Start Of A Secondary Reaction In A Stocks Bear Market

Stock-Markets / Stock Markets 2011 Oct 10, 2011 - 02:10 AM GMTBy: Andre_Gratian

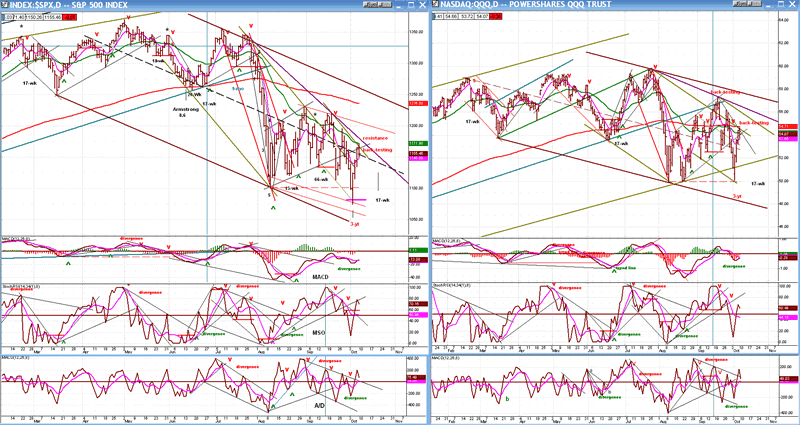

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline (which appears to have already started) into 2014.

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline (which appears to have already started) into 2014.

SPX: Intermediate trend - An intermediate uptrend has begun.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

Here is what I wrote in my last newsletter: "The SPX made a double-top at 1220 that created a pattern on the Point & Figure chart from which we can estimate the extent of the decline by taking a count across the 1195 line. We come up with two well-defined targets: One to 1080, and the other to 1040. These are closely correlated by Fibonacci projections. With the 3-yr cycle low about a week away, we could not ask for better conditions to predict the intermediate low."

The SPX made its low on Tuesday 10/4 at 1074.77, and has not looked back since! It closed out the week at 1155.46 after reaching a high of 1171 on Friday.

On Thursday, I sent the following update to subscribers:

From: Andre Gratian Sent: Thursday, October 06, 2011 9:07 AM Subject: Market update

...Right now, there is no weakness showing in the indices except for some negative divergence in the QQQ A/D. Looking a little bit ahead, the indices will undoubtedly be influenced by tomorrow's job report. If it is taken positively, the SPX could easily overrun its 1164 projection. A P&F pattern which was made by the recent action suggests a potential of 1173. Anything is possible on the upside until we get a sell signal. For the first time since the low, today the A/D is keeping up with the price. Late comers indicative of a top? Or is the big money beginning to take this rally seriously?

(I will let the two quotes above speak for themselves about the quality of the information that is dispensed to subscribers.)

What now? It looks as if, after the SPX reached its projection on Friday, the indices are beginning to form a short-term top. As of the close there was still no sell signal but plenty of warning in the indicators, as we will see when we look at the charts.

The action of the market last week confirms the view that we have started a counter-trend rally in the bear market that started in May for the SPX, and July for the QQQ. I don't have a specific target for the top of this move, but 1215 (a 50% retracement) and perhaps 1248 (.618 retracement) are good bets. I will try to be more precise after the Point & Figure pattern has progressed enough to warrant a projection.

Let's look at charts!

Chart analysis

Last week we looked at the long-term chart ,and this gave us an idea of what the SPX is likely to do over the next three years. (If you want to review it, go to my website www.marketurningpoints.com click on "Newsletters", and select the one for October 2, 2011). We'll now analyze the Daily Chart and show why we are likely to get a correction from this level.

The indicators have all given preliminary buy signals. They have crossed lines, moved above their previous peaks, and broken downtrend lines. But it's easy to see why this phase of the rally could come to an end. The SPX and the QQQ are both back-testing previous uptrend lines and running into downtrend lines and moving averages. They also remain below their main downtrend line drawn from the July top and therefore are, technically, still in a downtrend. In addition, there is a 17-wk cycle which is scheduled to make its low around the week of October 17. Just as the 3-year cycle marked the bottom of the intermediate downtrend, the 17-wk cycle may mark the bottom of the correction which is just starting.

