Is Newmont Mining a Refuge for Investors?

Commodities / Gold & Silver Stocks Oct 06, 2011 - 12:13 PM GMTBy: Eric_McWhinnie

Newmont Mining (NYSE:NEM) is one of the largest gold (NYSE:GLD) producers in the world. It is the only gold producer included in the S&P 500 (NYSE:SPY) and Fortune 500. It has also been a refuge to precious metal (NYSE:DBP) investors over the past few weeks. Shares recently hit an all-time high of $71.25 on September 20th. Now, investors have an opportunity to purchase this major gold miner at a cheaper price.

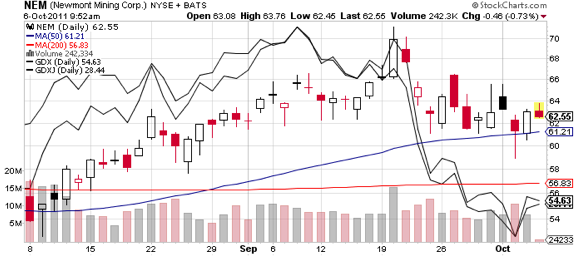

As the chart below shows, while the Market Vectors Gold Miners ETF (NYSE:GDX) and the Junior Gold Miners ETF (NYSE:GDXJ) declined heavily in September, Newmont was less volatile and found support at its 50-day MA, while the miner ETFs fell below their 50-day and 200-day moving averages.

Earlier this year, Newmont made a popular move with shareholders by linking its dividend to the price of gold. Each quarterly dividend will be determined as a function of Newmont’s average realized gold sales price for the preceding quarter. The Company’s quarterly dividend will increase at a rate of $0.05 per share for each $100 per ounce rise in the average realized gold sales price for the preceding quarter. Other gold producers that also pay a dividend include Barrick Gold (NYSE:ABX) and Yamana Gold (NYSE:AUY).

We brought Newmont Mining (NYSE:NEM) to the attention of our premium subscribers because of the company’s strong fundamentals and dividend potential. The gold-linked dividend offers investors some comfort as short-term gold prices tend to be volatile. Furthermore, the company continues to maintain a gross margin well over 50%, giving the company a nice cushion to absorb any costs increases. If you would like to receive more professional analysis on Newmont Mining and other precious metal investments, we invite you to try our premium service free for 14 days.

By Eric_McWhinnie

Wall St. Cheat Sheet : Only days after the S&P 500 crashed to the depths of hell at 666, the Hoffman brothers launched Wall St. Cheat Sheet: one of the fastest growing financial media sites on the web. Like a samurai, our mission is to cut through the bull and bear shit with extraordinary insights, a fresh voice, and razor-sharp wit. We provide the highest quality education and information for active investors, financial professionals, and entrepreneurs.

© 2011 Copyright Eric McWhinnie - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.