U.S. September Retail Sales Noteworthy Pickup, But Q3 Consumer Spending is Tepid

Economics / US Economy Oct 15, 2011 - 10:29 AM GMTBy: Asha_Bangalore

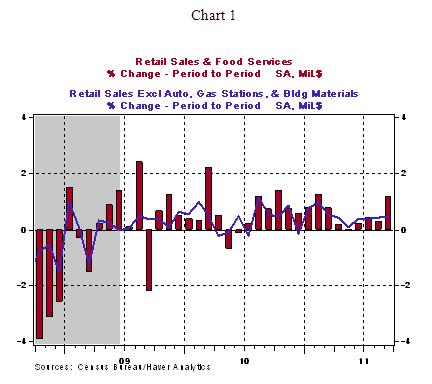

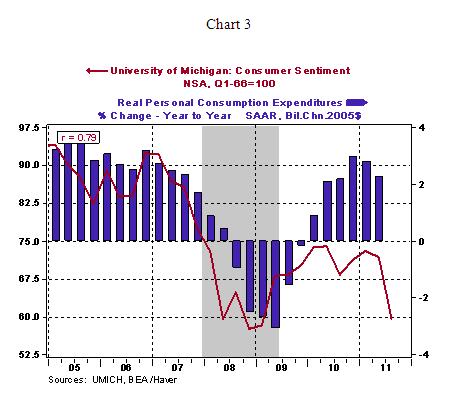

Retail sales rose 1.1% in September, after an upwardly revised 0.3% increase in August (previously reported as unchanged). Strong auto sales (+3.6%) and a 1.2% jump in gasoline sales were only part of the story. Purchases of apparel (+1.3%), furniture (+1.1%), and general merchandise (+0.7%) also advanced in September. In the third quarter, total retail sales increased at an annual rate of 4.5% vs. 4.7% in the second quarter. Excluding gasoline, retail sales move up at annual rate 4.6% in the third quarter vs. 3.1% in the second quarter.

Retail sales rose 1.1% in September, after an upwardly revised 0.3% increase in August (previously reported as unchanged). Strong auto sales (+3.6%) and a 1.2% jump in gasoline sales were only part of the story. Purchases of apparel (+1.3%), furniture (+1.1%), and general merchandise (+0.7%) also advanced in September. In the third quarter, total retail sales increased at an annual rate of 4.5% vs. 4.7% in the second quarter. Excluding gasoline, retail sales move up at annual rate 4.6% in the third quarter vs. 3.1% in the second quarter.

Frequently, we exclude building materials (because they are put in the residential investment expenditure component of GDP), autos (because unit sales matter in GDP computation) and gasoline (because the gains are price-related) to get a sense of underlying demand. The pared back version of retail sales, after excluding these three items, rose at annualized rate of 4.6% in third quarter, slightly smaller gain than the 5.2% increase seen in the second quarter. Comparing these numbers, the verdict is that retail sales staged a good comeback in September but it is not sufficient to lift consumer spending and GDP to an impressive level in the third quarter. The good news is that retail sales moved up in September and there were upward revisions to estimates of the prior two months. It is an encouraging report amid all the gloomy economic news day after day.

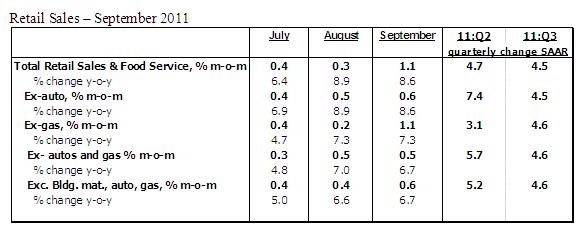

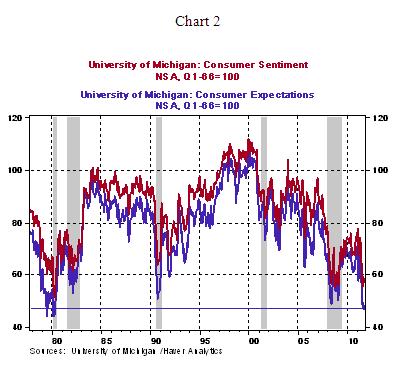

In other related economic news, the University of Michigan Consumer Sentiment Index edged down to 57.5 in the early-October survey from 59.4 in September. The Current Conditions Index dropped to 73.8 from 74.9 in September. More importantly, the Expectations Index declined to 47.0 from 49.4, which is the lowest since May 1980 (see Chart 2). The relationship between consumer spending and consumer outlook measures was more tenuous in the fifteen years ended 2005 than in recent years. In the last seven years, consumer sentiment measures show a strong positive relationship with consumer spending (see Chart 3). Based on this relationship, the outlook for consumer spending is not robust.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.