Gold to Top $2,000 on Central Bank Buying: Chart of the Day

Commodities / Gold and Silver 2011 Oct 14, 2011 - 08:05 AM GMTBy: GoldCore

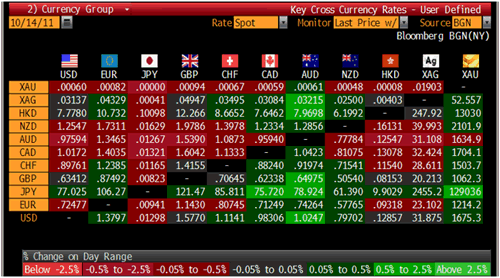

Gold is trading at USD 1,675.30, EUR 1,214.20, GBP 1,062.30, JPY 129,036.00, AUD 1,634.90 and CHF 1,503.70 per ounce.

Gold is trading at USD 1,675.30, EUR 1,214.20, GBP 1,062.30, JPY 129,036.00, AUD 1,634.90 and CHF 1,503.70 per ounce.

Gold’s London AM fix this morning was USD 1,676.00, GBP 1,062.31 and EUR 1,214.31 per ounce.

Yesterday’s AM fix was USD 1,673.00, GBP 1,065.74 and EUR 1,218.05 per ounce.

Cross Currency Table

Gold is marginally higher in most currencies today and continues to consolidate at the upper end of the range between $1,600 and $1,700/oz. Physical demand for coins and bars remains very strong with GoldCore experiencing a notable increase in demand this week.

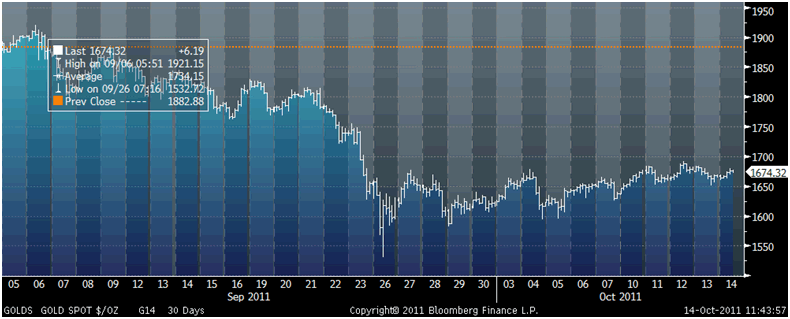

Gold in USD – 30 Day (Tick)

Gold is up nearly 3% on the week and looks set to post its biggest weekly gain in more than a month. Markets remain nervous about the risk of contagion ahead of a G20 meeting whose agenda will be dominated by the euro zone debt crisis and steps to tackle the contagion.

Gold should be supported by global inflation data this morning which remains stubbornly high particularly in emerging markets.

Inflation in China and India remains very high. In India, inflation exceeded 9% for the 10th month in a row and in China inflation is at 6.1% but the key food component of inflation rose 13.4% year-on-year in September.

European inflation accelerated the fastest in almost three years in September on soaring energy costs, complicating the European Central Bank’s task as it combats the region’s sovereign-debt crisis. The euro-area inflation rate jumped to 3 percent last month from 2.5 percent in August. Inflation in Germany also surprised to the upside this week.

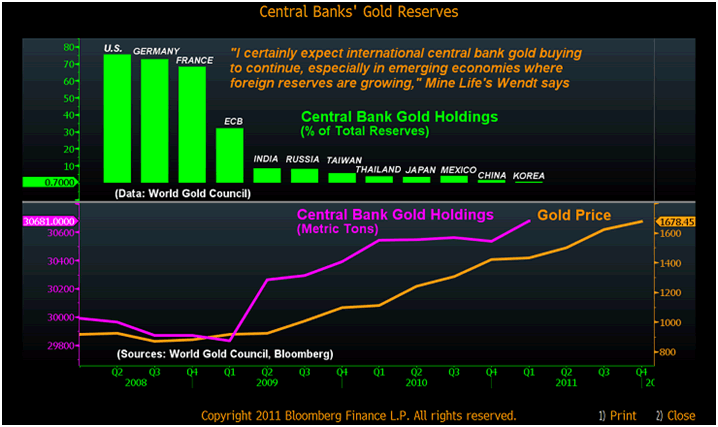

The Bloomberg ‘Chart of the Day’ shows the proportion of gold in the international reserves of India, Russia, China and Mexico is significantly lower than the rates in the U.S., Germany and France, based on data compiled from the World Gold Council. The lower panel tracks central bank holdings in metric tons and the bullion price since March 2008.

Central banks last year were net gold purchasers for the first time in two decades.

“I certainly expect international central bank gold buying to continue, especially in emerging economies where foreign reserves are growing,” said Gavin Wendt, founder and senior analyst at Sydney-based Mine Life, which publishes reports on the metals industry. “It’s the safest option for them.”

Central banks, the biggest gold holders, have expanded reserves due to the international financial crisis. Central bank and government-institution buying totaled 192.3 metric tons in the first half of 2011, World Gold Council data show. Gold accounts for 75.4% of the U.S.’s reserves and 72.7% of Germany’s.

The ratio is just 1.6% for China and 8.2% for Russia, WGC data show.

“Governments in many places like Asia and South America are rapidly embracing gold as a security mechanism,” said Wendt, who expects gold at $2,500 in 2013. “The value of their U.S. dollar foreign reserves has drastically fallen over the past decade.” Thailand, Bolivia and Tajikistan raised reserves in August, according to the International Monetary Fund.

China's foreign exchange reserves, the world's largest stockpile, rose by $4.2 billion in the third quarter to $3.2 trillion, the People’s Bank of China said on Friday.

Central bank demand due to concerns about currency debasement and contagion remains a primary driver of gold’s bull market and means that the foundations of the bull market are very sound.

Central bank demand is strategic leading to gradual accumulation and it is long term meaning that official sector demand will provide support to prices for the foreseeable future.

Thus, continuous suggestions that gold is a bubble today and in recent years and of a gold bubble bursting and prices falling sharply as seen in 1980 is uninformed and misguided.

The world of 2011 is very different to that of 1980.

In 1980, the U.S. was the world’s largest creditor nation. Today, it is the world’s largest debtor nation – the largest debtor nation the world has ever seen.

In 1980, China was a communist country whose citizens were banned from owning gold. Today, there are 1.3 billion Chinese people and a growing middle class who can buy gold.

The Chinese central bank did not have any currency reserves in 1980, today they have $3.2 trillion in foreign exchange reserves.

Similarly, India, China, Brazil and other emerging markets were debtor nations in 1980 today they are creditor nations with massive foreign exchange reserves denominated primarily in dollars.

In 1980, the much of the world was coming out of a period of recession and stagflation. Today, we appear to be on the verge of a recession or Depression possibly involving stagflation again.

In 1980, there was no banking or sovereign debt crisis and no risk of global financial and economic contagion.

SILVER

Silver is trading at $31.90/oz, €23.14/oz and £20.22/oz

PLATINUM GROUP METALS

Platinum is trading at $1,539.20/oz, palladium at $601/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.