Illusions versus Reality in the Copper Market Commodities Crash

Commodities / Commodities Trading Oct 12, 2011 - 11:55 AM GMTBy: Gary_Dorsch

“You unlock this door with the key of imagination. Beyond it is another dimension, a dimension of sound, a dimension of sight, a dimension of mind. You’re moving into a land of both shadow and substance, of things and ideas. It’s a journey into a wondrous land, whose boundaries are that of imagination. That’s a signpost up ahead, your next stop, the “Twilight Zone!”

“You unlock this door with the key of imagination. Beyond it is another dimension, a dimension of sound, a dimension of sight, a dimension of mind. You’re moving into a land of both shadow and substance, of things and ideas. It’s a journey into a wondrous land, whose boundaries are that of imagination. That’s a signpost up ahead, your next stop, the “Twilight Zone!”

Rod Serling was a multi-talented man and a prolific writer. His television series “The Twilight Zone” ran for five seasons in the early 1960’s and was extraordinary, winning three Emmy Awards. As the host and narrator, and writer of more than half of 151 episodes, he became an American household name and his voice always sounded a creepy reminder of a world beyond our control. For many traders in the commodity pits, every trading day is like entering “a fifth dimension beyond that which is known to man, that lies between the pit of man’s fears and the summit of his knowledge. It is an area called the “Twilight Zone,” Serling used to say.

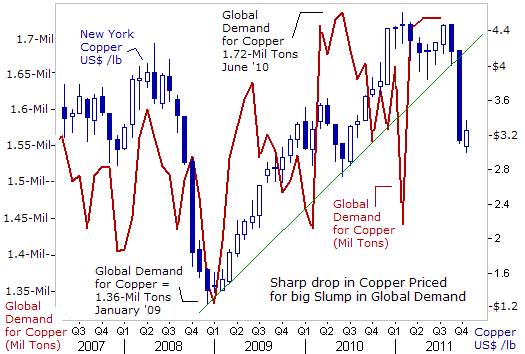

Such has been the case for the once high flying Copper market, which touched an all-time high of $4.6250 /pound, in February 2011, yet last week, briefly plunged to as low as $3 /pound, and tumbling -35% below its all-time high. Most of the slide occurred within a nine week period, starting on August 7th. It was the most rapid downward spiral the copper market has experienced since the “Crash of 2008.” Hedge fund traders, that control as much as $2-trillion is customer funds, were reported to be selling a wide array of commodities, including, corn, gold, silver, soybeans, and copper, in order to meet redemption calls by jittery investors, who were shell shocked by $11-trillion of losses in global stock markets.

Yet how does one explain the sudden sharp drop in copper prices that sliced off a third of its value? At last count, global demand for copper is not too far from record highs, and furthermore, demand for copper is expected to exceed new supplies by roughly 200,000-tons this year, leading to a supply deficit, which should buoy copper prices. “There has been some softening in copper demand, but not to the extent seen in the copper price,” said Richard Adkerson, chief executive of Freeport McMoRan Copper & Gold FCX.N, the world’s largest publicly traded copper miner. “There’s this disconnect right now, and that’s because investors are concerned about the future. There are huge macroeconomic uncertainties, and it’s driven by that,” Adkerson said. In other words, the traders in the copper market are operating in the Twilight Zone, where its difficult to separate illusion from reality.

Part of the reason for the sharp slide in the copper market since August 7th, are indications that activity in the global factory sector has slowed down to stall speed. On Oct 3rd, JP-Morgan reported that the Global Manufacturing PMI had contracted worldwide for the first time in over two years last month as incoming orders for new work dried up. The Global Factory PMI fell in September to 49.9 from 50.2 in August, the first time since June 2009 that the index has fallen below the 50-mark that divides growth from contraction, after sliding for the last seven months. More ominously, the New Orders index fell to 48.5, down from 49.4 in August, it’s lowest since May 2009 and the third straight month it has been below 50.

