The Stock Market Smells Deflation

Stock-Markets / Stock Markets 2011 Oct 02, 2011 - 11:06 AM GMTBy: Clif_Droke

In previous commentaries we've talked about how the 6-year cycle is scheduled to peak around Oct. 1. That now appears to be all but certain following the last few trading sessions. Although the cycle has a 1-2 week standard deviation (plus or minus), it appears that it peaked on schedule last week and that the stock market has lost the last remaining cyclical support it had throughout most of September.

In previous commentaries we've talked about how the 6-year cycle is scheduled to peak around Oct. 1. That now appears to be all but certain following the last few trading sessions. Although the cycle has a 1-2 week standard deviation (plus or minus), it appears that it peaked on schedule last week and that the stock market has lost the last remaining cyclical support it had throughout most of September.

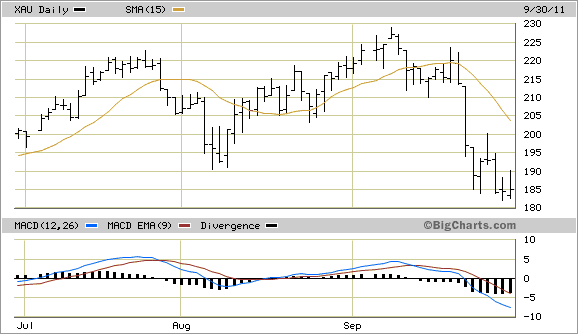

Interestingly, it was the commodity stocks that performed the strongest in the last cyclical bull market from late 2008/early 2009 until earlier this year. But in the last few months these stocks have been under heavy distribution and have lately led the way lower for the broad market. The gold/silver stocks took a big hit earlier this month as you can see in the chart of the XAU Gold Silver Index shown here.

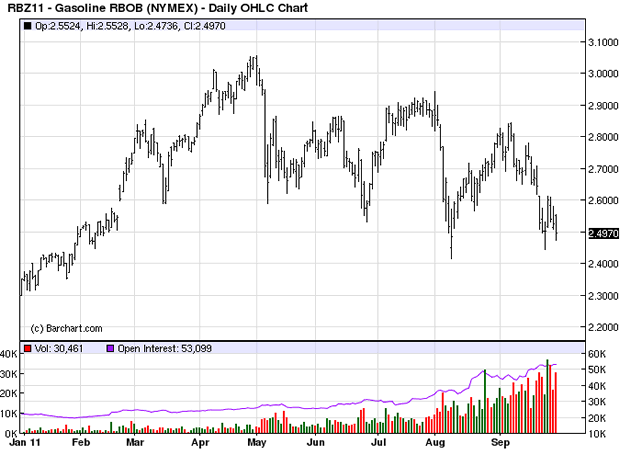

The oil and gas stocks haven't fared much better and still haven't confirmed a bottom. Even the gasoline futures price is showing signs of weakness and is on its way to giving back virtually all the gains it made since the Federal Reserve's QE2 monetary easing program began last fall. While this would be beneficial for everyone (except the oil companies), it underscores an important point that I'll be making in tonight's report, namely that deflation is starting to rear its ugly head again.

Looking at the list of stocks on the NYSE new 52-week lows list on Friday you will see a conspicuously high number of companies who either mine, explore or manufacture commodities or else service commodity related industries: Agrium (AGU), Alcoa (AA), Apache (APA), Ashland (ASH), DuPont (DD), Dow Chemical (DOW), Forest Oil (FST), Franco-Nevada (FNV), Hecla Mining (HL), National Fuel Gas (NFG), 3M (MMM), Potash of Saskatchewan (POT), Rio Tinto (RIO) and Teck Resources (TCK) just to give you an idea. This is a classic collection of industrial and hard asset related companies and many of these stocks have built up a tremendous amount of downside momentum in recent weeks and months. Never mind the near term stock market outlook, this doesn't speak well at all about the global economic outlook.

