Stock Market What's Next ... Will We Have a Rising or Falling Market?

Stock-Markets / Stock Markets 2011 Oct 07, 2011 - 12:24 PM GMTBy: Marty_Chenard

The most important market test of the past two months is coming up soon as seen on today's chart.

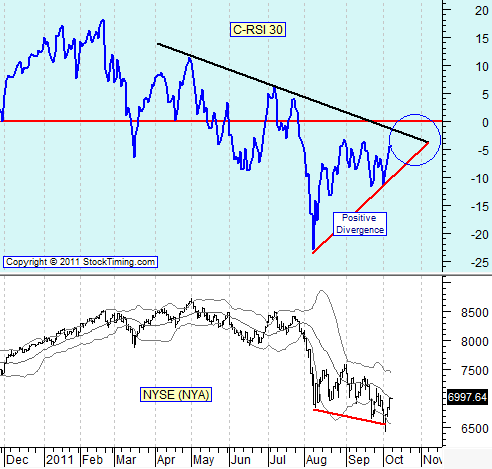

Note how the market Strength has behaved on our C-RSI, 30 day indicator. It has been in a down trend since April, and it has been in Negative Territory since the end of July. That has translated into a DOWN condition for the market during the past few months.

Will this change soon?

What happens within the next few weeks to our C-RSI behavior will determine what happens next in the stock market.

This describes the BIG test coming up and what has to happen for the market to rally:

There are two important things to note on the C-RSI chart below. First, is that the C-RSI is both below a resistance line, AND below the horizontal zero level. For a hold-able upside market rally, the C-RSI needs to be above the resistance, and above the zero line in Positive Territory.

Second, the important thing to notice is that the black resistance line, and the red support line are forming a triangular formation that is fast approaching its apex area (see the circle).

Why is it important when an approaching apex's occurs?

Because the market gets squeezed, and squeezed harder as the resistance and support lines converge on each other. Just before the apex is reached, the tension becomes too much and the indicator and/or market index breaks out of the pattern ... and when it does, you get an important move in the market.

Which direction it breaks out determines which way the market breaks out. You can't know for sure which direction such a pattern will break out, but this one has a two month positive divergence bias that the C-RSI has been developing relative to the NYA Index's movement. That could easily cause the CRSI to break out above the resistance line, but the big hurdle will be for the C-RSI to move higher than that and then close above the zero line.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.