On Oct 4th, Fed chief Ben Bernanke to Congress that “the US-economy is close to faltering,” and Goldman Sachs warned that the US-economy is on the edge of recession. “The European crisis threatens US-economic growth via tighter financial conditions, reduced credit availability and weaker growth of US-exports to the region. This impact is likely to slow the US- economy to the edge of recession by early 2012,” Goldman said. Earlier, the Economic Cycle Research Institute also warned that the US-economy was already past the point of no return, and beyond the ability of policymakers to help. “The most reliable forward-looking indicators are now collectively behaving as they did on the cusp of full-blown recessions, not soft landings,” the ECRI said in a report.

All these forecasts and reports conjured-up the illusion of an impending “double-dip” recession in the Trans-Atlantic economy. However, sentiments can turn on a dime in the commodity markets, especially when central banks intervene to try and change the realities. On Oct 4th, Bernanke stopped the panic on Wall Street, when he strongly suggested to Congress that he would unleash the Fed’s nuclear option, “QE-3,” to inflate the stock market’s value. Over the next few days, the S&P-500 soared by +8%, and escaping the grasp of the grizzly Bear.

Still, the magnitude of the recent collapse in copper prices is very surprising, considering that the global demand for copper has increased by an average of +4% per year for the past 110-years. Furthermore, the size of the world’s population is increasing 80-million persons each year, thus placing even greater demands on the world’s resources. On June 22nd, Bank of Canada Governor Mark Carney highlighted this point, saying that populations in “China and India are increasing by the entire size of Canada’s population every year and a half. The middle class globally is growing at 70-million people a year, so just the marginal demand for these commodities is enormous and being driven by the major emerging markets. We see strength in commodity prices persisting for some time,” Carney said.

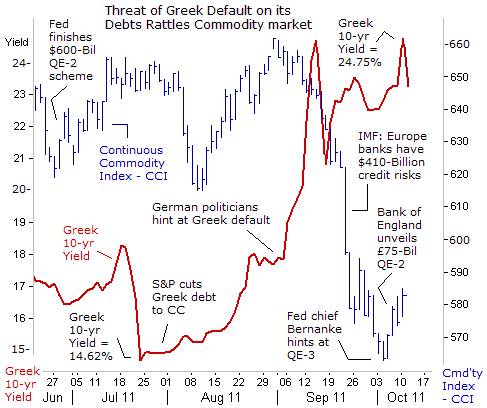

Yet three months later, the Continuous Commodity Index, a basket of 17-equally weighted commodities suddenly nosedived -15%, skidding to as low as the 560-level on October 5th, as traders dumped a wide array of commodities, including aluminum, corn, soybeans, sugar, silver, cocoa, nickel, natural gas, crude oil, coffee, and wheat. Of all the top commodities however, copper was the hardest hit. What compelled traders to dump this highly prized metal and other important commodities, in a panicked selling spree, when the reality is, there’s the inexorable increase in the world’s population background, that’ll boost demand, irrespective of the swings in the global business cycle?

As Albert Einstein used to say, “Reality is merely an illusion, albeit a persistent one.” Instead, traders were gripped by fear of Armageddon. The specter of a banking crisis in the Euro-zone was haunting frightened traders, after the interest rate on Greece’s 2-year note briefly soared to as high as 100-percent. Likewise, the yield on its 10-year bond jumped to 24.75%, knocking the price of the Greece’s 10-year bond to 36-cents per Euro. The odds are very high that Athens would default on its 357-billion Euros of debt, and based upon current prices, traders expect that the Euro-zone’s Oligarchic bankers would be forced to take a “haircut” of about 60% on their toxic holding of Greek bonds.

“Greece is bankrupt,” said Michael Fuchs, a deputy parliamentary floor leader for the Christian Democrats in the Bundestag, reflecting a growing mood of deep pessimism in Berlin. “Probably there is no other way for us other than to accept at least a 50% forgiveness of its debts,” Fuchs told the Rheinische Post newspaper. Hedge funds began dumping commodities, fearing that nervous bankers would call in margin loans, extended in ultra-cheap US-dollars.

The panic on the stock markets shows that if Greece defaults on its debts, it could trigger a deep recession in the Euro-zone, that’ll eventually spill over to the US-economy, which is already beset by stagnating growth and a high jobless rate. There are worries that companies would respond with new waves of layoffs, while Euro-zone governments are forced into further austerity, thus guaranteeing a “double-dip” recession.

