Netflix: What Not To Wear At The High Stake Tech Party

Companies / Tech Stocks Oct 10, 2011 - 02:03 AM GMTBy: EconMatters

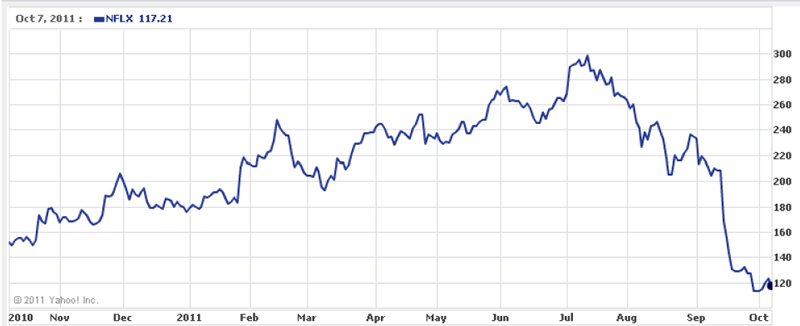

The stock price of Netflix Inc. (NFLX) has plunged 61% to its lowest level since the high of $298.70 reached on July 13 from a myriad of reasons. (See Chart Below)

The stock price of Netflix Inc. (NFLX) has plunged 61% to its lowest level since the high of $298.70 reached on July 13 from a myriad of reasons. (See Chart Below)

|

| Chart Source: Yahoo Finance |

Netflix tried to salvage the situation via a blog post by its CEO and Co-founder Reed Hastings openly apologizing that "I messed up and owe everyone an explanation". However, the so-called apology blog lacks substance, and the damage has already done. According to Reuters,

"Subscribers didn’t shy away from letting Hastings hear their displeasure, weighing in on the company’s blog with over 15,200 comments, the bulk of them overwhelmingly negative."

We think to some Netflix subscribers, the separation of DVD and streaming, and the rate increase are somewhat (barely) tolerable considering none of the others like Blockbusters or Amazon can match Netflix streaming content library at the moment. However, even with that advantage over rival services, Netflix streaming library still pales in comparison to the DVD selections, as many popular (new and classic) movies are only available in the disc format.

Blockbusters, meanwhile, boasts a similarly vast DVD library with movie studio deals to get many new DVD releases 28 days before Netflix to boot. So until Netflix's streaming library comes close to the depth of DVD's, it is presumptuous as well as arrogant on the part of Netflix management to think customers would automatically flock to the streaming service of Netflix simply due to its new pricing structure.

Then the last straw came when Netflix decided to spin off the DVD business into a separate company called Quikster, which means subscribers will need to manage their queues on two different web sties, and two separate monthly bills. This not only further infuriated Netflix subscribers, also left analysts at a loss. We get the symbolic significance of setting the company apart from the brick and mortar DVD operation. Nevertheless, we fail to see a real business case of a DVD unit operating under a different name and web site that'd serve only to further alienate the current DVD subscriber base of about 14 million.

This "Quikster move" not only seems to suggest a message that Netflix does not value DVD customers, but also looks like at least in part another concerted effort by Netflix to "encourage" customers to the streaming service where the company sees as the future.

From a strategy execution standpoint, there are many other much more subtle marketing, promotional and phased-in price increase tactics to achieve the same goal of migrating subscribers without looking like a bully. In the end, that kind of strong-arm "migration" approach would only lead to more subscriber losses while giving Blockbusters the perfect opportunity to have its "revenge campaign" after basically being driven into bankruptcy by Netflix.

Moreover, we also believe Netflix appears to have overestimated its branding power and customer loyalty. After all, Netflix is no Apple which has carved out a niche within the consumer digital products sector with high branding and an ecosystem to foster customer loyalty or just for the hip factor.

But the entertainment content business is fairly generic, where consumers essentially look for the best service and price combination. Netflix used to be the leader in that combo of service and pricing, but it has now lost that differentiation which has made the company successful in the first place, and it'd be just a matter of time before Amazon, Microsoft, or Apple (AAPL) would come up with a superior offer to completely replace Netflix.

Last but not least, there are multiple headwinds from increasing costs and rivals suggesting this is not yet the end of the stock price tumble.

On the cost structure side, Netflix is under pressure from Hollywood studios and pay-TV rivals, not to mention cable companies no doubt are looking to end Netlix free ride on their high-capital-cost broadband network.

On the competitive front, rivals Amazon.com (AMZN) and Microsoft Corp. (MSFT) have already unveiled competing products. Amazon has its own video stream service to work with its new Kindle Fire tablet, while Microsoft plans to offer online pay television service from Comcast Corp. (CMCSA) and Verizon (VZ) through its Xbox Live streaming service.

The hottest speculation right now is that by launching Kindle Fire, Amazon looks set to acquire Netflix. If a deal could be reached for Amazon to acquire Netflix, Amazon would instantly become the sector's leader, and Netflix stocks could get a bump as a result. Otherwise, there do not seem to be many near term catalysts to bring Netflix stock back into swing of things.

In the past year or so, we have repeatedly warned investors, even when the stock was killing all the shorts and seemingly unstoppable, to take profits off the table when possible, and identified Netflix as one of the five stocks due for a pullback in 2011. And this recent bungle and arrogance of Netflix, as discussed herein, has also left us to question the company executive's leadership and management capability.

So the bottom line is that we have not seen much to alter our view that Netflix is a pure momentum stock with a not-so-differentiable business model in the über competitive tech and digital entertainment sector. When the stock momentum is lost like it is now, look out below.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.