How much of a pull-back? A .382 retracement of the current rally would take the index back down to about 1134, and a 50% retracement to 1123. If the short-term top has been completed and we start down on Monday, the P&F chart gives us a potential projection to 1125, which is close enough to the 50% retracement. Should we get more sustained weakness, there is a lower projection to 1113 which would correspond to a Fibonacci retracement of .618 (1111) of the rally.

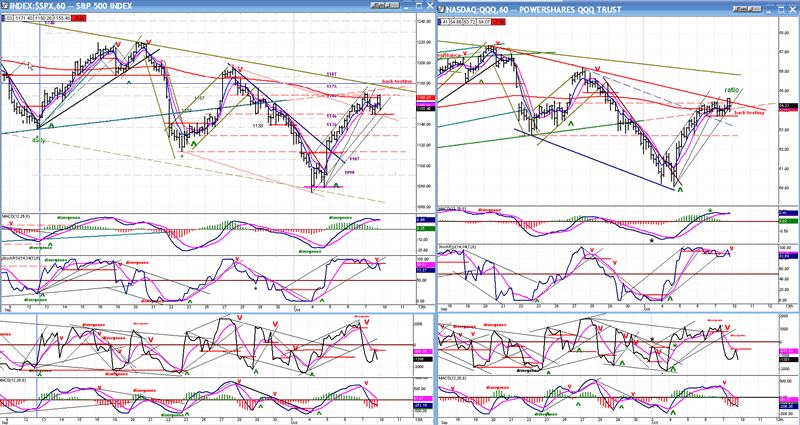

Now, let's take a look at the Hourly Chart so we can see how far along the short-term top formation has progressed.

It is evident in this time frame also that the rally has reached some serious resistance. The indices are up against their 200-hr MAs, some downtrend lines, and they are back-testing uptrend lines. The result is some hesitation (profit-taking) in the uptrend after it reached its SPX projection. This is probably a precursor to a pull-back.

The loss of upside momentum shows even more in the indicators. The A/D oscillators (bottom) are already in established downtrends, and the MSO is just getting started after remaining 100% overbought for several days. Its normal pattern is to retrace all the way down to its 0% valuation before turning up again. While it is declining, the price will also retrace, probably to one of the projections given above. Moving from overbought to oversold within the prevailing time frame is a normal cyclical action of the stock market.

The daily indicators, by contrast, are just getting started on the upside, so it's likely that we'll have reached higher prices by the time they get to the tops of their ranges. A good chunk of the entire reversing process has already been spent in last week's powerful rally, but traders should get a second chance when the correction pulls prices back down to a more favorable entry level.

Cycles

I've been talking about the 3-yr cycle ad nauseam for the past few weeks. I promise not to mention it again for another 3 years. We'll now shift our attention to the 17-wk cycle which is due in a couple of weeks. Its effects will be minimal by comparison, but it could signal the end of the correction which is in the process of getting started. We don't know that for sure, but we also have price projections to guide us. If the SPX happens to have reached one of those around that date, you'll know what it means.

Breadth

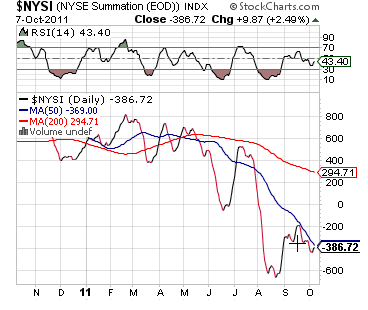

This is an updated chart of the NYSE Summation Index (courtesy of StockCharts.com) Last week I wrote: "It is not likely that it will make it back down to the August low before turning up again while the market makes its final low, setting up the positive divergence typical of a low of an intermediate nature."

Well, it did not, and it has turned up, but imperceptibly, which gives you an idea of the strength (or lack of it) which underpins this market rally. So now I can add to the above statement: "when it does turn up, since it will do so in a bear market rally, I would not expect for it to make it back to the previous tops before it turns down again as the bear trend resumes."