The political elite of France and Germany have no choice but to bow to the demands of Europe’s banking Oligarchs, by placing a firewall around this “too-big-to-fail” cartel. Finance official and central bankers will deny the possibility that Athens would default on its debts, - until it actually happens! While buying some extra precious time, France and Germany are preparing the groundwork for an orderly restructuring of Greece’s debt by year end. The reality is, Europe’s banking Oligarchs would survive, but could end up as zombie banks.

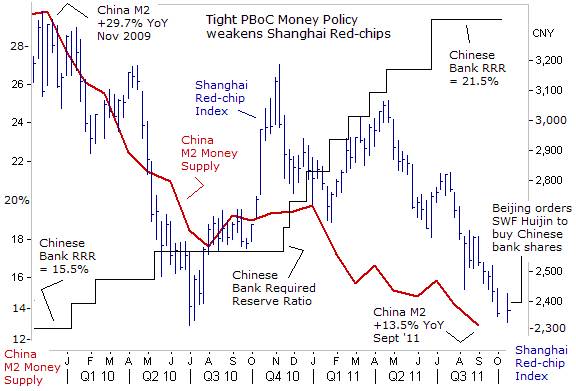

As far as the copper market is concerned, the radar screen is squarely focused on the outlook for juggernaut Chinese economy, which consumes about 40% of the world’s supply of refined copper. In fact, the growth in worldwide demand for copper has been driven by China, increasing by a stunning +215% over the past ten years, to a record 5.1-million tons in 2010. Recently, traders are becoming anxious about the unrelenting slide in the Shanghai red-chip index, which tumbled last week to its lowest level since July 2010, this conjuring-up the illusion of a so-called “hard landing” in the Chinese economy.

China’s economic engine helped propel the world out of the last recession, after Beijing unveiled a 4-trillion yuan ($570-billion) stimulus package, that kick-started its economy, and helped to catapult many commodities to record heights. However, the cylinders driving China’s economy appear to be slowing down. HSBC’s purchasing managers’ index was stuck at 49.9 in September, and staying submerged below the 50-mark for a third-consecutive month. That helped to knock commodity markets lower and fed fears that this time, the world’s #2 economic engine will not be able to overcome a downturn in the European and US-economies, while Japan has already been stuck in recession for the past nine months.

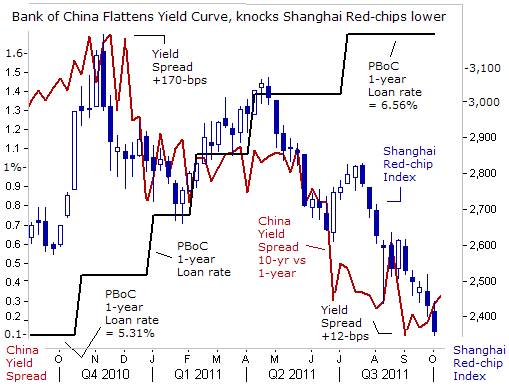

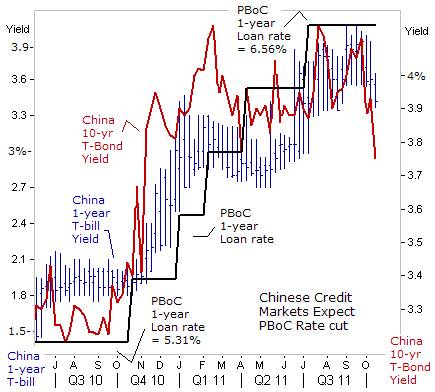

Beijing’s stimulus package unveiled in November 2008, left in its wake massive amounts of excess liquidity of yuan swirling in the economy that ultimately fueled an upward spiral in inflation. Combined with credit-fuelled growth, an increasing number of bad bank loans, and a inflating property bubble, Beijing was forced to tighten its monetary policy using its various macro-tools. For about 1-½-years, the People’s Bank of China (PBoC) has sold T-bills and hiked bank reserve requirements to drain excess liquidity, and manage to slow the growth of the M2 money supply. On July 6th, the PBoC lifted the benchmark one-year lending rate to 6.56%, and its benchmark one-year deposit rate to 3.50-percent. Beijing has also allowed the yuan to appreciate by +7.2% versus the US-dollar since June 2010.

