Gold Supported by Geopolitical Risks in Middle East and China, Currency and Trade War

Commodities / Gold and Silver 2011 Oct 12, 2011 - 09:20 AM GMTBy: GoldCore

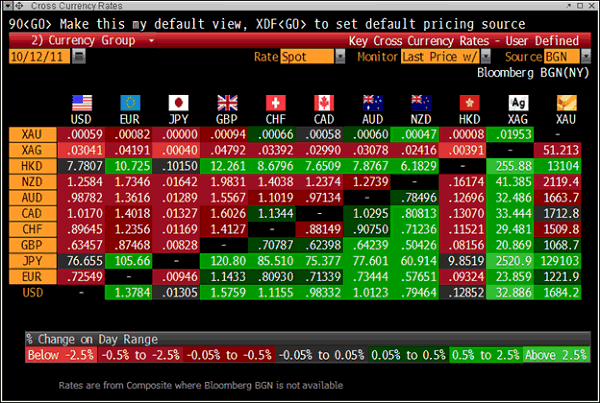

Gold is trading at USD 1,684.20, EUR 1,221.90, GBP 1,068.81, JPY 129,103.00, AUD 1,663.34 and CHF 1,509.80 per ounce.

Gold is trading at USD 1,684.20, EUR 1,221.90, GBP 1,068.81, JPY 129,103.00, AUD 1,663.34 and CHF 1,509.80 per ounce.

Gold’s London AM fix this morning was USD 1,687.00, GBP 1,070.36 and EUR 1,222.02 per ounce.

Yesterday’s AM fix was USD 1,662.00, GBP 1,064.09 and EUR 1,222.96 per ounce.

Cross Currency Table

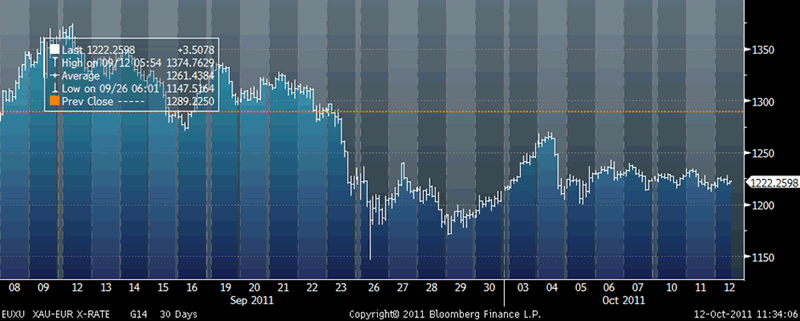

Gold has traded in a range between $1,580/oz and $1,680/oz for two weeks. Gold has broken out above the upper end of the range and resistance at $1,680/oz this morning. A close above $1,680/oz and rise to over $1,700/oz could result in gold quickly rising back to $1,800/oz.

Gold in US Dollars – 30 Day (Tick)

Support is at $1,600/oz, $1,580/oz and below that strong support is seen at the lows reached on September 26th of $1,532.70/oz.

Market participants are divided as to whether this is consolidation prior to a resumption of the bull market, whether a further sell off takes place or whether a bear market has commenced.

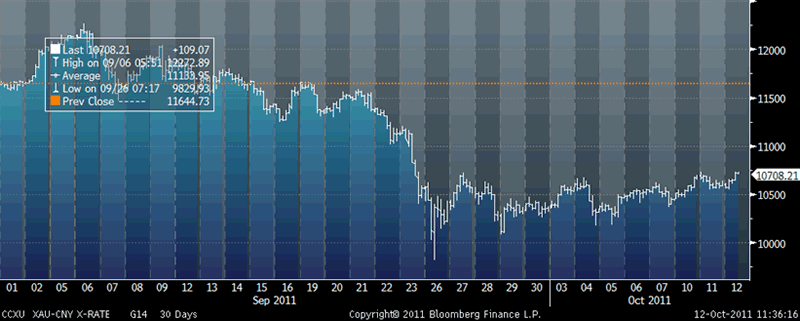

Strong physical demand being seen internationally, but especially in Asia, would suggest that gold may have bottomed and the bull market is set to continue in the traditionally strong autumn and winter months.

The fundamental factors that have driven the gold market in recent years - macroeconomic, monetary, systemic and geopolitical risk – also suggest gold’s bull market is set to continue.

Geopolitical risk is seen in the bizarre alleged plot by the Iranian revolutionary guard to use a purported Mexican drug dealer to assassinate Saudi Arabia's ambassador to the United States.

The Obama administration plans to leverage the incident into a new global campaign to further isolate the Islamic republic and maintain US dominance over the strategically vital region.

Gold in Euros – 30 Day (Tick)

The Middle East is already a tinder box on the brink of conflict over Iran's nuclear programme, with Israel increasingly twitchy over the progress Tehran is making towards an alleged capacity to make nuclear weapons.

A small spark such as this alleged plot and the reaction of the US, Iranian, Saudi and Israeli governments could result in military conflict in the region. Also, there are simmering geopolitical tensions between the US and the increasingly powerful Russia and China about the Middle East.

A military conflict would see oil and gold prices rise sharply due to supply concerns and safe haven demand respectively.

Geopolitical risk and the geopolitical instability in North Africa and the Middle East was one of the factors that led to gold’s rise in recent months and it is likely to remain an important driver of prices in the coming months.

Monetary risk remains and the Slovakian vote is another reminder of the real risk posed to the Eurozone and the euro through contagion.

Currency and macroeconomic risk is also seen in the Chinese warning to the US overnight that the US currency law risks a trade war and a 1930s style Depression.

Gold in Chinese Yuan – 30 Day (Tick)

Systemic risk remains heightened and Trichet acknowledged that yesterday with his warning that the crisis is ‘systemic’ and his warning that the high interconnectedness in the EU financial system has led to a rapidly rising risk of ‘significant contagion’.

European banks are on the verge of collapse and global debt markets risk a critical meltdown.

Finally, these risks are contributing to elevated macroeconomic risk and the significant risk of severe recessions in all major economies and the risk of a new Great Depression.

Gold remains an essential diversification that will protect from the real risks facing investors and savers today.

Those negative on gold and calling gold a bubble continue to focus almost exclusively on price.

A more enlightened approach for those genuinely concerned about people’s financial welfares would be to advocate a diversification into the safe haven asset and currency that is gold in order to protect against these real risks

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.