Own U.S. Treasury Bonds or Gold and Silver?

Commodities / Gold and Silver 2011 Oct 09, 2011 - 09:07 AM GMTBy: George_Maniere

The drop in price of gold and silver is because they are considered to be in a bubble. In my opinion a bubble is when the underlying asset trades in high volumes at prices that are inflated to their true values. There are economists that assert that asset prices often deviate from their intrinsic values. Because it is often difficult to determine what the intrinsic value of an asset is bubbles are often seen in retrospect like when sudden drops in prices appear. They are seen as a crash or a bubble burst. It is important to recognize that prices of a bubble can fluctuate erratically and make it impossible to predict from supply and demand alone.

The drop in price of gold and silver is because they are considered to be in a bubble. In my opinion a bubble is when the underlying asset trades in high volumes at prices that are inflated to their true values. There are economists that assert that asset prices often deviate from their intrinsic values. Because it is often difficult to determine what the intrinsic value of an asset is bubbles are often seen in retrospect like when sudden drops in prices appear. They are seen as a crash or a bubble burst. It is important to recognize that prices of a bubble can fluctuate erratically and make it impossible to predict from supply and demand alone.

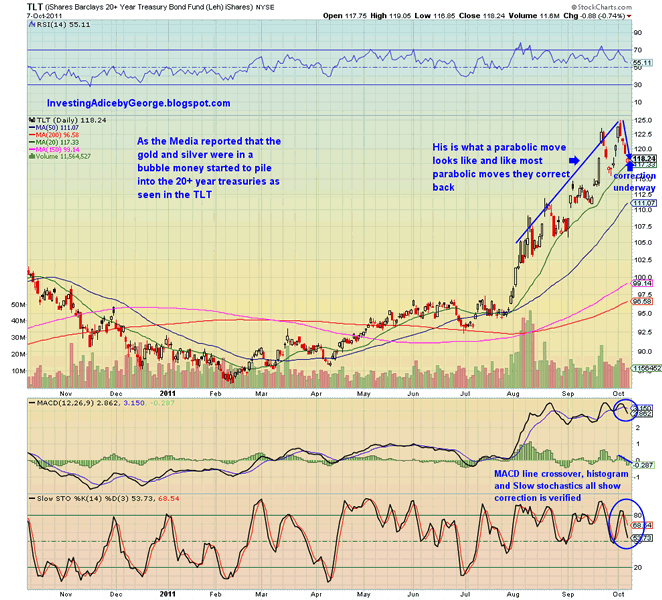

The new safe havens are perceived as the dollar and US Treasuries. To prove this point the media points to that fact that gold and silver have sold off. They pointed to the strengthening of the dollar and reported that the safe haven was US Treasuries. Please see the chart of the TLT below.

As we can see on this chart the treasuries ran up from August to October as the dollar grew stronger. However what the media failed to mention is that the United States is bankrupt! Imagine investing in US debt for 30 years. It reminds me of the old cartoon where the guy says I will gladly pay you for a hamburger next Tuesday for one today. As if he ever had any intention of paying for it in the first place. Investing in 30 year Treasuries is the ultimate bubble.

I admit it. I have been a gold and silver bug since I was 8 years old. As far as I know I’m the only 13 year old that asked for a double eagle for my birthday present. You should have seen the look on my dad’s face when I came out with that. Back then it was a hobby and my grandma taught me the love of numismatics. Now it’s serious business.

There are too many very smart people who couldn’t care less about gold and silver. Who am I to say they’re wrong? They chose to invest in high yielding, large cap stocks and are content to trade their positions (buy on the dips and sell on the rips) and collect their yields while they wait. In all honesty, half my portfolio is a diversified collection of these stocks. The other half however is more risky. I like SPXU and UPRO, which are plays on the S&P.