Sentiment

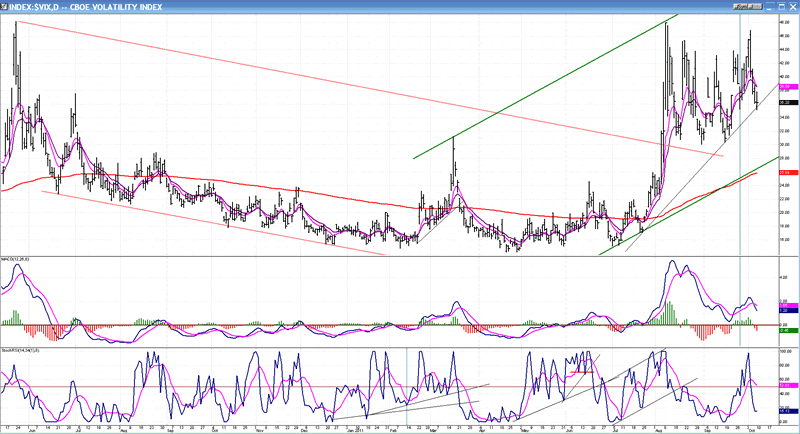

It is easy to see that the VIX is in a solid uptrend, and if it is supposed to move opposite to the SPX, this means that the SPX must be in a solid downtrend, or a bear market. In order for this to reverse, the VIX would have to drop below the 30 level, and then break out of the green channel on the downside, while starting to trade below its 200-DMA. It's pretty clear that none of this is about to happen. We can therefore surmise that until it does, the equity indices will remain in a bear phase.

Its counter-trend move to the SPX is a useful tendency of the VIX. Another is that one can also time the bottoms of intermediate corrections with the divergence that the VIX displays. Note that when the SPX made a new low at 1075, the VIX remained well below its earlier peak. This shows up even more clearly in the secondary peak of the MACD.

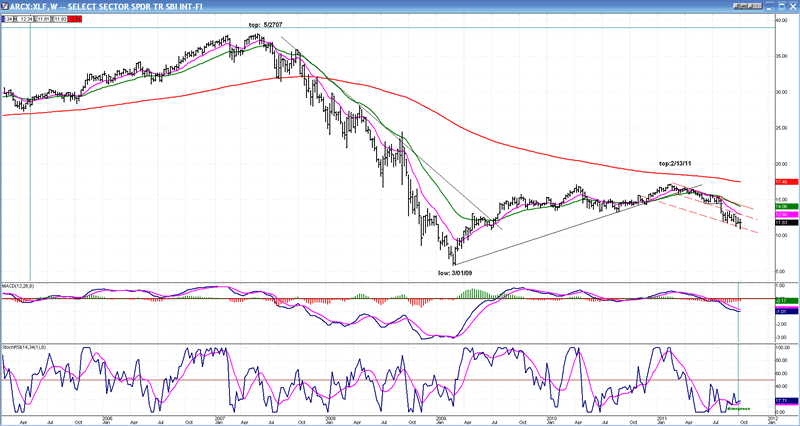

Last week, we looked at an economic leading indicator: Copper. We concluded that it is portending a weakening economy. This week, we'll look at a leading indicator of a different nature, but equally -- if not more - predictive of the health of the stock market. It appears to have a propensity for advertising the major turns in the stock market well ahead of time. It's the XLF, the Financial Select Sector SPDR (ETF), which is listed on the NYSE.

To begin, let's look at the overall pattern that the index has made since the 2007 top. Can you find the bull market which started in 2009? It's hard to speak of that consolidation in a long-term downtrend as a bull market, isn't it? That, in itself, should have alerted us that we had started a secular bear market in 2007, and had only completed the A wave in 2009.

Now, look at the long-term timing that this index affords! In 2009, it made its low only one week before the SPX, hardly anything to shout about. But the advance notice that it gives at the tops is remarkable. In 2007, the XLF made its top in May, a full five months before the SPX. And again this year, it topped in January and broke below its intermediate trend line on 4/1, giving plenty of notice that the "bull" market was over.

There was no warning for the reversal which took place last week, which probably means that, in the larger framework, it is not very important. The chart shows that the index is trending in a well-defined down channel and trading predominantly it its lower half -- a continuing sign of weakness which is enhanced by the fact that, in contrast to the SPX, it has already broken well below its July 2010 consolidation pattern.

All in all, it seems to be warning us that an end to the long-term trend is nowhere in sight.

Summary

The SPX appears to have made an intermediate term low at the time and price level that was projected. This reversal should offer a relief of several weeks from the bear market and, unless we see some exceptional strength return, this is only a temporary reprieve. By making a new low last week, the index has pretty much confirmed that it has resumed its secular bear trend which is likely to last until 2014.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.