Will the Hawks of the FOMC Have to Reconsider?

Interest-Rates / US Interest Rates Oct 05, 2011 - 01:20 PM GMTBy: Asha_Bangalore

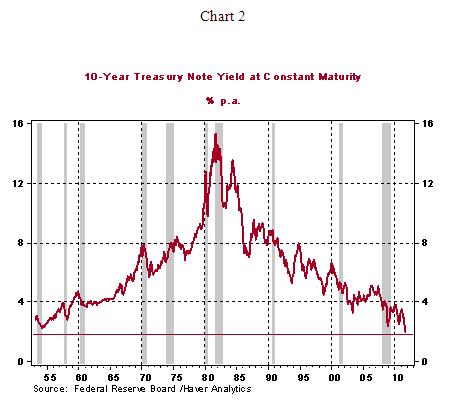

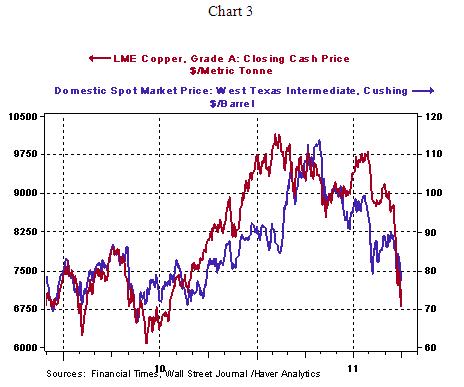

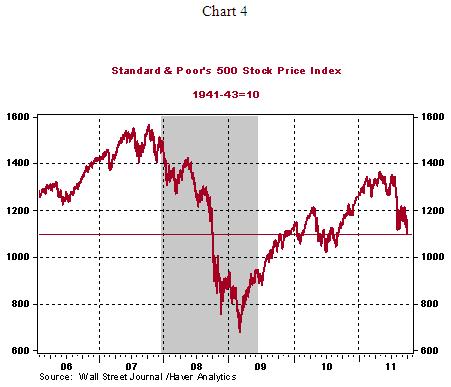

The Bernanke Fed is currently divided about its view of the pace of future economic activity. The vote at the August and September meetings included three dissents. The dissenters held the view that additional monetary policy support is uncalled for and they remain concerned about future inflationary pressures. Charts 2-4 are telling exhibits that represent market assessment of future economic conditions.

As of this writing, the 10-year Treasury note yield was trading at 1.80%, the lowest since the early-50s (see Chart 2). The 10-year Treasury note yield closed at 2.20% following the August 9 FOMC meeting and was 1.88% after the September 21 FOMC meeting. Essentially, the bond market signals weak economic conditions in the months ahead. The same opinion is echoed in the sharp drop in copper and oil prices (see Chart 3). Equity prices also reflect projections of soft economic conditions (see Chart 4). The S&P 500 at 1088 is down

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.