Gold Stocks Bargains Galore...

Commodities / Gold & Silver Stocks Oct 14, 2011 - 11:44 AM GMTBy: Dudley_Baker

...at the 5¢ & 10¢ Store: TSX

...at the 5¢ & 10¢ Store: TSX

I'm sure many of our readers remember the 5¢ and 10¢ stores of the past. What a treat as a kid to browse through the merchandise looking for the chance to purchase some of our favorite items literally for pennies. Well, guess what? The 5¢ and 10¢ store is back and this time it is packed with many incredible values for us big boys and girls.

This time the 5¢ and 10¢ store is the Toronto Exchange as well as the Venture Exchange.

These exchanges are home to the Canadian resource companies and many are now selling at bargain basement prices.

Yes 5¢ and 10¢ a share is not an exaggeration for many of these resource companies and some with good properties and management.

Simply put, if you want to make money in the markets, you must buy low and sell high. Sounds very easy but at times like these many investors are afraid to step into the resource sector much less think of buying the penny stocks.

Investors have experienced substantial losses in their portfolios due to the recent market fears.

But, we continue to remind ourselves, subscribers and all readers interested in the natural resource sector, that the big picture has not changed.

All the reasons and arguments for these long term investments are as sound today, if not more so. Corrections will come and yes, they will go, leading us to another great rally. But obviously that day has not yet arrived. Patience and focus is essential for all of us at this time.

As we have said before and will continue saying, 'keep your eyes on the prize'. The prize by our definition is the high probability of a strong market for resource shares starting soon and the possibility of the beginning of the long awaited mania phase of the bull market for the resource sector.

Those of us following the mining shares, particularly the juniors and small exploration companies, are well aware of the carnage over the last few months. Many of the shares are down 70%, 80% or even 90% in value. Some shares that were trading for a $1 or more are now available at the 5¢ and 10¢ store.

We continue to believe there is a high probability that gold will drift back below $1500, at least briefly, before this current consolidation is complete in the coming weeks. So perhaps it is not yet time to back up the truck. But, it is surely time to be preparing your wish list of companies to buy and perhaps place some stink bids on those shares.

Get ready for the bottom which could come very soon.

Patience and cash is now your best friend.

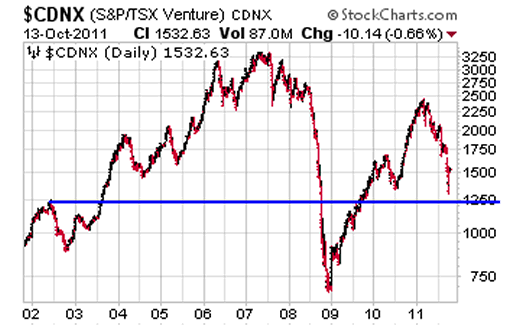

We present you with this chart on the TSX Venture. Hardly a pretty chart at this point in time but look to the future when we anticipate selling our shares and warrants for dollars while currently buying them at the 5¢ and 10¢ store.

We continue to stress our view that this correction is within the framework of the long-term bull market and is giving investors a great once in a lifetime buying opportunity.

For those readers unfamiliar with our services we provide:

1. An online database for all warrants trading on the natural resource companies in the

United States and Canada. Our database is the most comprehensive database that

you will find.

2. In addition for our Gold Subscribers we provide:

A. "A Look Over My Shoulder" - This is my entire personal portfolio and I provide an

audio update each Thursday evening and emails as I buy or sell securities or

warrants. Each subscriber can decide whether to follow me but this is your

decision and we suggest that subscribers do their own due diligence before

buying any securities.

B. Insiders Trading Data:

We track the insider trading on the Canadian Securities and issue BUY and SELL

Alerts as we deem necessary. We have a great track record of approximately

100% gains on all closed trades.

We encourage all readers to sign up for our free weekly email.

Dudley Pierce Baker

Guadalajara/Ajijic, Mexico

Email: support@preciousmetalswarrants.com

Website: PreciousMetalsWarrants

Website: InsidersInsights

Dudley Pierce Baker is the owner and editor of Precious Metals Warrants and Insiders Insights. Articles are written by Dudley Baker along with contributing editors, Arnold Bock of Mendoza, Argentina and Lorimer Wilson of Toronto, Canada. PreciousMetalsWarrants provides an online subscription database for all warrants trading on junior mining and natural resource companies in the United States and Canada and a free weekly newsletter. InsidersInsights alerts subscribers when corporate insiders of a limited number of junior mining and natural resource companies are buying and selling.

Disclaimer/Disclosure Statement:PreciousMetalsWarrants.com is not an investment advisor and any reference to specific securities does not constitute a recommendation thereof. The opinions expressed herein are the express personal opinions of Dudley Baker. Neither the information, nor the opinions expressed should be construed as a solicitation to buy any securities mentioned in this Service. Examples given are only intended to make investors aware of the potential rewards of investing in Warrants. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions involving stocks or Warrants.

Dudley Pierce Baker Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.