The Paradox of Deflation Facing Global Investors

Economics / Deflation Oct 09, 2011 - 02:28 AM GMT The primary purpose for markets is to allow buyers and sellers to reach a deal, strike a price. Anything that distorts this purpose, leads the world inexorably toward crisis and chaos. Free markets best determine prices based on how many sellers there are of goods, services and assets and how much they have available to sell, and of course how many buyers there are and how much those buyers want to buy and are willing to pay. Truly free markets balance supply and demand. The economic calculation problem means governments cannot determine accurately how to intervene.

The primary purpose for markets is to allow buyers and sellers to reach a deal, strike a price. Anything that distorts this purpose, leads the world inexorably toward crisis and chaos. Free markets best determine prices based on how many sellers there are of goods, services and assets and how much they have available to sell, and of course how many buyers there are and how much those buyers want to buy and are willing to pay. Truly free markets balance supply and demand. The economic calculation problem means governments cannot determine accurately how to intervene.

Government fiscal or central bank monetary intervention distorts the prices that free markets are attempting to ascertain at any given time of houses, cars, stocks, bonds or beans. Attempting the impossible, Keynesian mechanics in governments and central banks have unleashed dynamic forces they cannot control. These forces are leading inexorably toward chaos. The paradox of deflation, ironically, may be the only thing that can restore order out of the chaos.

The amount of currency and the prevailing rates of interest also come to bear on the destiny of prices, nationally and globally. Global markets for all goods, services, labor and assets, both financial and hard assets, are in a state of greater flux than usual these days. Sellers, buyers and producers are all trying to figure out what is next for prices, and they are sweating the outcome of their decisions, and for good reason, the destiny of the global economy hangs in the balance.

First, it must be recognize that the Internet is changing the pricing mechanism of markets, providing information and making the pricing mechanism of markets more transparent. From Groupon's deals of the day for a local restaurant to options on Netflix to Greek bonds, buyers and sellers review the available and evolving information with lightening speed. Prices go up, and prices go down, based in large part on the number of willing buyers and the amount of goods, services or assets sellers hope to sell at a particular place, price and time.

There is a great debate raging regarding whether the greatest global financial crisis in history will culminate in a monetary folly driven inflation or a debt bust induced deflation in the price of everything. It is likely that this important debate will be settled by the pricing mechanism of markets, and not by misguided government fiscal and central bank monetary intervention, which is rapidly losing its charm. Mr. Market always gets his way in the end.

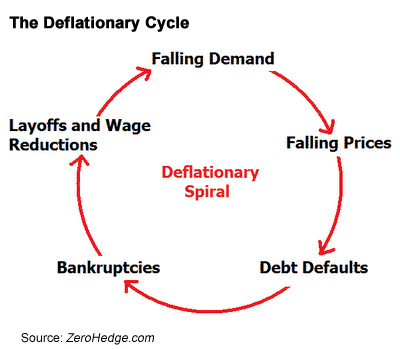

The focus on prices is now more tangible than ever as the stability of the global economy comes down to the wire. Either the government stimulus and central bankers of the world have stopped the great deflation, and the prices goods, services and financial assets will now rise, or the price trends in markets from the NYSE to the local flea market are starting to indicate they have failed. There is mounting evidence that a great deflation, paused since market crisis lows in 2009, will now swamp the global economy. Deflation threatens to turn world markets upside down.

Gary Shilling is one of the most articulate expositors of the case for a deflationary outcome. He has presented five different deflations currently at work and plaguing the global economy in his book, The Age of Deleveraging. Shilling's fabulous five deflations are, 1) financial asset deflation, 2) tangible asset deflation, 3) commodity deflation, 4) wage deflation, and 5) currency deflation. Shilling makes a compelling case for all five categories of deflation, which threaten to torpedo the global economy into the up and coming bottom of the long wave winter season. Anyone looking for an inflationary resolution to this global mess should ponder the wisdom of Shilling's reasoning and the many decades of experience and accurate forecasting.