Reflecting the success of the PBoC’s operations, the growth rate of China’s M2 money supply slowed to a +13.5% annualized rate in September, down sharply from +29.7% in November 2009. Much of the drainage of excess liquidity was accomplished by hiking banks’ reserve requirements to a record high of 21.5%, thus forcing banks to park more of their customer deposits at the central bank, and leaving less yuan available for lending. Furthermore, five quarter-point interest rate hikes, by the PBoC, flattened China’s yield curve to the brink of inversion. In late August, the yield on China’s 1-year T-bill rate and its 10-year bond was only 5-basis points apart, narrowing the spread from +170-bps a year ago,

The specter of a possible “Inverted” yield curve in Shanghai, coupled with the descent of the Shanghai red-chip market into Bear market territory, whipped-up fear mongering ideas that Beijing could miscalculate, by tightening its monetary policy too far, and possibly topple its juggernaut economy into a “hard landing.” It’s still unclear when such a long awaited correction would happen, or whether it’s just an illusion, that’s at odds with reality. On July 27 Xia Bin, an influential member of the PBoC, told the People’s Daily newspaper that monetary policy should stay relatively tight in the foreseeable future to help tackle inflation. “China should gradually make real bank deposit rates positive and continue to use open market operations and bank reserve requirements to slow money supply,” he said. Bin’s remarks spooked traders in both the Shanghai copper and red-chip markets.

After global stock markets fell to a 2-year low and the Euro tumbled to its weakest level against the Japanese yen in more than a decade on October 4th, as illusions of a Greek default moved closer to becoming a reality, the yield on China’s 1-year T-bill fell sharply, by a half-percent to 3.42%, while yields on the 10-year bond fell to 3.75-percent. The sharp drop in China’s T-bill rate, and the widening of the yield curve, sent a signal that Beijing would not cross the line into an inverted yield curve that could’ve weakened China’s economy.

Beijing also sent a strong signal to the marketplace, on October 10th, that it’s prepared to rescue the Shanghai red-chip market, and stop its slide, when it instructed the Central Huijin Investment Co, a unit of China’s sovereign wealth fund to start buying more shares in the country’s big banks. The additional share purchases of the Agricultural Bank of China 1288.HK, Industrial and Commercial Bank of China 1398.HK, China Construction Bank Corporation 0939.HK and Bank of China 3988.HK are the first by Central Huijin Investment since the fourth quarter of 2008, when the Politburo first officially acknowledged that it was intervening in the marketplace to prop up share prices during the financial crisis.

The initial reaction in the Shanghai red-chip market was surprisingly muted, surrendering an early +2.5% gain, to close unchanged for the day. However, the Hang Seng Index in Hong Kong managed to extend gains for a fourth day, closing at 18,141, but still hovering far below last November’s peak at the 25,000-level. Beijing aims to squeeze short sellers in Hong Kong, where 14% of all outstanding shares have been sold short by speculators. Any significant rebound in Chinese equity markets could buoy sentiment tin the base metals markets.

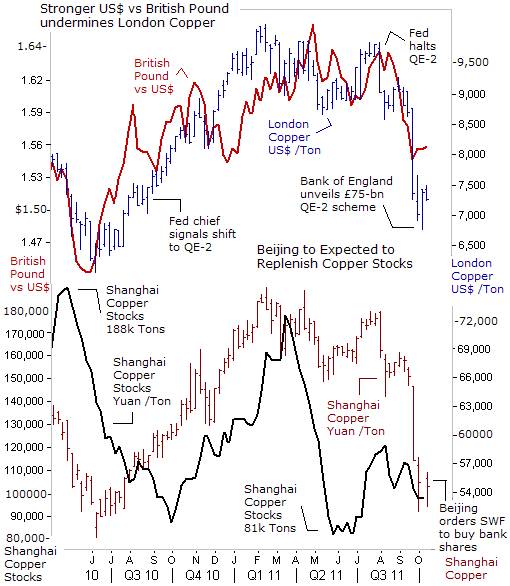

Another reason cited for the surprising -35% drop in copper prices to its lowest in 14-months, is the rebound in the value of the US-dollar, against a basket of six currencies. A strong US-dollar makes copper and other commodities more expensive for holders of other currencies. The British pound fell by nearly 12-cents versus the US-dollar to as low as $1.5270 on October 7th, after the Bank of England (BoE) decided to inject a further £75-billion into the London money markets in the months ahead. Thus, a suddenly resurgent US-dollar is mostly attributable to a destructive BoE policy aimed at weakening its own currency, while at the same time, the Fed has paused its own QE money printing operations.

