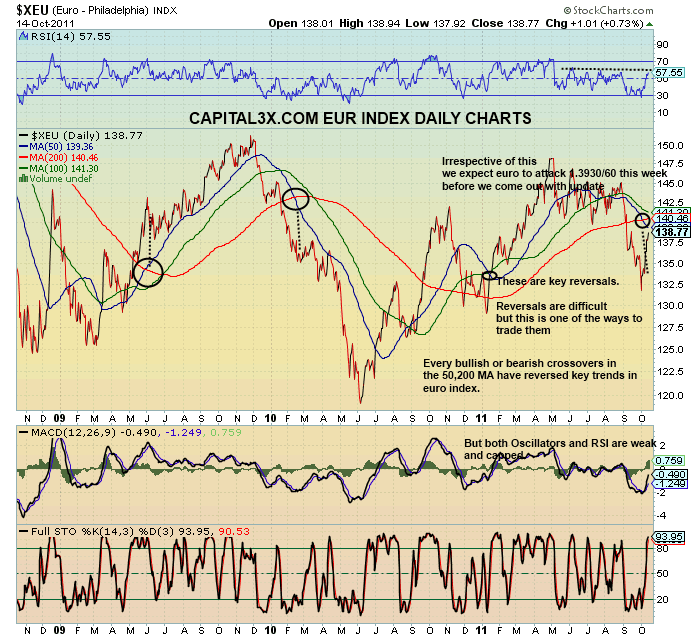

EURO Index

EURO is set to extend and test 50 MA and even move to the 200 MA. The sheer velocity in the Index is expected to pummel euro to key crossover levels. The macro for such a move has been well priced in for the Oct 23 eur head meeting which many believe could give EU bonds a new sigh of life. Trichet has told FT that Treaty changes could be possible.

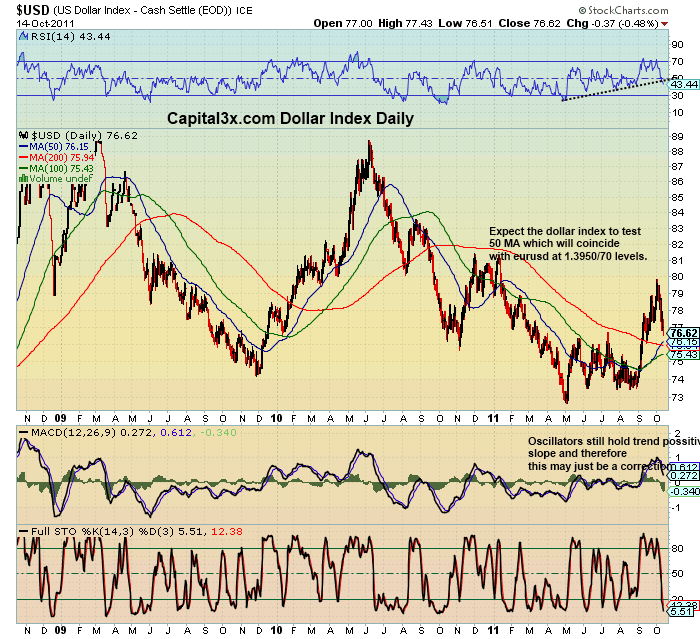

Dollar Index Daily

On the daily charts, we see the index, still above key levels but heading to test the 50 MA at 76.15 a level corresponding with the EURUSD at 1.3950/70

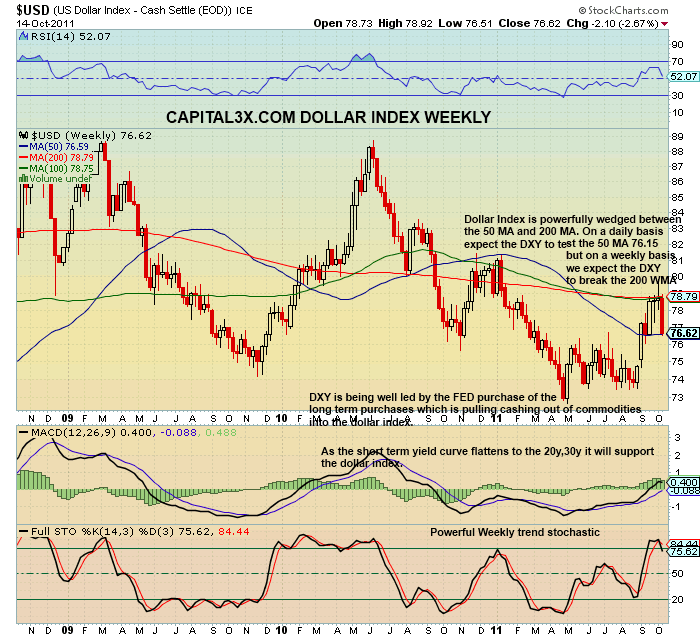

Dollar Index Weekly

The weekly chart reveal far more than the daily as we see the Index wedged between the 50 and the 200 WMA. These are key level and expect the dollar to test both levels.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.