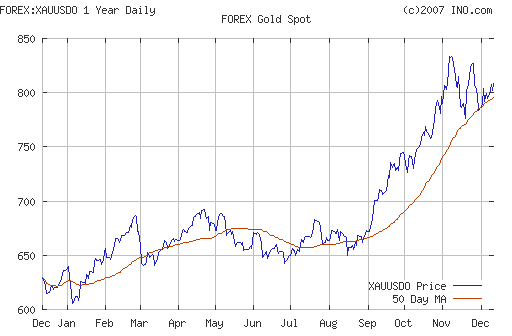

Gold Sell off Due to Dollar Strength on the Encouraging Retail Sales Data

Commodities / Gold & Silver Dec 14, 2007 - 11:07 AM GMTBy: Gold_Investments

Gold was down $14.60 to $798.60 per ounce in New York yesterday and silver was down 55 cents to $14.09 per ounce. Subsequently gold rallied back up to $803 in Asian trading but it has since given up those gains and has gradually traded down in European markets and the London AM Fix was at $796.25. At the London AM Fix gold was trading at £392.18 GBP (down from yesterday's London AM Fix at £396.18) and €547.18 EUR (down from yesterday's London AM Fix at €550.60).

Gold was down $14.60 to $798.60 per ounce in New York yesterday and silver was down 55 cents to $14.09 per ounce. Subsequently gold rallied back up to $803 in Asian trading but it has since given up those gains and has gradually traded down in European markets and the London AM Fix was at $796.25. At the London AM Fix gold was trading at £392.18 GBP (down from yesterday's London AM Fix at £396.18) and €547.18 EUR (down from yesterday's London AM Fix at €550.60).

There is support at $776 and strong support at $750. We continue to belief that any sell off will be short and that gold will end 2007 above $800 per ounce before making new record highs early in 2008.

Extremely counterintuitive trading in the gold market continues. Ostensibly the gold sell off was due to dollar strength on the encouraging retail sales data. But with news of the worst producer-price inflation since Richard Nixon was president and imposed price controls in 1973, inflation surging in the US and internationally and the property and credit crisis deepening, gold would normally soar. Yet it sold off some 2% yesterday. US inflation at a 34-year high rate of 3.2% in a slowing US economy and serious credit crunch is very gold bullish. The 7.2 percent increase in producer prices from November 2006 was the largest 12-month gain since November 1981. Gasoline prices rose 34.8 percent in the month, eclipsing the previous record gain of 28.8 percent in April 1999. Prices for all energy goods also rose by a record 14.1 percent, surpassing the previous high of 13.4 percent recorded in January 1990.

Further confirmation of surging international inflation was seen in the CRB Commodity Index surging 5.42 to a new record high of 470.73. These are very stagflationary conditions as they were in the 1970's.

Short term gold players seem to have a hold of the market at the moment. The quants and black box algorithm traders in large hedge funds and financial institutions speculating long and short are about maximising short term trading opportunities (based on complex mathematical and statistical modeling, measurement and research) rather than value investors or safe haven investors. However, they can influence the price in the short term. But this sell of will be another short term dip as the paper players can only artificially surpress the gold price in the short term. Given the extremely favourable supply and demand fundamentals of gold, it is akin to a large beach ball being pushed under the water and held down. Eventually the fundamental supply demand imbalance will dictate higher prices. When that happens the beach ball surges up out of the water and the more it is pushed under the water the greater the move to the upside.

Large buyers in Russia, the Middle East, China, India, wider Asia and internationally will ultimately dictate the price and not the short term speculative players.

The money spigots are wide open with unprecedented credit creation and the huge financial deficits facing the US remain with November Budget Deficit coming in at $98.2 billion. The federal budget deficit for November was up a very sharp 34.5% compared with a year ago. The Commerce Department said the trade deficit for October increased to $57.8 billion, the highest level since July, boosted by high oil prices and Chinese imports.

The trade deficit has only improved marginally and remains near record levels month on month and now the federal buget deficit is deteriorating. Fears regarding the US economy and the US dollar will lead to safe haven buying which will alomost definitely drive gold to new record highs in 2009.

Silver

Silver is trading at $14.00/02 at 1200 GMT after yesterday's sharp sell off.

PGMs

Platinum was trading at $1458/1464 (1200 GMT).

Spot palladium was trading at $346/350 an ounce (1200 GMT).

Oil

Oil remains at elevated levels above $90 per barrel and was trading at over $93 a barrel.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.