The BoE decided not to wait to launch QE-2 until November or beyond, after hearing of grim figures that showed the British economy is in worse shape than previously thought. The Office for National Statistics (ONS) data showed the UK economy grew by just +0.1% in the second quarter of the year and +0.4% in the first quarter – slower than the 0.2 per cent and 0.5 per cent previously reported. The ONS also said the UK-economy shrank by -7.1% in the depths of the Great Recession – more than the -6.4% originally thought.

Yet the BoE’s main goal was to manipulate the British stock market, and prevent the Footsie-100 Index from falling below the key psychological 5,000-level. When the BoE succeeded in jigging-up the Footsie-100 and its companion FTSE-250 Index, it also helped to stabilize the copper market, finding support at the psychological $3 /pound level, before bouncing higher. For several weeks, currency traders were short selling the British pound vs the US$, in anticipation of QE-2 in London. As is often the case, traders decided to buyback short positions after hearing the news of QE-2. As the British pound rebounded towards $1.5650 - the copper market also jumped +10% higher to $3.36 /pound.

There’s also speculation that Chinese users of copper might decide to take advantage of the sharp drop in prices, by replenishing their depleted stockpiles. In the warehouses in Shanghai, the supply of copper has been whittled down to as low as 98,000-tons. With excess stocks now extremely low and assuming the illusion of hard landing in China, doesn’t materialize into reality then China’s purchases of the red-metal could increase. Last October, Chinese traders began to rebuild their inventories of copper, by doubling the size of their stockpiles to 180,000-tons, and helped to push-up the price of copper to above 72,000-yuan /ton.

Copper is the metal with a PH-D in Economics because it’s regarded as a leading indicator of the health of the global economy. It is used in the construction of buildings, power generation and transmission. Copper wiring and plumbing are integral in these items. By using copper for circuitry in silicon chips, microprocessors are able to operate at higher speeds, using less energy. From the beginning of civilization copper has been used by various societies to make coins for currency. In the US, one cent coins and five cent coins contain 2.5% and 75% copper, respectively. Euro coins, first introduced in 2002, also contain copper.

So generally speaking, the higher the price for copper, the more buoyant the global economy is thought to be. That’s why the recent fall off a cliff is perplexing. Usually at the beginning of a change in trend that the fundamentals do not explain or support what the market is doing. By the time the time the fundamentalists realize what’s changing, it’s often too late to profit. In other words, while the known fundamentals have already been discounted in the market, prices are now reacting to the unknown. Some of the most dramatic market movements in history have begun with little or no perceived change in the fundamentals.

