Gold Not in a Bubble, On Its Way to $10,000 an Ounce

Commodities / Gold and Silver 2011 Oct 12, 2011 - 03:48 AM GMTBy: Nick_Barisheff

"Gold is not a financial asset to be compared with dot-com stocks or Miami condos and it is not a commodity like pork bellies or crude oil. It is the ultimate currency for the truly sophisticated wealth holder in a time of substantial unreserved credit promotion." ~ Paul Brodsky (Fund Manager)

"Gold is not a financial asset to be compared with dot-com stocks or Miami condos and it is not a commodity like pork bellies or crude oil. It is the ultimate currency for the truly sophisticated wealth holder in a time of substantial unreserved credit promotion." ~ Paul Brodsky (Fund Manager)

The recent correction in gold has once again led, to financial commentators warning of a bubble--just as they have incessantly since it first passed $400 an ounce. A bubble usually ends with day after day of speculative higher highs, not corrections like we have just seen or as we saw in August where a $200 fall was followed by the resumption of its decade long rise That gold continues to climb a wall of worry, and that so many are even calling it a bubble, is actually an extremely bullish indicator since financial bubbles burst only after sustained periods of exuberance. We are far from the days when people lined up for blocks each day to buy gold, as they did in Toronto in 1980.

A simple rebuttal, however, is never enough when discussing gold. It will continue to be subjected to the most aggressive "perception management" assault of any asset class, because it is a direct challenge to all the world's fiat currencies. Since no paper currency is convertible to gold at this time, this is some challenge. The warnings of bubbles and the many other reasons for not owning gold will continue unabated as gold persists to $10,000 an ounce, or higher. Independent study of the underlying causes of gold's rising price, in my opinion, is the best way to gain sufficient confidence to buy and hold gold long enough to protect one's wealth through the turbulent years ahead.

This is the premise of my upcoming book, $10,000 Gold--Why it will get there sooner than you may expect. In this article, we will look at three of the most significant reasons why gold is not in a bubble and will continue rising in value for years to come.

There are two ways of looking at gold. The first is the Western way, viewing gold through the lens of fiat currency training. This approach sees gold as a wealth-gaining asset that can be traded like any other asset class or commodity for currency gains. The second way is how the world's major gold buyers at this time see gold. The Chinese, Indians and Middle Easterners see gold as a wealth-preserving asset that serves the purpose of money. The second group will ultimately be responsible for driving gold into the five-digit range. Many of these people have had direct experience of the damage to one's wealth a currency crisis can cause. The most aggressive buyers, the Chinese, experienced 4,000 percent inflation per month between 1947 and 1949.

If gold were a commodity it would be in a bubble, but it is not. Gold has been money for over 3,000 years, and still is today. Although never officially recognized as such, gold trades on the currency desks of all the banks and brokerages, and is held by central banks. Since 2009, central banks have become net buyers of gold. Pension fund manager Shane McGuire makes the point in his book, Hard Money: Taking Gold to a Higher Investment Level , that gold and silver are really the newest asset class, not the oldest, since until 40 years ago they were money. Many readers will remember a time when silver dollars were exchanged in stores at face value.

To step outside a fiat mindset, we encourage our clients to think in terms of ounces of gold rather than dollars--a task that is much easier to do when one owns gold. We encourage them to ask questions like, "What is the risk in ounces of an investment?" and "How many ounces can I expect to gain in return?"

This perspective gives us the single most important insight into gold's true behaviour, as it tells us that gold is not rising in value--currencies are losing value against gold. This means that gold, as money, can appear to rise in value as far as currencies can fall. In light of this, we can look at three features of gold's rise that tell us it is not only not in a bubble, but unless current monetary policy is drastically changed, it will almost certainly rise to $10,000 an ounce and beyond.

These features are:

- The loss of purchasing power of global currencies

- The inflationary effects of money creation

- Irreversible trends will continue to cause gold to rise

1. Loss of Purchasing Power

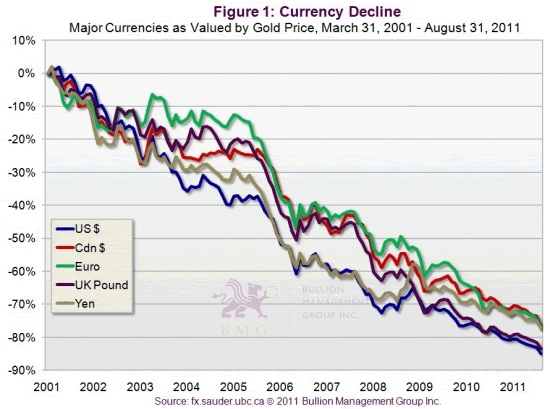

A basket of goods that cost $100 in 1800 would have cost $102 in 1900. During this time, the dollar was pegged to gold. Today that same basket would cost over $4,000. This is what we mean by loss of purchasing power. Over the past decade, the Canadian dollar, the euro and the Japanese yen have lost over 70 percent of their purchasing power against gold (Figure 1). The US dollar and the British pound have lost over 80 percent.