Inflationists largely hang their arguments on monetary theories of inflation. The Austrian school of economics is correct, the less government and central bank intervention the better, but their expectation for an inflationary outcome is likely misguided. The problem with the Austrian view is their belief that booms and busts are primarily the result of inflationary monetary policy. They fail to recognize that business cycles are driven at a much deeper level of the human psyche. Monetary policies are only part of the puzzle of human action. There were fabulous booms and busts in the global economy long before the innovation of fiat currency managed by central bankers. Bad monetary policy ultimately makes business cycles worse, but business cycles, large and small are natural events, ebbs and flows in inflation and the paradox of deflation. Central banks do not cause booms and busts, they just make them worse.

Central bankers rarely defend themselves. They do not like to point out that it is bad government fiscal policy that creates the problems they must attempt to fix with tools that will not work. Few recognize that the world would scarcely know the names of central bank Chairman's Bernanke and Trichet if their respective governments were competent enough to manage a simple budget. Those that think Congress should be running the banking system should reconsider that option.

Central banks are bad policy enablers, and are then charged with trying to clean up the mess left behind by the political tomfoolery. Financial philosopher PQ Wall was fond of saying, "Politics destroys the money world." A more accurate and salient observation into the current global crisis is hard to find. Fortunately, Mr. Market, driven by human ingenuity and survival instincts, has always found a way to fix the mess handed to us by the politicians. In the future, the rise of private and sovereign digital gold currency will help keep the politicians in check, and provide an option to businesses and savers when central bankers enable politicians to trash their currencies and their economies.

Ideas have consequences. The problem with politicians and central bankers trying to fix the economy and financial markets is unfortunately the misguided foundation to their Keynesian approach. It is important to recognize that Keynesian economics is based on the false premise that Newtonian mechanics can be applied in global economics and finance. The idea that the right torque on a few bolts or the right amount of pressure on a lever at just the right time will right the global economic ship is simply wrong-headed thinking.

There is some interesting history on this front. Economist Paul Samuelson had a major impact on current economic thinking. In his 1947 book, Foundations of Economic Analysis, Samuelson asserted that physics is the science for economics to imitate. The problem here is that it takes a while for academic types to catch up with what is going on in fields outside their own. Samuelson pointed economics toward Newtonian mechanics where weights and measures can be calculated. Newtonian mechanics leads economists to believe that once calculations are made, bolts can be torqued, and deflation can be stopped. If it were true, this would be great, but unfortunately, they have discovered physics do not work that way. The politicians and their yes men have not caught up with the science.

Here's the problem, the field of physics had blown past Newtonian mechanics to the wonderful world of quantum mechanics and unknowable outcomes. The implication of the quantum mechanics approach to physics confirms Fredrick Hayek's position that economists don't know how hard to torque that bolt, or what the outcome will be of experimental fiscal and monetary policy efforts. Hayek explained this fundamental issue with Keynesian intervention in detail as the economic calculation problem. The implication for economics imitating physics with Newtonian mechanics is clear. Failure is not just probable, it is guaranteed. You cannot accurately calculate or measure the policy needed or the response it generates. If you actually manage to measure accurately, the field of economic activity then changes. Unexpected changes are sometimes radical, based on the Heisenberg's uncertainty principle, sinking your plans.

Based on Shilling and other articulate deflationists, Chairman Bernanke and his European counterparts are right to be terrified of deflation. The real question is whether they can stop deflation with Keynesian-Newtonian mechanical intervention, or will they simply make matters worse due to the economic calculation problem.

A great example of Keynesian-Newtonian mechanics gone awry is that artificially low rates are reducing if not eliminating the income and therefore spending of savers, reducing real demand and feeding deflation. Lower interest rates for business, while intended to encourage economic growth and job growth, are keeping the production lines of weaker producers running full tilt, feeding overproduction, and increasing global deflationary pressures. Yes, there is solid reason to believe that monetary policy that is seeking to stop deflation will just make it last longer, and may make the deflation worse than it otherwise would be, crushing the little guy, while perpetuating the inefficient world of crony capitalism run amuck.

Central banks are now considering doubling down on their efforts to try to stop deflation. The notion that it is the role of governments and central banks to manipulate market-pricing mechanisms with monetary and fiscal policy, in order to achieve some subjective gain, is rooted in Keynesian notions of the role of government. The Keynesian approach is based in the idea that fiscal and monetary policy is a form of applied Newtonian mechanics. More torque on the wrench or nut will be just enough to produce jobs. Good luck with that.

