Global Money Supply and Currency Debasement Driving Gold Higher

Commodities / Gold and Silver 2011 Oct 13, 2011 - 12:06 PM GMTBy: GoldCore

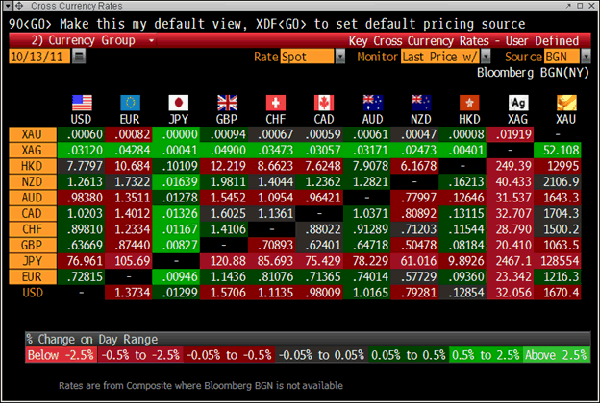

Gold is trading at USD 1,670.40, EUR 1,216.90, GBP 1,063.81, JPY 128,555.00, AUD 1,643.34 and CHF 1,500.20 per ounce.

Gold is trading at USD 1,670.40, EUR 1,216.90, GBP 1,063.81, JPY 128,555.00, AUD 1,643.34 and CHF 1,500.20 per ounce.

Gold’s London AM fix this morning was USD 1,673.00, GBP 1,065.74 and EUR 1,218.05 per ounce.

Yesterday’s AM fix was USD 1,687.00, GBP 1,070.36 and EUR 1,222.02 per ounce.

Cross Currency Table

Gold is marginally lower in all currencies today and appears to be steadying near four-week highs on further evidence of strong consumer demand in Asia. Market concerns about contagion in the eurozone should prevent significant price falls from these levels.

Jewellers and bullion dealers in India and China continue to stock up prior to their various festivals - such as Diwali in India and Chinese New Year in January 2012.

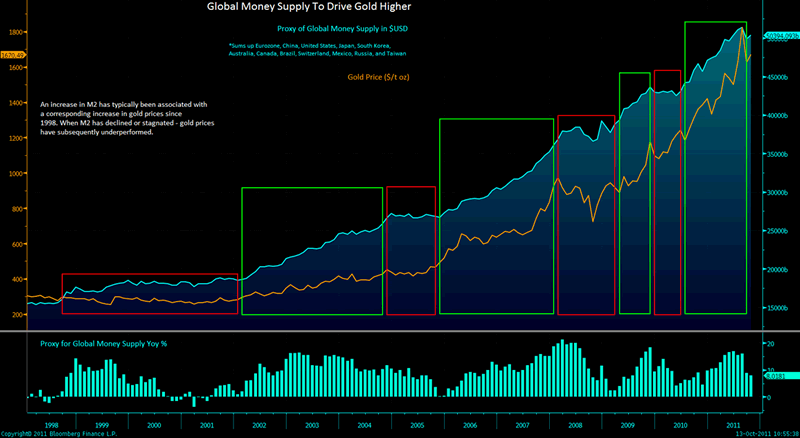

One of the primary drivers of higher gold prices in recent years has been money supply growth in the US and globally and consequent concerns about currency debasement.

Since 1998, increases in the price of gold have been correlated with increases in global M2. If central banks in both the developed and developing world continue to adhere to highly accommodative monetary policies, global M2 should subsequently rise and support a further increase in gold prices, as it has in the past.

Global Money Supply Growth – 1998 to Today

(Eurozone, US, China, Japan, South Korea, Australia, Canada, Brazil, Switzerland, Mexico, Taiwan and Russia)

Developing China’s M2 money supply has been rising by a large 20% and Russia’s by a very large 30%.

Even developed countries such as Switzerland have seen money supply growth of 25%. Japan’s M2 is gradually moving higher after the ‘Lost Decade’ and after recent events exacerbating an already fragile situation.

Global money supply growth is increasing by 8%-9% per annum. Meanwhile annual gold production is less than 1.5% per annum.

We looked at money supply growth and charts regarding global money supply, debt levels etc in a comprehensive article in early August (‘Is Gold a Bubble? 14 Charts, the Facts and the Data Suggest Not’) when gold was trading at $1,670/oz or much the same price level as today. The charts and conclusions remain apposite.

In order to fight economic problems brought about due to too much debt, debt based paper and electronic currency has been created at historically high levels. There is no sign of this abating any time soon given the scale of the global financial and economic crisis.

Indeed, shuffling debt from one sector to another and creating more debt to deal with what was essentially a problem of too much debt is making the situation worse and leading to currency depreciation and debasement.

Growth in global money supply, U.S. dollar, euro, pound and all fiat currencies depreciation or currency debasement and massive uncertainty in global financial markets and the real risk of contagion will likely continue to lead investors and savers toward using precious metals, and specifically gold and silver bullion, as stores of value and safe havens.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.