Throughout the year we've read story after story in the business and financial press about how so many U.S. based companies had decided to focus their energies on growing their business in the emerging markets overseas. Well it looks like those high hopes will have to be put on hold as the overseas markets are slowing down and will soon be entering an economic slowdown on par with the one the U.S. is currently suffering.

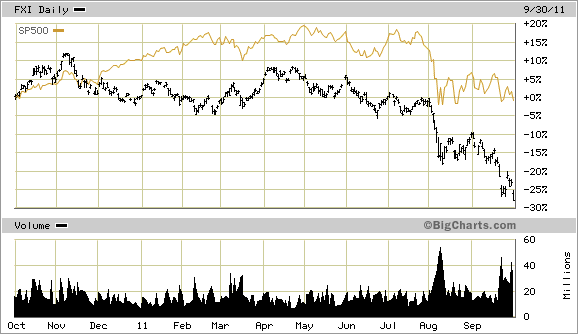

The darling of the emerging markets crowd is China and it has become an article of faith that China will someday soon eclipse the U.S. as the world's leading economic superpower. That day will have to wait as China's stock market continues to spiral lower, drastically underperforming the U.S. equities market. Keep in mind that the stock market is a barometer of future business conditions since it discounts corporate earnings 6-9 months in advance and is a reflection of where the economy is headed.

To illustrate this, below is a chart of the China 25 Index Fund ETF (FXI) in relation to the S&P 500 Index (SPX). China has been in a bear market since its stock market peaked last November. The country is suffering from a glut of commercial and residential real estate and unnecessary public works thanks to a massive stimulus on the part of China's Communist Party after the credit crisis of 2008.

China's financial sector is in major decline and already we're seeing a corresponding decline in demand for the commodities which fueled the country's mega boom. This diminishing appetite for commodities will continue as we approach the 60-year Grand Super Cycle bottom in 2014.

Meanwhile on the home front, the peaking of the 6-year cycle has taken away the last remaining cyclical pillar of support for the artificial, Fed-induced inflation of the past couple of years. Fed chief Bernanke has made no imminent plans for another round of financial stimulus. The Fed's latest gambit to revive the U.S. economy has been dubbed "Operation Twist" and involves nothing more than swapping short-term Treasuries for longer dated ones. This will register little more than a blip on the economic radar screen and will do nothing to increase aggregate demand in the U.S. economy. The Fed is likely underestimating the degree to which deflation will ravage the economy as we head closer to the long-term cycle bottom. Each passing year beginning with 2012 should bring a greater degree of deflation and it's doubtful either the Fed or the U.S. government can do anything to stop it.

It has been said that avalanches can start with insignificant snowballs rolling down the hill. In a similar vein economic collapse typically begins with financial market weakness, which tends to be overlooked by economists. While economists focus on GDP and other "big picture" lagging indicators, the real action takes place at or just below the economic surface in the financial market, which discounts economic activity by several months in advance.

As important as the commodity related companies have become in recent years, when there is as much weakness in the commodity company stocks as we're seeing right now it should give economists pause for thought. The message that the recent commodity stock liquidation is sending is that deflation is coming. Instead of discussing constructive ways of dealing with this problem, Congress is debating the merits of a potential tax increase on Americans - a policy which can only exacerbate the negative impact that deflation will have on the economy. The Fed meanwhile is whistling past the proverbial graveyard in a meager attempt at keeping the interest rate low. Both the Fed and the Congress will be taken by surprise when deflation descends with its full force and fury in the next several months.

Cycles

Over the years I've been asked by many readers what I consider to be the best books on stock market cycles that I can recommend. While there are many excellent works out there on the subject of technical and fundamental analysis, chart reading, etc., precious few have addressed the subject of market cycles. Of the relatively few booksh on cycles that are available, most don't even merit mentioning. I've read only one book in the genre that I can recommend - The K Wave by David Knox Barker - but even that one doesn't deal directly with stock market cycles but instead with the economic long wave. I'm pleased to announce, however, that after nearly 10 years of research and one year of writing, I've completed a book on the subject that I believe will meet the critical demands of most cycle students. It's entitled, The Stock Market Cycles, and is available for sale at: http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.