Paul Krugman is one of those proposing aggressive Keynesian based efforts to stop deflation. Krugman is terrified by the looming specter of global deflation and believes it is a major threat to the global economy. You have to enjoy the irony here. It is possible to disagree with all of Krugman's Keynesian policy recommendations, while recognizing his brilliant insights into the nature of deflation. In articles over the past decade he has written of what he calls the paradox of deflation. Krugman explained the paradox of deflation in a 1999 article as follows, "Japanese-type deflation is an economy's way of 'trying' to get the expected inflation it needs... The logic of deflation in a liquidity trap is the same; it is because spending in the current period is unattractive unless prices are expected to rise that the current price level is pushed down."

What Krugman clearly does not appreciate is that this is why markets work. The paradox of deflation comes into play for global investors and traders as they begin to recognize that in order to get the rate of returns they require for the risks they take, based on the prospects for corporate profits and cash flows, that financial markets must endure price deflation and fall substantially. This is required so that they can then rise at a clip where the potential reward justifies the risk taken by investors.

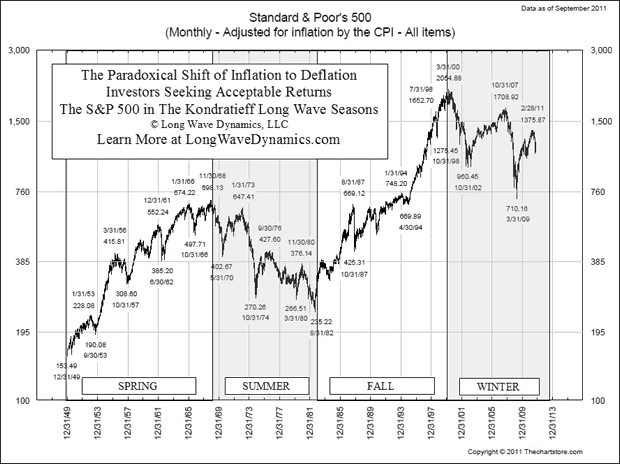

Global equity and bond markets are now demonstrating the paradox of deflation at work. The great global equity long wave deflation discount is underway, so that investors can realize an acceptable rate of return in the future. The chart below is the inflation adjusted S&P 500, which reflects the long wave ebb and flow. It illustrates, adjusted for inflation and by default deflation, where the paradox of deflation finally turns to reward for the prudence of patience. The patience of waiting for the paradox of deflation to run its course before buying is a challenge. However, it tends to work out better for investors than buying because central bank policy is tricking you into drinking the cool aid and going long.

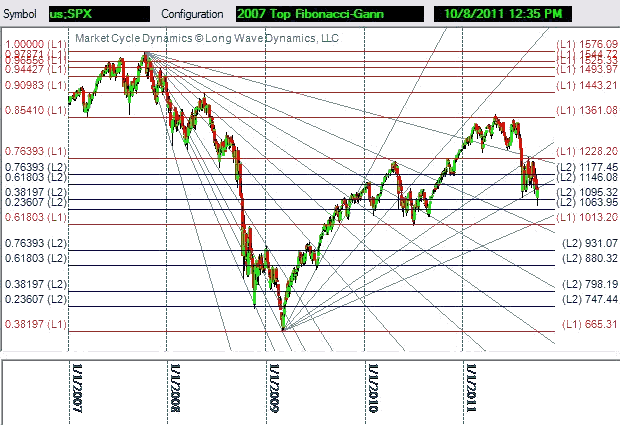

The global long wave deflationary adjustment has been in the works for years. When Mr. Market has a sale, the paradox of deflation is in play. Invariably, it is when everyone wants to sell and few want to buy that it is the best time to buy. That time has not likely arrived yet, but it is not that far away. Good technical analysis is all about finding the pivot points where the paradox of deflation offers patient investors a buying opportunity. New methods in Fibonacci drill-down grids and Gann-Fibonacci fans identify the large and small shifts in the paradox of deflation in global market cycles, as demonstrated in the chart below.

By tracking the large and small market cycles, you are essentially tracking the paradox of deflation in global financial assets. Tracking the cycles allows you to better estimate when the paradox of deflation has played out. Those that recognize the forces at work in markets will buy when the paradox of deflation has run its course, and most investors are throwing in the towel, believing that doomsday has finally arrived. It is then that the seeds of the coming global long wave spring season will sprout and the paradox of deflation will give birth to a global boom.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2011 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.