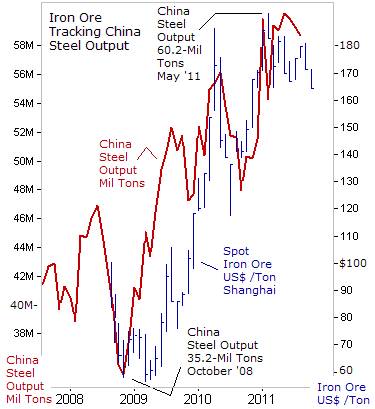

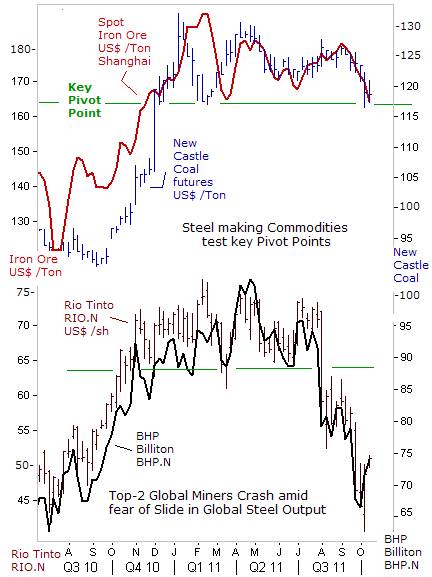

China is the world’s biggest buyer of iron ore -- a key steel-making material. The price of iron ore in the Chinese spot market has fallen by -13% from its peak level of $189 /ton reached in February 2011, and far less than the -35% drop in copper prices. Iron ore has not yet tumbled below its key pivot level of support seen at the $165 /ton level, distancing itself from the copper market, even though the two key industrial metals had closely traded in synchronization for the past few years. One reason perhaps, is that speculators cannot trade in the Chinese spot market for iron ore, and the supply of the iron ore is largely under the control of an Oligopoly of three major metal miners.

Iron ore accounts for 73% of Rio Tinto’s earnings, mostly extracted from the Pilbara region of Australia and also in Canada. BHP Billiton earns 40% of its profits from iron ore. Only Brazil’s Vale mines more iron ore each year. However, Rio Tinto aims to expand its iron ore output by +50% to 333-million tons a year by the first half of 2015, which is expected to cost $11-billion in capital spending. BHP Billiton is earmarking $10-billion of a planned $80-billion spending spree over the next five years to expand its iron ore and coal mining.

Chinese steel production continues to grow, expected to hit 680-million tons in 2011, up from 627-million tons in 2010, and 567-million tons in 2009. That’s 46% the world’s total output. In the 31-year time period through 2009, China’s economy grew an average +9% /year enabling it to become the world’s second largest economy. China’s steel industry, along with a number of other key industries such as the automotive, construction, textile, home appliances, and petrochemical industries are considered to be key barometers of its overall economy. Nearly 91% of the crude steel produced in China, comes from integrated mills, which use iron ore. More than half of the iron ore has to be imported.

China’s steel output hit an all-time record high of 60.25-million tons in May, but inched lower to 58.75-million tons in August. That was still +14% higher than a year earlier, but many traders are convinced that China’s steel output has reached a cycle peak. However, “What we’ve seen over the past five years is that China continues to climb a wall of worry. It continues to see concerns, but it grows past those concerns,” said Rio Tinto’s RIO.AX, RIO.N’s chief executive Tom Albanese said on October 11th.

China’s imports of iron ore in August totaled 59-million tons, up +8.3% higher compared with July, and up +32.5% from a year earlier. Yet index-based spot prices for iron ore fell -5% in September, skidding to $165 /ton today. “We continue to see robust business conditions for Rio Tinto products into China, particularly in iron ore. We would not foresee real significant changes in that demand profile in the next few months,” said Albanese.

The fear arising from the European debt crisis that shook the world’s commodity and stock markets this past summer, and slammed the copper market, don’t seem to reflect the realities of the “real economy” as the underlying demand for iron ore and coal remains strong. “My sense is that these expectations are gloomier than what’s actually taking place on the ground. From what I’m seeing, the actual real economy is doing better than the financial markets are worrying about,” Albanese added.

“The risks around Greece and the contagion beyond Greece are probably having a dampening on sentiment. I would just hope that the leaders, particularly in Europe, who are dealing immediately with the debt crisis in Greece, recognize that they themselves can influence expectations.” Albanese said last month that Rio’s order books were full and pricing was strong. “Since I made those comments in September, we haven’t seen that much of a change in sentiment or our underlying businesses. What we’ve been seeing in our business is that the general economy is going OK, even in the US,” he said.

Coking coal is also a key raw material in steelmaking. As a major coal mining country, China is the world’s leading miner of coke, with annual output of 3.3-billion tons, the largest in the world. China was a net exporter of coal until 2008, when its demand for coal to meet its energy and manufacturing needs outpaced the domestic supply. In 2009, China became a net importer of coal for the first time. It bought 104-million metric tons of coal, including both thermal coal - used to fire power plants for generating electricity, and coking coal.

