Stock Market Breaking Down The Bullish Argument

Stock-Markets / Stock Markets 2011 Oct 09, 2011 - 02:33 AM GMTBy: Tony_Pallotta

Equity bulls have found solace in the abnormally high bearish sentiment readings. Seems everyone wants to be considered a contrarian. Rather than follow the herd these free thinkers venture out into the cold dark tundra alone and unafraid. They proclaim to the world "huge bearish sentiment to propel the stock market rally."

Equity bulls have found solace in the abnormally high bearish sentiment readings. Seems everyone wants to be considered a contrarian. Rather than follow the herd these free thinkers venture out into the cold dark tundra alone and unafraid. They proclaim to the world "huge bearish sentiment to propel the stock market rally."

The great omen of Wall Street is to fade the herd and where better to find their direction than a simple sentiment survey. When it says go east they go west. When it says to ying, they yang. The American Association of Individual Investors declares this survey to be the true contrarian indicator.

"History shows us that more times than not the market will go against the majority. Extremely bullish levels of sentiment often come after strong market run-ups when investors are fully invested in the market. Even if they are bullish about the future, they have limited additional resources to invest. By following market sentiment indicators, you may be able to pick out market tops and bottoms. In other words, investor sentiment may be used as a contrarian indicator for the overall market."

Who to argue with history and years of precedence. Surely a simple analysis of the data will substantiate this modern day folklore? Or will it?

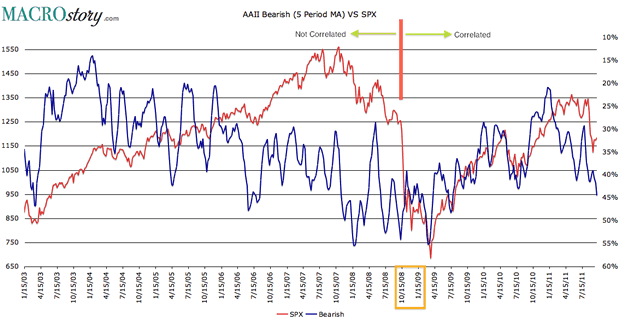

AAII Percent Bearish VS SPX

The historical analysis below shows something odd happening in late 2008? Investors went from contrarian indicators to actual leading indicators. Don't believe it? Look at the data and decide for yourself.

Something that correlated poorly although inversely now as of 2008 correlates very tight and no longer contrarian. One can speculate why the change but one cannot deny how rising bearish sentiment can no longer be considered contrarian.

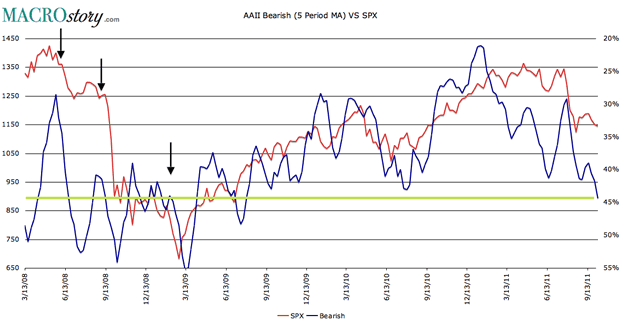

Go Long Stocks At High Bearish Levels

The data also refutes this adage. Just because bearish sentiment is at high levels does not mean you go long. Just look at the data below. If you bought because bearish readings were close to current levels of 45% you would have suffered some nasty selloffs.

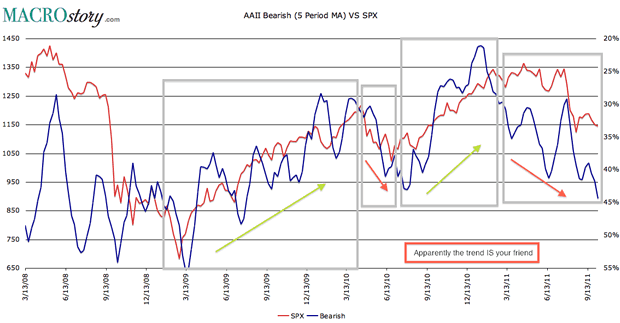

Did Wall Street Mislead Us

Don't completely fret if it appears Wall Street folklore is no longer. Another folklore will come to your aid, "the trend is your friend." Yes the trend. Not the absolute value as a line in the sand but rather the trend of those with bearish views. If they are rising stay short. If they are following go long. But judge for yourself from the chart below.

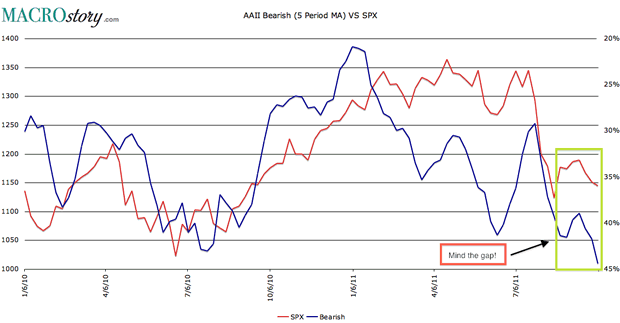

So What's A Bull To Do

Dare I say these words but you may want to consider moving to cash or if really feeling like living on the edge go short. Here is what those "contrarian" investors are telling the AAII each week they are surveyed.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.