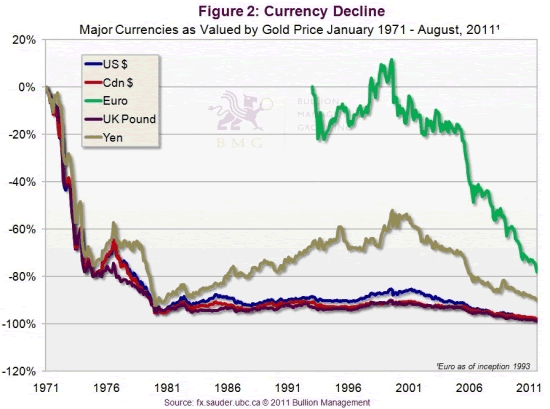

The next chart (Figure 2) takes a longer view. It shows how the same currencies, including the venerable Swiss franc, have performed against gold since President Nixon closed the gold window in 1971.

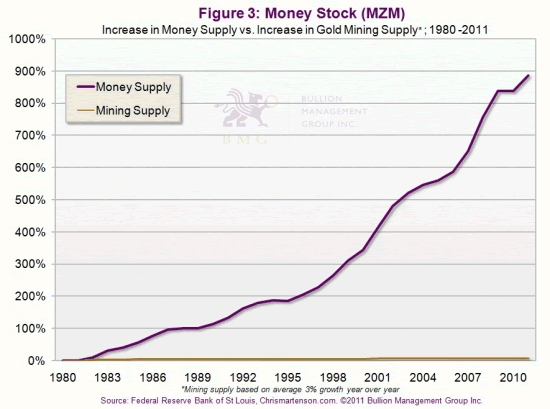

What is the cause of this loss of purchasing power, and will it continue? Currencies lose purchasing power against gold for one simple reason: Currency supplies are expanding faster than gold supplies. Bullion is the one form of money governments cannot artificially multiply. Since 1980, above-ground gold bullion supplies have risen, on average, about 3 percent per year. We can see in the next chart (Figure 3) a comparison with the much more rapid rate of currency creation provided by MZM, one of the most reliable indicators of currency supply.

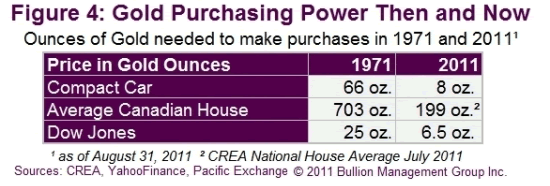

Another way to understand this loss of purchasing power is by looking at the number of ounces it would have taken at different periods to buy a house, a car or the Dow. In 1971, an average car cost 66 ounces of gold; an average house cost 703 ounces of gold and the Dow cost 25 ounces of gold. Today, 66 ounces of gold would buy nearly four cars, 703 ounces of gold would buy two houses and only 6.5 ounces of gold would be needed to buy the Dow (Figure 4).

2. The inflationary effects of currency creation

In 1983 Webster's Dictionary defined inflation as:

"Inflation is an increase in the amount of money, resulting in a fall in its value and a rise in prices of goods and services."

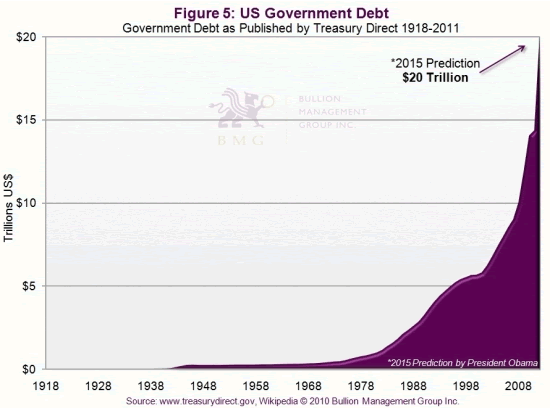

Since the presidency of Bill Clinton, government Consumer Price Index (CPI) reports have moved from being a fixed measure of a standard of living to a flexible measure of a standard of living. Through a variety of machinations such as hedonic regression and substitution (if steak becomes too expensive, remove it and substitute with hamburger), these measures grossly understate true inflation. Currency debasement (a term derived from the Roman practice of hollowing out gold and silver coins and filling them with base metals), leads directly to inflation. In the few dozen hyperinflations that have occurred throughout history, all have been the direct result of governments attempting to compensate for slowing growth through currency creation, which is exactly what we see happening today. Figure 5 shows that this currency creation has already turned exponential.