Every ton of crude steel needs about 600-kilograms of coking coal, according to BHP, which forecasts demand for the fuel to gain more than +50% by 2025. China is not the only force driving up world coal demand. India’s rising coal needs, along with those of South Korea, and Taiwan are contributing to the upturn in demand. Indeed, world crude steel production in the first six months of 2011 was 758-million tons, or +7.6% higher compared with the same period of 2010, with all geographical areas showing signs of growth.

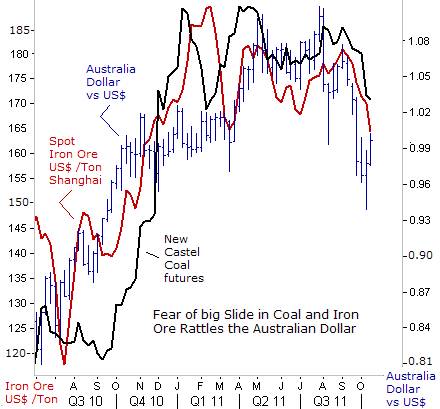

Yet the collapse in copper prices and the share prices of the world’s top-2 miners, BHP and Rio Tinto appear to be discounting a deep and troublesome global economic slump in the months ahead that might not occur. The deep seated sense of pessimism isn’t matched by the price of NewCastle coal or iron ore in the Chinese spot market. Instead, both commodities are still clinging to their key pivot points of support. New Castle thermal coal has limited losses, tumbling by just -10% below its peak level reached last January. Global steel mills including Baoshan Iron & Steel, China’s biggest publicly traded steelmaker, Sumitomo Metal Industries, Japan’s third-largest steelmaker, and India’s Tata Steel, would be happy to see coking coal and iron ore prices tumble further, in order to help lower their input costs.

Coal and iron ore are Australia’s top-2 export earners, and their price direction is a key driver for the Australian dollar. The boom in commodity prices fueled by the Fed’s $600-billion printing operation, dubbed QE-2, helped to lift many global commodities to record highs, and elevated the Aussie dollar to 29-year peaks at $1.1050. The Australian Bureau of Agricultural and Natural Resources is projecting $255-billion in annual commodity export earnings -- equal to a fifth of the country’s gross domestic product -- over the next four years.

Australian iron ore exports, the biggest earner, are forecast to jump +5% to 425-million tons in 2011, fuelled by a recovery in global demand from steel-makers, and could near 600-million tons by 2016. The main drivers will be the urbanization of China and India. Australia is uniquely blessed to benefit from a rise world steel production, that’s expected to grow +7% to 1.5-billion tons and +6% /year through 2016 to reach 2-billion tons. Australia’s exports of metallurgical coal, used to heat steel furnaces, are projected to grow at an average annual rate of +5% to reach 219-million tons in 2016.

Australia’s export prices in June were +10.5% higher than a year earlier, far outstripping import prices which were down -1% on the year. That pushed the ratio of export to import prices, to double the average for the whole of the 1990’s. The Reserve Bank of Australia (RBA) has estimated that for every year the terms of trade stays at such stratospheric levels, it is worth a staggering 15% of the country’s A$1.3-trillion of annual economic output. This A$200-billion in extra income shows up in profits, wage, and employment and is fuelling massive investment as miners scramble to meet demand from China and India.

Yet the income gains are very unbalanced, and actually have created more losers than winners. For example, BHP Billiton posted a $22-billion profit -- nearly a third of the total $71.4-billion profits reported by Australian companies. In fact, the state of Western Australia, with 10% of the population is earning about 60% of Australia’s foreign exchange. The other 90% of Australia is earning less than half the foreign exchange. Industries trying to win exports or fend off imports have shed 90,000 jobs in the past three months as they try to deal with the cost of the high Australian dollar, while miners reaped record profits.

Fears of a cyclical top in Australia’s top-2 export earners, coal and iron ore, have already led to a sharp slide in the value of the Australian dollar, to as low as 94-cents on October 4th. Yet the highly volatile Aussie dollar, - the symbol of global risk taking, rebounded back to parity with the US-dollar, after Fed chief Bernanke hinted at unleashing QE-3. For now, all eyes are focused on Europe, waiting for the crooked politicians to rescue the banking Oligarchs, because that’s a big part of what’s needed to turn the copper market upward.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2011 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.