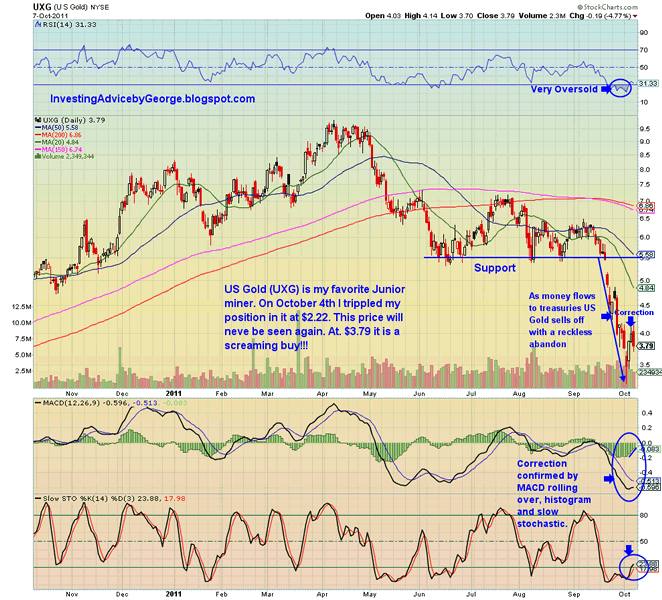

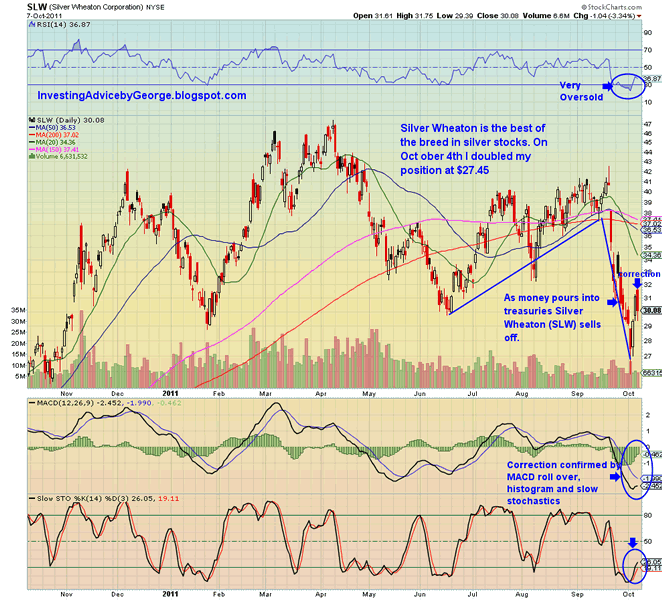

I like the gold and silver trade. My favorite junior miner is US Gold (UXG) and while the sheep were herded into the US treasuries thanks to the talking heads, I was buying US Gold (UXG) at @.$2.22 a share and my favorite silver stock Silver Wheaton b(SLW) at $27.45 a share. Please see these two charts below and notice how they correlate to the run up in the TLT.

Please take note that as TLT hit its highs UXG hit extreme lows. Please see chart of SLW below.

Again, please take note that as TLT hit its highs SLW hit its extreme lows.

In conclusion, the treasuries have been very strong in the last few weeks but it won’t last. The dollar which has been beaten down has for a short bright shining moment it had its day in the sun as it was the best house on the worst block. Compared to the imminent Greek default, the contagion in Europe, the global economic slowdown and the tepid economic conditions here in the treasuries are on the way back down. Let us not forget that no matter what may come out of the mouths of the politicians a key to this administration is to keep the dollar low. This is the only way we will be able to pay off the staggering debt we have amassed. A dollar that is worth 70% of what we borrowed makes it 30% easier to pay back the debt. This will not stop. The debasement of the currency will continue.

After gold’s parabolic move it is healthy for a stock to pull back before it begins its move up again. My expectation is for gold to rise to a minimum of $2000.00 by the end of the year and if we use the generous historic ratio of gold to silver of 50 to 1 silver will be $50.00 by the year’s end.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.