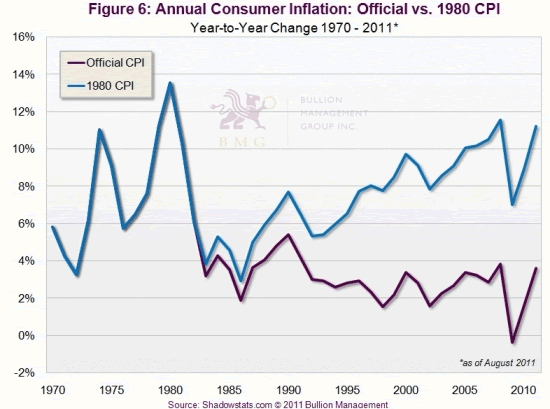

Fortunately, one economist, John Williams of ShadowStats (Figure 6) continues to track the original basket of goods governments used to track inflation prior to the early 1990s. His data shows inflation running at a much higher rate than is publicly acknowledged. His CPI is at 12 percent, over eight points higher than the "official" inflation reports.

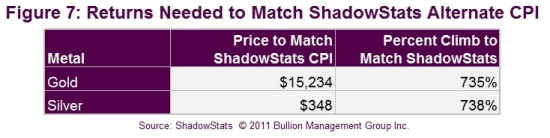

Eventually, we will have to admit the truth about inflation, the truth that anyone who eats, drives or sends their children to college already knows. Figure 7 shows what gold and silver would trade at if we were to accept Mr. Williams' CPI numbers.

3. Irreversible Trends Will Continue to Cause Gold to Rise

Finally, there are many independent trends that are having a direct impact on the price of gold. The most prominent are central bank buying, Chinese and Indian buying, the movement away from the US dollar, peak gold and under-investment in gold by pension funds.

Central banks were net sellers for nearly two decades until 2009, when they officially became net buyers. We can expect this trend to last two decades as well. During the gold "bull" market of the late 1970s, the Chinese public was not allowed to own gold. Today, their government encourages gold ownership, and has even made several significant innovations to facilitate this goal. The Chinese government has also led by example, with China's central bank publicly stating it would like to increase its reserves from 1,100 to 6,000 tonnes. Unofficially, they have stated a target of 10,000 tonnes.

There can be little doubt that a race to exit the dollar is underway, as governments feel the US has no choice but to continue debasing their currency just to meet existing obligations. Peak gold, like peak oil, occurs when gold miners fail to increase production or discovery despite the rising price of the underlying commodity. Gold production has fallen since 2005, and is only slightly higher in 2010. To quote a recent exhaustive Standard Chartered Bank report:

"In our study of 375 global gold mines and projects, we note that after 10 years of a bull market, the gold mining industry has done little to bring on new supply. Our base-case scenario puts gold production growth at only 3.6 percent CAGR over the next five years ."

With pension funds holding less than 1.5 percent of their assets under management (AUM) in gold bullion, they will have little choice but to increase their position as gold continues to outperform all other asset classes.

These trends are significant, but they are all capable of being changed, however unlikely that may be. What cannot be changed are the "irreversible trends." These have an indirect impact on the price of gold; they are causing growth to slow, and are therefore creating the need for governments to compensate through ever-increasing currency creation.

Three of the most significant "irreversible" trends are:

- The aging population

- Outsourcing

- Peak oil

The largest population sector, the baby boomers, are starting to retire, and living longer than any previous generation. Their demands, which previously fuelled growth in the global economy, will reverse. They will downsize, reduce spending, liquidate investments and draw down on pension funds, social security and medical benefits. This will reduce GDP, increase unemployment, reduce government revenues, increase budget deficits and require even greater currency creation. This will reduce confidence, further debase currencies and result in increasing gold prices.

With the advent of globalization and outsourcing, politicians and multi-national corporations have let the genie out of the bottle; this has resulted in the decimation of the manufacturing base in Western economies. This will manifest as systemically high unemployment, reduced GDP, higher government deficits and further currency debasement. Again, this will lead to higher gold prices.

In September 2010, a German military think tank reported the German government was taking the threat of peak oil seriously and preparing accordingly. Numerous studies around the world have concluded that we are very close to peak oil production, which will be accelerated due to Gulf drilling bans. This will lead to higher price inflation for most goods, reduced GDP, higher trade deficits, and higher budget deficits. More monetization will result, thereby debasing currencies. Higher price inflation together with further currency debasement will again be a driver for higher gold prices.

Like a spinning top must continue spinning or fall, our modern economic debt-based fiat system depends on perpetual growth. It is disturbingly similar to a classic Ponzi scheme, which requires new borrowers to bring currency into existence that can be used to pay the interest on the previous loans. The greatest threat to its health is slowing growth or deflation. With interest rates near zero, central banks have only one tool left to combat slowing growth--currency creation, which means inflation. These irreversible trends, therefore, virtually ensure gold will continue rising in value for years to come.

In conclusion, I know many readers are hesitant to buy as they feel they have "missed the boat." Perhaps this Chinese proverb will help:

The best time to plant a tree is twenty years ago. The second best time is today.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2011 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.