Bernanke Presents a Pessimistic Economic View, Reassures Fed Stands Ready to Support

Economics / US Economy Oct 05, 2011 - 01:18 PM GMTBy: Asha_Bangalore

At the outset, Bernanke’s testimony to the Joint Economic Committee listed positive developments of the current economic recovery – improvement of factory production, narrowing of the trade gap compared with the period prior to 2007, strong equipment and software spending, and a more sound banking and financial sector. The rest of the testimony was significantly more subdued and pessimistic. He reiterated his observations from last month that consumers are very cautious in their spending decisions as their net worth has dropped and that households “continue to struggle with high debt burdens and reduced access to credit.” More importantly, Bernanke sees “more sluggish job growth in the period ahead.” He also noted that the FOMC has revised down its projections of GDP growth. The weak housing market was also part of the testimony. In the prepared testimony and Q&A session, Chairman Bernanke stressed the importance of solving housing market issues.

In his opinion, although financial market stress is significantly different from the period when financial markets had ceased to function during the crisis, there are stresses that need to be addressed. Bernanke cites “tight credit conditions for households, small businesses, and residential and commercial builders” as areas of concern. The impact of the Eurozone debt crisis on the U.S. economy remains unclear but Bernanke pointed out that it has hurt “household and business confidence, and that they pose ongoing risks to growth.”

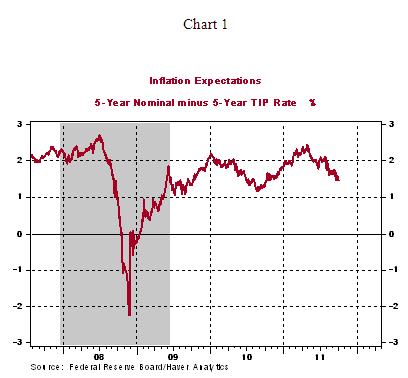

Bernanke mentioned that inflation has begun to moderate and stressed that the “higher rate of inflation experienced so far this year does not appear to have ingrained in the economy.” Readings of inflation validate Bernanke’s statement. Inflation expectations obtained from the yields on nominal and inflation-protected Treasury securities show a decline from highs seen in the early part of 2011 (see Chart 1).

Bernanke listed four objectives that Congress should aim to achieve: Congress should work toward attaining long-run fiscal sustainability, avoid fiscal actions that hinder economic growth, promote long-term growth and economic opportunity through fiscal policy actions and improve the process of making long-term budget decisions such that it avoids disruptions in financial markets.

Bernanke closed the prepared testimony with the following: “The Committee will continue to closely monitor economic developments and is prepared to take further action as appropriate to promote a stronger economic recovery in a context of price stability.” The reassurance, however, included a qualification. The final word was directed at Congress indicating that “monetary policy is not a panacea for the problems currently faced by the U.S. economy. Fostering healthy growth and job creation is a shared responsibility of all economic policymakers, in close cooperation with the private sector.”

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.